France Canned Tuna Market Size, Share, and COVID-19 Impact Analysis, By Type (Skipjack Tuna, Yellowfin Tuna, Albacore Tuna, and Others), By Distribution Channel (Store-Based and Non-Store-Based), and France Canned Tuna Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesFrance Canned Tuna Market Insights Forecasts to 2035

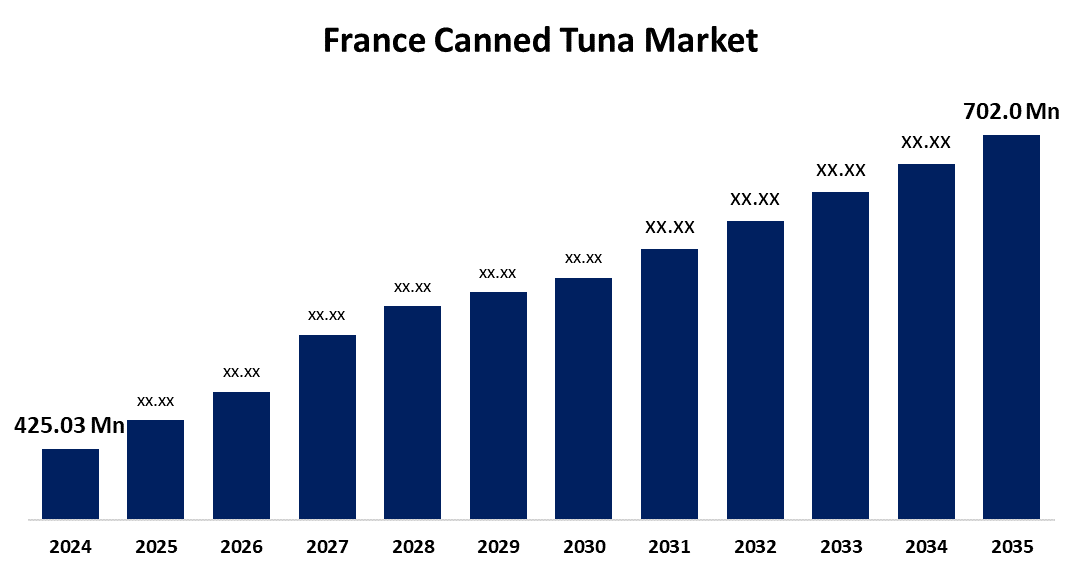

- The France Canned Tuna Market Size was Estimated at USD 425.03 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.67% from 2025 to 2035

- The France Canned Tuna Market Size is Expected to Reach USD 702.0 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the France Canned Tuna Market Size is Anticipated to Reach USD 702.0 Million by 2035, Growing at a CAGR of 4.67% from 2025 to 2035. Growing consumer awareness of health issues and a desire for quick, high-protein foods. Market appeal is also being increased by sustainability initiatives, such as environmentally friendly packaging and ethical fishing methods.

Market Overview

The France canned tuna market refers to the commercial environment encompassing the production, importation, distribution, and consumption of tuna preserved in sealed containers, like tins or jars, is referred to as the French canned tuna market. The demand for convenient, high-protein seafood from consumers has led to the inclusion of both domestically processed and imported goods. Additionally, with a focus on protecting fish stocks and marine biodiversity, the French government has taken the initiative to promote sustainable fishing. Furthermore, the market for ready-to-eat canned tuna products is expanding as consumers continue to look for convenience in their meals. These days, multi-guarded eating habits have a big impact on market turnover as well. In addition to being an excellent source of protein, canned tuna is thought to be easy to prepare and adaptable to a variety of recipes. Businesses that market their products as wholesome or nourishing meals or snacks typically succeed in satisfying the demands of their target market. The French culinary culture also enables the provision of more unique products, such as tuna suitable with spices, which appeals to the younger target market that seeks flavorful yet quick-to-prepare meals. Opportunities with particular market segments, such as those who would prefer organic or gluten-free products, are also presented by the expanded product line.

Report Coverage

This research report categorizes the market for the Japan electrodeposited copper foils market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan electrodeposited copper foils market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan electrodeposited copper foils market.

France Canned Tuna Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 425.03 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 4.67% |

| 2035 Value Projection: | USD 702.0 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 120 |

| Tables, Charts & Figures: | 150 |

| Segments covered: | By Type, By Distribution Channel and COVID-19 Impact Analysis. |

| Companies covered:: | Petit Navire, Saupiquet, Champex, Compteurs Océaniques, ACQUA TERRA FOOD, ETS Paul Paulet SAS and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for canned tuna in France is expanding significantly as a result of consumers' growing consciousness of wellness and health. A good source of protein, omega-3 fatty acids, and important vitamins is canned tuna. According to the French Ministry of Health, over the past five years, roughly 63% of French consumers have actively sought out healthier food options, indicating a growing trend. Canned tuna is becoming more and more popular among health-conscious people as a result of the increased demand for nutrient-dense products. Additionally, groups like the French National Institute for Agricultural Research (INRA) are supporting public awareness initiatives that highlight the importance of eating fish as part of a healthy diet. As consumers are urged to include more seafood in their diets for health reasons, this public support further boosts the French canned tuna market.

Restraining Factors

Rising raw material costs, overfishing laws, sustainability concerns, and consumer preferences for fresh or alternative seafood are some of the factors that are limiting the growth of the canned tuna market in France. In addition to supply chains being challenged by environmental scrutiny and certification requirements, traditional product appeal is being limited by health-conscious consumers' growing demand for low-sodium and additive-free options. All of these factors work together to impede market growth and make sourcing tactics more difficult.

Market Segmentation

The France canned tuna market share is classified into type and distribution channel.

- The skipjack tuna segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France canned tuna market is segmented by type skipjack tuna, yellowfin tuna, albacore tuna, and others. Among these, the skipjack tuna segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The its reputation for affordability and environmentally friendly fishing methods, skipjack tuna is in high demand in France's retail market. In recent years, skipjack tuna has become more well-known due to increased awareness of fisheries sustainability and the health advantages of eating fish.

- The store-based segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France canned tuna market is segmented by ddistribution channel into store-based and non-store-based. Among these, the store-based segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The distribution landscape is dominated by store-based channels, such as supermarkets, hypermarkets, and neighborhood grocery stores, because of their extensive reach and customers' inclination to physically inspect products before making a purchase. These shops frequently use marketing techniques that attract customers and increase revenue.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France canned tuna market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Petit Navire

- Saupiquet

- Champex

- Compteurs Océaniques

- ACQUA TERRA FOOD

- ETS Paul Paulet SAS

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France Canned Tuna Market based on the below-mentioned segments:

France Canned Tuna Market, By Type

- Skipjack Tuna

- Yellowfin Tuna

- Albacore Tuna

- Others

France Canned Tuna Market, By Distribution Channel

- Store-Based

- Non-Store-Based

Need help to buy this report?