France Biomaterials Market Size, Share, and COVID-19 Impact Analysis, By Product (Natural, Metallic and Polymer), By Application (Cardiovascular, Orthopedics, and Plastic Surgery), and France Biomaterials Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareFrance Biomaterials Market Insights Forecasts to 2035

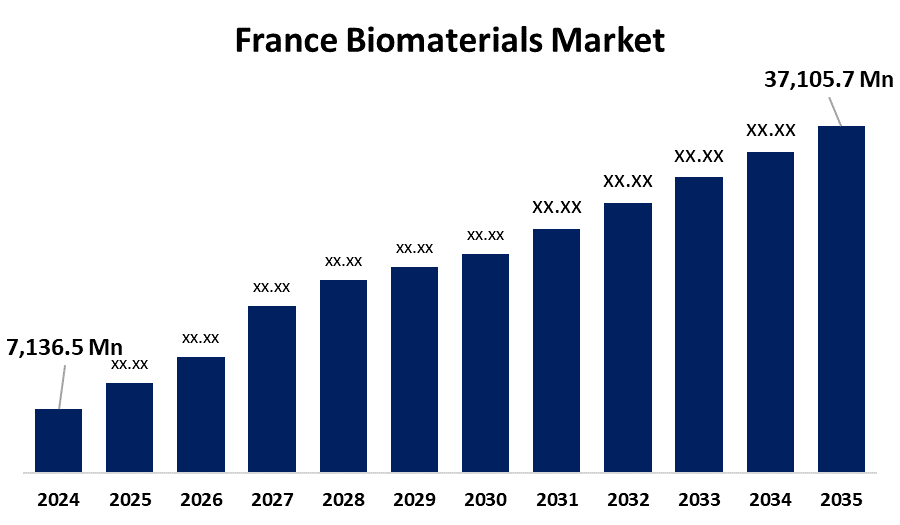

- The France Biomaterials Market Size was estimated at USD 7,136.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 16.17% from 2025 to 2035

- The France Biomaterials Market Size is Expected to Reach USD 37,105.7 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the France Biomaterials Market Size is anticipated to reach USD 37,105.7 Million by 2035, growing at a CAGR of 16.17% from 2025 to 2035. It is anticipated that the increasing prevalence of musculoskeletal and chronic skeletal disorders will boost demand for biomaterial-based implants, facilitating market growth.

Market Overview

The France biomaterials market is composed of materials developed for medical and healthcare applications, including implants, prostheses, tissue engineering scaffolds, and drug delivery systems. These materials interface with biological systems to improve the patient's well-being and address several needs. It is a highly competitive market where constant innovation is pressing as major players seek improvements across medical devices, tissue engineering, and drug delivery systems. The greater incidence of musculoskeletal and chronic skeletal medical conditions raises concerns about implant demand based on biomaterials, thereby giving impetus to market development. Namor intenso in the incidence of chronic diseases, such as osteoarthritis and degenerative bone diseases, and the demand for advanced biomaterials. The mechanical restorations needed become important therapeutic interventions for those with little mobility and painful conditions. Metallic biomaterials address this need by providing more durable and long-lasting solutions, integrating with the body so that any patient can restore functionality and improve their quality of life. Advances in technologies continually modify biomaterials to meet specific medical needs.

Report Coverage

This research report categorizes the market for the France biomaterials market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France biomaterials market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France biomaterials market.

France Biomaterials Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 7,136.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 16.17% |

| 2035 Value Projection: | USD 37,105.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product (Natural, Metallic and Polymer), By Application (Cardiovascular, Orthopedics, and Plastic Surgery) |

| Companies covered:: | Medtronic, Evonik Industries AG, Zimmer Biomet Holdings, Inc, Stryker, Johnson & Johnson, Carpenter Technology Corporation, BASF SE, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The France biomaterials market is driven by this breakthrough makes it possible to develop implants that not only battle the biomechanics of the body but also encourage integration and healing, lowering the potential of problems after implantation. Furthermore, the need for biomaterials has been greatly exacerbated by the aging of the France population. Chronic diseases and age-related injuries are increasing in frequency as the population ages, which increases the need for persistent and efficient medical treatments. This is due to their expanding use in tissue replacement and repair, including for bones, teeth, and other organs, the demand for innovative biomaterials has been rising recently. Technological advancements, especially in nanotechnology-enabled methods for treatment delivery at the molecular length scale, are responsible for this growing adoption.

Restraining Factors

The French market for biomaterials is restricted by the high development costs, regulatory barriers, biocompatibility issues, and competition from less expensive synthetic materials are some of the issues facing the biomaterials market. Furthermore, biomaterials' long-term performance, durability, and waste management pose serious difficulties.

Market Segmentation

The France biomaterials market share is classified into product and application.

- The metallic segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France biomaterials market is segmented by product into natural, metallic, and polymer. Among these, the metallic segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of their special blend of corrosion resistance, biocompatibility, and mechanical qualities. The most common biomaterial is metal, which is typically utilized in the production of load-bearing implants.

- The orthopedics segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France biomaterials market is segmented by application into cardiovascular, orthopedics, and plastic surgery. Among these, the orthopedics segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. One major factor driving this segment's growth is the increasing use of metallic biomaterials in orthopedic applications, which is attributed to their high load-bearing capacity. Additionally, it is anticipated that market vendors' ongoing efforts to introduce cutting-edge orthopedic implants will boost revenue generation.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France biomaterials market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Medtronic

- Evonik Industries AG

- Zimmer Biomet Holdings, Inc

- Stryker

- Johnson & Johnson

- Carpenter Technology Corporation

- BASF SE

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France biomaterials market based on the below-mentioned segments:

France Biomaterials Market, By Product

- Natural

- Metallic

- Polymer

France Biomaterials Market, By Application

- Cardiovascular

- Orthopedics

- Plastic Surgery

Need help to buy this report?