France Bionic Ear Market Size, Share, and COVID-19 Impact Analysis, By Type (Cochlear Implant, Auditory Brainstem Implants, and BAHA/BAHS), By End-use (Hospitals and Clinics), and France Bionic Ear Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareFrance Bionic Ear Market Insights Forecasts to 2035

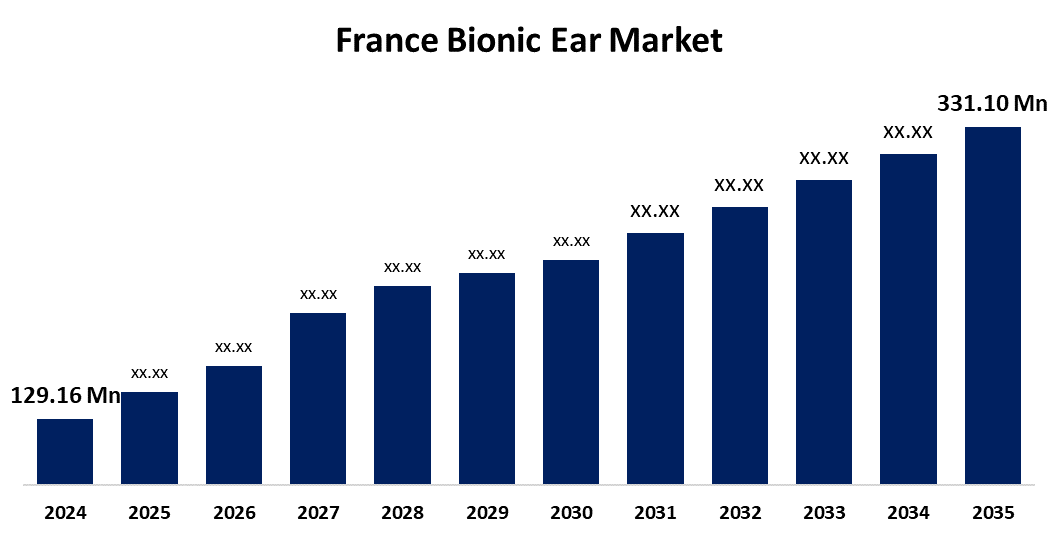

- The France Bionic Ear Market Size was estimated at USD 129.16 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.93% from 2025 To 2035

- The France Bionic Ear Market Size is Expected to Reach USD 331.10 Million By 2035

Get more details on this report -

The France Bionic Ear Market Size is Anticipated to reach USD 331.10 Million By 2035, Growing at a CAGR of 8.93% from 2025 To 2035. The France bionic ear market is primarily driven by the increasing prevalence of hearing loss among the aging population, advancements in hearing aid technology, and supportive government reimbursement policies.

Market Overview

The bionic ear market in France refers to the sector focused on advanced hearing devices such as cochlear implants, bone-anchored hearing aids (BAHA), and auditory brainstem implants. These devices help individuals with severe hearing loss or deafness by directly stimulating the auditory nerve or related structures, allowing improved sound perception. France has a substantial population affected by hearing impairments, with millions potentially benefiting from these technologies. The market includes both domestic and international manufacturers who provide a variety of bionic ear solutions to meet diverse medical needs. Government initiatives like the “100% Santé” program support greater accessibility by offering financial coverage for hearing devices, including bionic ears. This makes such devices more affordable for the general population. The presence of well-established companies such as Cochlear Ltd, Sonova Holding AG, and MED-EL ensures a broad selection of products available in France. Ongoing advancements in medical technology continue to enhance device functionality and patient outcomes within this market.

Report Coverage

This research report categorizes the market for the France bionic ear market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France bionic ear market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France bionic ear market.

France Bionic Ear Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 129.16 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.93% |

| 2035 Value Projection: | USD 331.10 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Type, By End-use and COVID-19 Impact Analysis |

| Companies covered:: | Sonova Holding AG, Amplifon, Demant Group, Starkey Hearing Technologies, GN Store Nord (GN Hearing), Widex A/S, Cilcare, Alain Afflelou Acousticien, Audika (Groupe Demant), Audition Mutualiste, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Key driving factors for the bionic ear market in France include the country’s aging population, which increases the prevalence of hearing loss. Growing awareness and diagnosis of hearing impairments also boost demand for advanced hearing solutions. Government programs like the “100% Santé” initiative, which offers full reimbursement for hearing aids, reduce financial barriers and encourage adoption. Additionally, continuous technological advancements improve device effectiveness, comfort, and user experience, making bionic ears more appealing. Increased healthcare infrastructure and rising healthcare spending further support market growth, enabling better access to these innovative auditory devices for patients across France.

Restraining Factors

There is a lack of awareness among healthcare providers and the general public about the benefits and availability of bionic ear solutions, leading to underutilization. Cultural factors also play a role, as some members of the Deaf community view cochlear implants as an attempt to "fix" deafness, potentially leading to social stigma and reluctance to adopt such technologies. These factors collectively contribute to the challenges faced by the bionic ear market in France.

Market Segmentation

The France bionic ear market share is classified into type and end-use.

- The cochlear implant segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The France bionic ear market is segmented by type into cochlear implant, auditory brainstem implants, and BAHA/BAHS. Among these, the cochlear implant segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. This segment is driven by its widespread adoption for treating severe to profound hearing loss. Its dominance reflects the effectiveness of cochlear implants in restoring hearing and enhancing quality of life for a broad patient base.

- The hospitals segment held the highest market share in 2024 and is expected to grow at a substantial CAGR during the forecast period.

The France bionic ear market is segmented by end-use into hospitals and clinics. Among these, the hospitals segment held the highest market share in 2024 and is expected to grow at a substantial CAGR during the forecast period. The segment is driven due to their advanced infrastructure, availability of skilled specialists, and access to comprehensive diagnostic and surgical facilities required for procedures like cochlear implantation. Additionally, hospitals often serve as referral centers for complex hearing loss cases, making them the preferred choice for bionic ear surgeries.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France bionic ear market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sonova Holding AG

- Amplifon

- Demant Group

- Starkey Hearing Technologies

- GN Store Nord (GN Hearing)

- Widex A/S

- Cilcare

- Alain Afflelou Acousticien

- Audika (Groupe Demant)

- Audition Mutualiste

- Others

Recent Developments:

- In February 2024, Demant introduced the Oticon Intent, a premium hearing aid designed to offer superior sound quality and user experience. The launch contributed to positive growth in the French market, with Demant expecting high-single-digit growth in units in 2025.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France bionic ear market based on the below-mentioned segments

France Bionic Ear Market, By Type

- Cochlear Implant

- Auditory Brainstem Implants

- BAHA/BAHS

France Bionic Ear Market, By End-use

- Hospitals

- Clinics

Need help to buy this report?