France Carbapenem Market Size, Share, and COVID-19 Impact Analysis, By Drug Class (Meropenem, Imipenem and Ertapenem), By Application (UTI, Blood Stream Infections and Pneumonia), and France Carbapenem Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareFrance Carbapenem Market Insights Forecasts to 2035

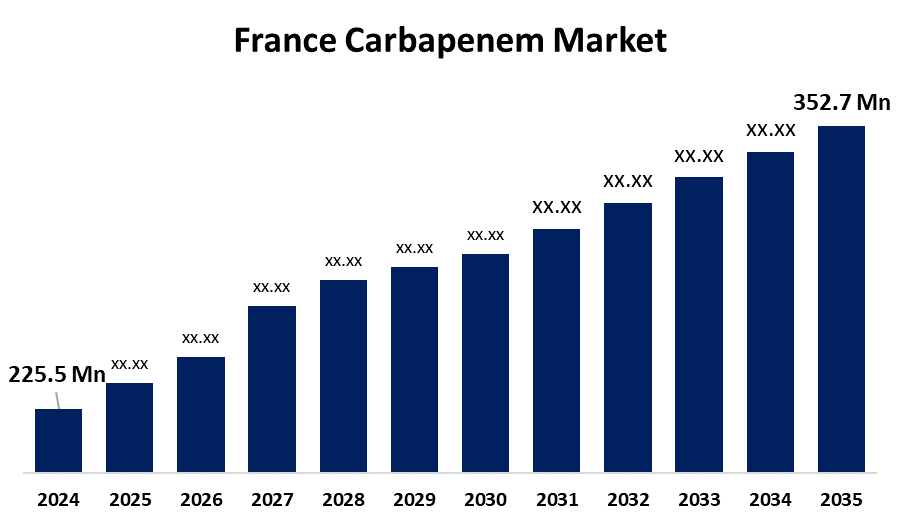

- The France Carbapenem Market Size was estimated at USD 225.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.15% from 2025 to 2035

- The France Carbapenem Market Size is Expected to Reach USD 352.7 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the France Carbapenem Market Size is anticipated to reach USD 352.7 Million by 2035, growing at a CAGR of 4.15% from 2025 to 2035. One of the main factors driving the market for carbapenems has been the increase in bacterial infections that are resistant to antibiotics.

Market Overview

In the France carbapenem market, broad-spectrum antibiotics known as carbapenems are employed to cure severe infections induced by multiple drug-resistant bacteria. These are very effective against gram-positive and gram-negative bacteria. The rise in antibiotic-resistant infections due to bacteria has been one of the major drivers for the carbapenems market. Apart from this, the older generation is bound to increase UTIs as a result of weakened immune systems and other age-related problems. Moreover, carbapenems are usually utilized to treat infections that one acquires in hospitals, i.e., infections that a patient acquires while in the hospital. As more hospital-acquired infections rise, the utilization of carbapenem antibiotics increases. Carbapenems are usually used as a last resort when other antibiotics have already failed. In France, the empirical use of carbapenems in hospital settings has significantly increased. This reflects the increasing dependency on this group of antibiotics to treat infections, particularly in response to the increasing number of carbapenem-resistant bacteria in healthcare-associated infections within the country. Research has shown an increase in carbapenem consumption by different hospital clusters.

Report Coverage

This research report categorizes the market for the France carbapenem market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France carbapenem market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France carbapenem market.

France Carbapenem Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 225.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.15% |

| 2035 Value Projection: | USD 352.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Drug Class (Meropenem, Imipenem and Ertapenem), By Application (UTI, Blood Stream Infections and Pneumonia) |

| Companies covered:: | Menarini Group, Pfizer Inc., Lupin, Kopran Limited, Merck & Co., Inc., Aurobindo Pharma, Sun Pharmaceutical Industries Ltd, Venus Remedies Ltd, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

In France carbapenem market, the generic medicine manufacturers have more options to enter the market with their cheaper drugs due to the expiry of carbapenem-based antibiotics' patents. The aim of generic medicine manufacturers is to increase the market share of their products. In addition, among the primary drivers of the growth in the market is the shortage of antibiotics to use when fighting bacterial diseases. Generic carbapenem-based antibiotics are increasingly available in several low- and middle-income countries due to rising production.

Restraining Factors

In France carbapenem market, this is because carbapenem antibiotics are typically more costly than other antibiotic classes; their availability may be restricted, especially in areas with lower incomes. Even in cases where these are clinically necessary, their widespread use may be limited by the financial strain on healthcare systems.

Market Segmentation

The France carbapenem market share is classified into drug class and application.

- The meropenem segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France carbapenem market is segmented by drug class into meropenem, imipenem, and ertapenem. Among these, the meropenem segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growing incidence of antibiotic-resistant bacteria and the necessity for therapeutic use against dangerous inflammation drove the demand for meropenem antibiotics. Meropenem is also frequently added to hospital formularies, or lists of drugs approved for prescription use within the hospital.

- The UTI segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France carbapenem market is segmented by application into UTI, blood stream infections, and pneumonia. Among these, the UTI segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. UTIs are one of the most common bacterial infections, with millions of individuals across the nation annually. These are most common among women, and approximately half will have had a UTI in their lifetime. Their widespread incidence is part of the reason that these are hold a leading role based on overall bacterial inflammation. The increasing number of clinical trials regarding carbapenems used in treating UTIs is expected to have implications for the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France carbapenem market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Menarini Group

- Pfizer Inc.

- Lupin

- Kopran Limited

- Merck & Co., Inc.

- Aurobindo Pharma

- Sun Pharmaceutical Industries Ltd

- Venus Remedies Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France carbapenem market based on the below-mentioned segments:

France Carbapenem Market, By Drug Class

- Meropenem

- Imipenem

- Ertapenem

France Carbapenem Market, By Application

- UTI

- Blood Stream Infections

- Pneumonia

Need help to buy this report?