France Automotive Software Market Size, Share, And COVID-19 Impact Analysis, By Software Layer (Operating System, Middleware, Software Application), By Application (ADAS & Safety Systems, Body Control & Comfort System, Powertrain System, Infotainment System, Communication System, Vehicle Management & Telematics, Connected Services, Autonomous Driving, HMI Application, Biometrics, Remote Monitoring, and V2X System), and France Automotive Software Market Insights, Industry Trend, Forecasts to 2033

Industry: Automotive & TransportationFrance Automotive Software Market Insights Forecasts To 2033

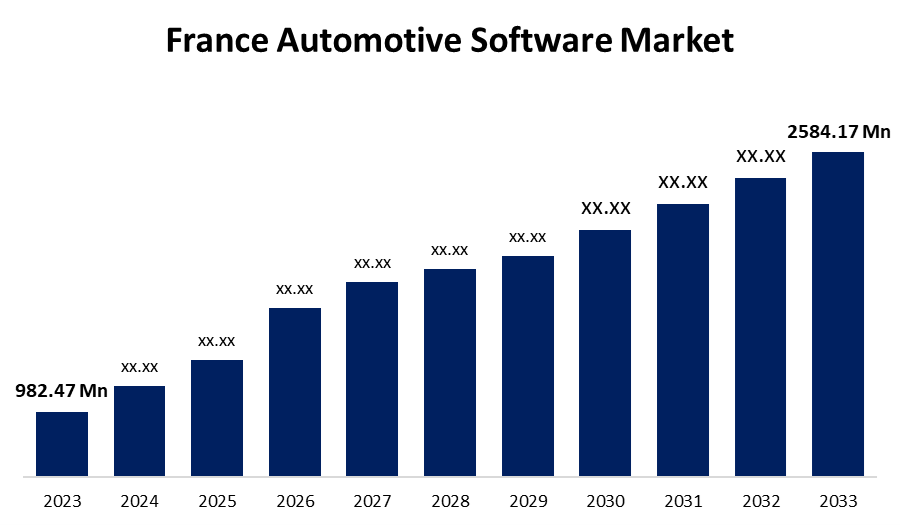

- The France Automotive Software Market Size was valued at USD 982.47 Million in 2023.

- The France Automotive Software Market Size is Expected to Grow at a CAGR of around 10.15% from 2023 to 2033.

- The France Automotive Software Market Size is Expected to Reach USD 2584.17 Million by 2033.

Get more details on this report -

The France Automotive Software Market size is predicted to Grow from USD 982.47 Million in 2023 to USD 2584.17 Million by 2033 at a CAGR of 10.15% during the forecast period. The Market growth is driven by strong government support and development in the automotive sector with technological interpretation.

Market Overview

The French automotive software market refers to the business that supports the automotive sector by introducing electrical solutions in different forms for improving the automotive and automobile functionality through the integration of electronics and software in automotive engineering, which has enhanced vehicle performance, decreased emissions, and boosted fuel efficiency. The vehicle's engine, gearbox, steering, brakes, safety, navigation, entertainment, and networking are all under their control. The demand for and supply of automotive electronics and software have grown significantly in recent years due to several factors, including the complexity of vehicle systems, changing consumer preferences, and evolving governmental regulations. Moreover, to meet this requirement, these automakers have equipped their vehicles with an array of cutting-edge electrical gadgets and software platforms that propel the market expansion. Besides, the key market players and their collaboration, such as in May 2023, Renault Group and Valeo announced plans to develop the next generation of Software Defined Vehicles (SDVs). This partnership focuses on creating an advanced electrical and electronic architecture that allows vehicles to stay up-to-date throughout their lifecycle, integrating new functionalities without requiring hardware modifications.

Report Coverage

This research report categorizes the France automotive software market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the France automotive software market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the France automotive software market.

