France Auto-Injectors Market Size, Share, and COVID-19 Impact Analysis, By Product (Disposable and Reusable), By Indication (Rheumatoid Arthritis, Multiple Sclerosis, Diabetes, and Other Therapies), and France Auto-Injectors Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareFrance Auto-Injectors Market Insights Forecasts to 2035

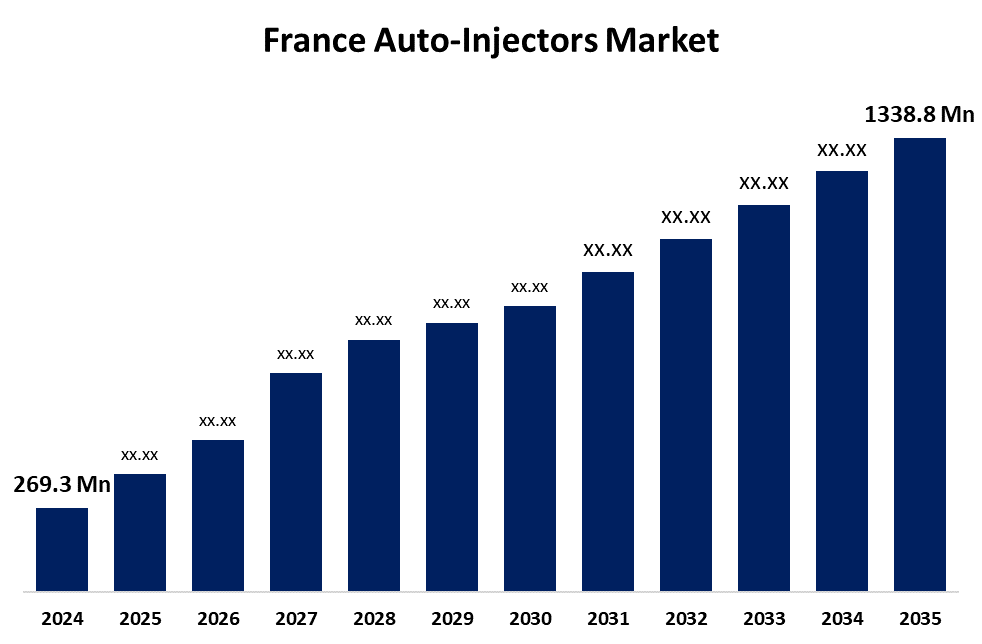

- The France Auto-Injectors Market Size was Estimated at USD 269.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 15.70% from 2025 to 2035

- The France Auto-Injectors Market Size is Expected to Reach USD 1338.8 Million by 2035

Get more details on this report -

The France Auto-Injectors Market Size is Anticipated to Reach USD 1338.8 Million by 2035, Growing at a CAGR of 15.70% from 2025 to 2035. The driving factor of the France auto-injectors market is the increasing prevalence of chronic diseases such as diabetes and anaphylaxis, which boosts the demand for user-friendly, self-administrable drug delivery systems.

Market Overview

The France auto-injectors market refers to the sector dealing with devices designed for the self-administration of medications, typically through subcutaneous or intramuscular injection. Auto-injectors are pre-filled, portable, and easy-to-use devices that allow patients to manage their treatment with minimal training. In France, the market includes applications across various therapeutic areas such as emergency medicine, autoimmune disorders, and hormone therapy. These devices are commonly used for medications like epinephrine, insulin, and biologics. The market encompasses a range of products from single-use disposable injectors to advanced reusable systems. France’s strong healthcare infrastructure and emphasis on modern medical technologies contribute to the adoption of auto-injectors in clinical and homecare settings. The market includes both domestic and international manufacturers, with a focus on safety features, ergonomic design, and precision dosing. Regulatory standards in France ensure the quality and reliability of these devices, supporting continued innovation and expansion in the auto-injector landscape.

Report Coverage

This research report categorizes the market for the France auto-injectors market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France auto-injectors market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France auto-injectors market.

France Auto-Injectors Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 269.3 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 15.70% |

| 2035 Value Projection: | USD 1338.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Indication, and COVID-19 Impact Analysis. |

| Companies covered:: | AbbVie Inc., Bausch Health Companies Inc., Eli Lilly and Company, Novo Nordisk A/S, Sanofi S.A., Teva Pharmaceutical Industries Ltd., Amgen Inc., Johnson & Johnson Services, Inc., Ypsomed AG, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Key driving factors of the France auto-injectors market include the growing prevalence of chronic diseases such as diabetes and autoimmune disorders, along with a rising demand for self-administered drug delivery systems that enhance patient convenience and compliance. Technological advancements in auto-injector design, increased availability of biologics, and supportive healthcare policies also contribute to market growth. Additionally, the push to reduce hospital visits and promote home-based care further fuels the adoption of user-friendly, safe, and efficient auto-injector devices across the country.

Restraining Factors

Stringent regulatory requirements and complex approval processes can delay the introduction of new products into the market. Additionally, some patients may find auto-injectors difficult to use correctly, leading to potential dosage errors or ineffective medication delivery. The availability of alternative drug delivery methods, such as oral medications and inhalers, also poses a challenge to the adoption of auto-injectors.

Market Segmentation

The France auto-injectors market share is classified into product and indication.

- The disposable segment held a significant market share in 2024 and is expected to grow at a substantial CAGR during the forecast period.

The France auto-injectors market is segmented by product into disposable and reusable. Among these, the disposable segment held a significant market share in 2024 and is expected to grow at a substantial CAGR during the forecast period. The growth can be attributed to factors like ease of use, hygiene, and lower upfront costs compared to reusable options. Disposable injectors might also offer more convenience for patients who may not have regular access to medical professionals or the resources to maintain reusable devices.

- The diabetes segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The France auto-injectors market is segmented by indication into rheumatoid arthritis, multiple sclerosis, diabetes, and other therapies. Among these, the diabetes segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The growth can be attributed to the increasing focus on improving patient adherence to treatment regimens and reducing the burden of manual injections, auto-injectors have become a preferred choice. Also, with innovations like smart injectors that can track doses or provide feedback, the market for diabetes-related auto-injectors might see even more growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France auto-injectors market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AbbVie Inc.

- Bausch Health Companies Inc.

- Eli Lilly and Company

- Novo Nordisk A/S

- Sanofi S.A.

- Teva Pharmaceutical Industries Ltd.

- Amgen Inc.

- Johnson & Johnson Services, Inc.

- Ypsomed AG

- Others

Recent Developments:

- In May 2022, Stevanato Group and Owen Mumford advanced their partnership on the Aidaptus auto-injector, focusing on simplifying device development and optimizing glass solutions. This collaboration aims to enhance patient outcomes through innovative design and materials.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France auto-injectors market based on the below-mentioned segments:

France Auto-Injectors Market, By Product

- Disposable

- Reusable

France Auto-Injectors Market, By Indication

- Rheumatoid Arthritis

- Multiple Sclerosis

- Diabetes

- Other Therapies

Need help to buy this report?