France Automotive After Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Type (Passenger vehicle and Commercial vehicle), By Channels (Authorized repair and Independent repair), and France Automotive After Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationFrance Automotive After Market Insights Forecasts toti 2035

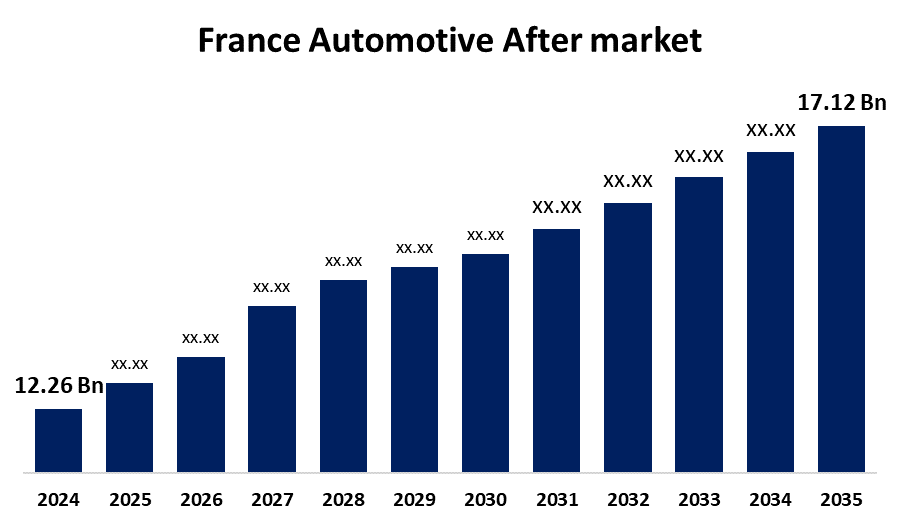

- The France Automotive After Market Size was Estimated at USD 12.26 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.08% from 2025 to 2035

- The France Automotive After Market Size is Expected to Reach USD 17.12 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The France Automotive After Market Size is anticipated to reach USD 17.12 Billion by 2035, growing at a CAGR of 3.08% from 2025 to 2035. Growing gradually as a result of the fleet's aging, which raises the need for maintenance and replacement parts. Growth is also being driven by consumer preference for environmentally friendly repair options, the digitization of parts distribution, and an increase in vehicle ownership. The market momentum is further increased by government support for innovations in mobile services and sustainability.

Market Overview

The France automotive aftermarket refers to the industry that manufactures, distributes, and sells car parts, accessories, and services after the initial sale of the vehicle is known as the France Automotive Aftermarket. Throughout a vehicle's lifecycle, it offers diagnostics, maintenance, repair, and customization services. Additionally, The French automotive aftermarket has a lot of parts and services that could expand. The French government's increased emphasis on environmental sustainability has created a demand for green solutions like recycled parts and environmentally friendly repair techniques. Other technological innovations that enable further improvement of customer satisfaction and service efficiency include telematics and smart diagnostics. In France, there has been a recent surge in the use of mobile apps for scheduling auto repairs or purchasing auto parts, suggesting a high need for quick fixes. Mobile services are becoming more popular among French consumers because they are convenient.

Report Coverage

This research report categorizes the market for the France automotive after market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France automotive after market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France automotive after market.

France Automotive After market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 12.26 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.08% |

| 2035 Value Projection: | USD 12.26 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Vehicle Type, By Channels and COVID-19 Impact Analysis |

| Companies covered:: | Autodistribution (Parts Holding Europe), Infopro Digital Automotive, EFI Automotive, Marketparts, DriveQuant, mybatteryhealth, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The automotive aftermarket in France is changing significantly due to a number of factors. The growing number of cars on the road many French cars are over ten years old is a major factor driving the market. This has increased demand for maintenance, repair, and spare parts. Additionally noteworthy is the increase in vehicle electrification as more people choose electric vehicles (EVs), which change the market landscape by requiring particular parts and services. Digitalization is also important; online sales of auto parts and services are growing in popularity, giving customers easier access to a greater selection of goods.

Restraining Factors

The increasing use of EVs is decreasing the need for conventional parts, supplier competition is fierce, and consumers are price-sensitive, which are some of the challenges facing the French automotive aftermarket. Additionally, market scalability and service innovation are hampered by complicated regulations, a lack of technician training for sophisticated systems, and a slower rate of digital transformation in rural areas.

Market Segmentation

The France automotive after market share is classified into vehicle type and channels.

- The passenger vehicle segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France automotive after market is segmented by vehicle type into passenger vehicle, commercial vehicle. Among these, the passenger vehicle segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The market for passenger cars is vital since many French people still rely heavily on personal transportation for daily needs, which creates a steady need for parts and services. Significantly, opportunities in this market have been fueled by rising vehicle ownership rates and growing awareness of the importance of vehicle maintenance.

- The independent repair segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France automotive after market is segmented by channels into authorized repair and independent repair. Among these, the independent repair segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Growing numbers of cars on the road and the need for easily accessible service options outside of traditional dealerships are driving the growth of the independent repair market. The emergence of mobile repair shops and online service booking platforms, for example, is changing the way these channels function and improving the client experience. Another factor affecting market dynamics is France's aging car population, which sustains demand for both independent and authorized repair services.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France automotive after market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Autodistribution (Parts Holding Europe)

- Infopro Digital Automotive

- EFI Automotive

- Marketparts

- DriveQuant

- mybatteryhealth

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France Automotive After Market based on the below-mentioned segments:

France Automotive After market, By Vehicle Type

- Passenger vehicle

- Commercial vehicle

France Automotive After market, By Channels

- Authorized repair

- Independent repair

Need help to buy this report?