France Automotive Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 982.47 Million |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 10.15% |

| 2033 Value Projection: | USD 2584.17 Million |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Software Layer, By Application |

| Companies covered:: | Valeo Siemens eAutomotive, Bosch France, Metacar Mobility Systems, Virtuo, NXP Semiconductors, and Others |

| Pitfalls & Challenges: | The COVID-19 has a substantial impact on the performance of the manufacturing industry. |

Get more details on this report -

Driving Factors

The automotive software market in France has been expanding considerably due to the growing popularity of autonomous vehicles. Furthermore, the growing adoption of 5G technology is yet another important advancement in the field of vehicle software, which opens a wide opportunity for market growth. Moreover, market growth opportunities are established by the growing high-speed network access to provide end users with the greatest possible benefits in various amenities in vehicles, such as infotainment and communication systems, vehicle management & telematics, connected services, and autonomous driving. Further, the market growth is driven by market players with the launch of novel electric solutions, which has seen an enormous increase in interest in the automotive industry. Beyond that, development in the automotive design section which making some changes in automotive software with their supportive structure.

Restraints & Challenges

The French automotive software market expansion is being restricted by several barriers, such as the high cost of the infrastructure needed for 5G and wireless connectivity with appropriate data analytics and Internet of Things (IoT) software interaction platforms. Moreover, the industry's complex safety and regulatory requirements which could be seen as a risk of data breaches or privacy of consumer data.

Market Segmentation

The France automotive software market share is classified into the software layer and application.

- The operating system segment accounted for the largest market share of the France automotive software market in 2023 and is expected to grow at a remarkable CAGR over the forecast period.

Based on the software layer, the France automotive software market is categorized into operating system, middleware, and software application. Among these, the operating system segment accounted for the largest market share of the France automotive software market in 2023 and is expected to grow at a remarkable CAGR over the forecast period. This is because the electronic control units and other subsystems of the vehicle are built on the foundation of automotive operating systems. Further, the fundamental framework for arranging and directing various tasks, including infotainment and powertrain control, is provided by these operating systems. Also, specialized automobile operating systems (OS) meet the high dependability and real-time responsiveness requirements of these services, which shows their benefits.

- The ADAS & safety system segment held the highest share of the France automotive software market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the France automotive software market is categorized into ADAS & safety system, body control and comfort system, powertrain system, infotainment system, communication system, vehicle management & telematics, connected services, autonomous driving, HMI application, biometrics, remote monitoring, and V2X system. Among these, the ADAS & safety system segment held the highest share of the France automotive software market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This is because ADAS technologies, which encompass adaptive cruise control, collision avoidance, and lane-keeping assistance, are vital for enhancing vehicle safety. Furthermore, the rising popularity of EVs and autonomous cars, which are majorly integrated with cutting-edge safety features like ADAS systems, propels the segment expansion, which is crucial for enhancing the safety of passengers, making them an ideal choice.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France automotive software market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers and acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Valeo Siemens eAutomotive

- Bosch France

- Metacar Mobility Systems

- Virtuo

- NXP Semiconductors

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Key Market Developments

- In December 2024, Ampere, Renault Group's dedicated electric vehicle (EV) and software subsidiary, inaugurated a new software research and development center in Sophia Antipolis, near Nice, France. This facility was tailored to support Ampere's software teams, combining office and laboratory spaces designed for agile collaboration. The center focused on developing centralized architectures for Software Defined Vehicles (SDVs) and housed nearly 200 engineers with expertise in EV and software technology.

- In September 2024, CARYA, a prominent name in automotive software, expanded its operations into France, marking another milestone in its European growth strategy. The launch of CARYA France included the acquisition of Incadea.DMS division of Solware Auto, a French company, along with its existing customer base and nine contracts. Six experienced employees joined the French branch to ensure smooth operations.

Market Segment

This study forecasts revenue at France, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the France automotive software market based on the below-mentioned segments:

France Automotive Software Market, By Software Layer

- Operating System

- Middleware

- Software Application

France Automotive Software Market, By Application

- ADAS & Safety Systems

- Body Control & Comfort System

- Powertrain System

- Infotainment System

- Communication System

- Vehicle Management & Telematics

- Connected Services

- Autonomous Driving

- HMI Application

- Biometrics

- Remote Monitoring

- V2X System

Need help to buy this report?