France Broadband Services Market Size, Share, and COVID-19 Impact Analysis, By Broadband Connection (Fiber Optic, Wireless, Satellite, Cable, and Digital Subscriber Line), By End Use (Business and Household), and France Broadband Services Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyFrance Broadband Services Market Insights Forecasts to 2035

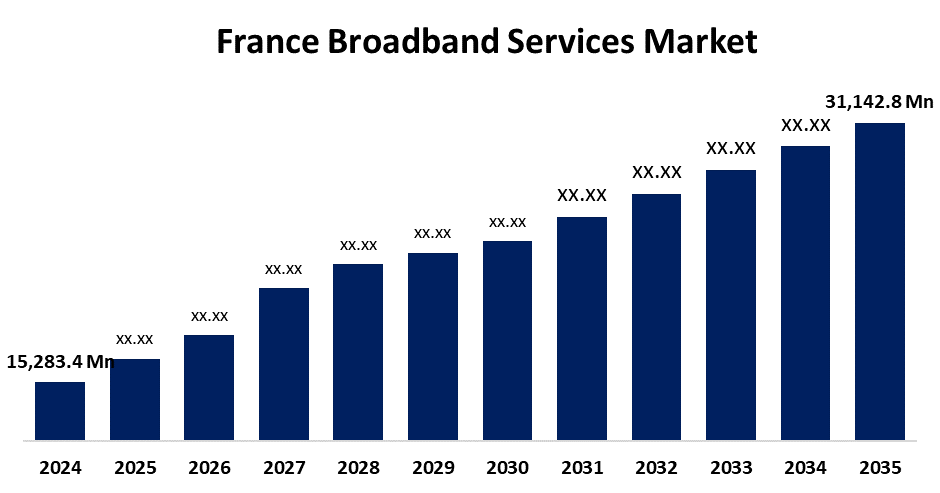

- The France Broadband Services Market Size was estimated at USD 15,283.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.69% from 2025 to 2035

- The France Broadband Services Market Size is Expected to Reach USD 31,142.8 Million by 2035

Get more details on this report -

The France Broadband Services Market Size is anticipated to reach USD 31,142.8 Million by 2035, Growing at a CAGR of 6.69% from 2025 to 2035. The growth of the France broadband services market is driven by increasing demand for high-speed internet, fueled by digital transformation, remote work, and streaming services.

Market Overview

The France broadband services market refers to the provision of high-speed internet access through various technologies, including fiber optics (FTTH), ADSL, VDSL, and 5G networks. It encompasses services offered by telecom operators, internet service providers (ISPs), and other players that deliver residential and business broadband solutions. The market is highly competitive, dominated by key companies such as Orange, SFR, Bouygues Telecom, and Free, which lead in both fiber deployment and mobile broadband services. France has been focusing on expanding fiber-to-the-home (FTTH) networks, aiming for nationwide high-speed broadband coverage by 2030. Government initiatives like the "France Très Haut Débit" program aim to provide high-speed internet access even to rural and underserved areas. With the increasing demand for 4K streaming, gaming, and remote work, the market continues to evolve, with innovations like 5G home internet and smart home integration shaping future growth.

Report Coverage

This research report categorizes the market for the France broadband services market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France broadband services market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France broadband services market.

France Broadband Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 15,283.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 6.69% |

| 2035 Value Projection: | USD 31,142.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 269 |

| Tables, Charts & Figures: | 113 |

| Segments covered: | By Broadband Connection and By End Use |

| Companies covered:: | Orange S.A., SFR (Société Française du Radiotéléphone), Bouygues Telecom, Free (Iliad Group), Numericable (Altice Group), Proximus, La Poste Mobile, OVHcloud, Comcast France (Sky), Covage, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Key driving factors in the France broadband services market include the growing demand for high-speed internet driven by streaming, remote work, and online gaming. Government initiatives like France Très Haut Débit promote fiber optic and 5G expansion to underserved areas. Increased adoption of IoT devices and smart homes also fuels broadband demand. Moreover, competition among major players such as Orange, SFR, and Free drives innovation and improvements in service quality and speed.

Restraining Factors

Restraining factors in the France broadband services market include high infrastructure costs for expanding fiber networks, particularly in rural areas. Regulatory challenges, lack of competition in some regions, and installation delays can slow progress. Additionally, digital literacy issues and service availability in remote areas remain ongoing challenges.

Market Segmentation

The France broadband services market share is classified into broadband connection and end use.

- The fiber optic segment held the largest market share in 2024 and is expected to grow at a substantial CAGR during the forecast period.

The France broadband services market is segmented by broadband connection into fiber optic, wireless, satellite, cable, and digital subscriber line. Among these, the fiber optic segment held the largest market share in 2024 and is expected to grow at a substantial CAGR during the forecast period. The segment is driven by the increasing demand for high-speed internet, 4K streaming, and smart home integration. Fiber optic networks offer superior speed and reliability compared to traditional DSL or satellite connections, making them the preferred choice for both residential and business customers.

- The business segment held the highest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France broadband services market is segmented by end use into business and household. Among these, the business segment held the highest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is primarily driven by the increasing demand for high-speed internet to support cloud-based applications, remote work, and data-heavy business operations. As more businesses embrace digital transformation and IoT technologies, the need for reliable and fast broadband services continues to rise.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France broadband services market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Orange S.A.

- SFR (Societe Française du Radiotéléphone)

- Bouygues Telecom

- Free (Iliad Group)

- Numericable (Altice Group)

- Proximus

- La Poste Mobile

- OVHcloud

- Comcast France (Sky)

- Covage

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France broadband services market based on the below-mentioned segments:

France Broadband Services Market, By Broadband Connection

- Fiber Optic

- Wireless

- Satellite

- Cable

- Digital Subscriber Line

France Broadband Services Market, By End Use

- Business

- Household

Need help to buy this report?