France Antidote Market Size, Share, and COVID-19 Impact Analysis, By Type (Chemical Antidote, Physical Antidote, and Pharmacological Antidote), By Route of Administration (Oral, Topical, and Injectable), and France Antidote Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareFrance Antidote Market Insights Forecasts to 2035

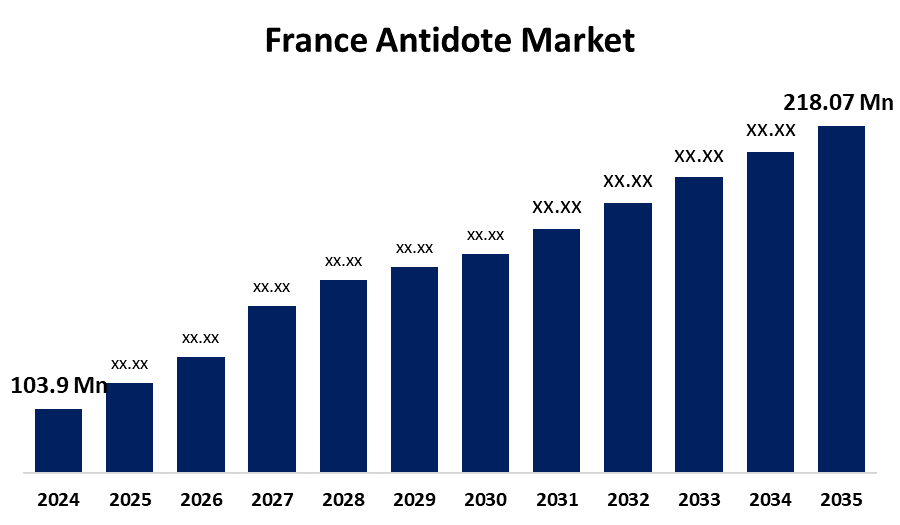

- The France Antidote Market Size was estimated at USD 103.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.97% from 2025 to 2035

- The France Antidote Market Size is Expected to Reach USD 218.07 Million by 2035

Get more details on this report -

The France Antidote Market Size is anticipated to reach USD 218.07 Million by 2035, growing at a CAGR of 6.97% from 2025 to 2035. The France antidote market is experiencing significant growth due to a surge in poisoning cases, along with advancements in the development of targeted antidote therapies.

Market Overview

The France antidote market encompasses the development, production, and distribution of substances used to neutralize or counteract the effects of toxic substances, such as poisons, drugs, and chemicals. Antidotes are crucial in medical emergencies, offering life-saving treatments for conditions like drug overdoses, chemical poisoning, and venomous bites. These therapies work by either binding to the toxic agents, blocking their effects, or facilitating their removal from the body. The market includes a wide range of antidotes, from those used for common poisons to specialized treatments for specific toxins. With ongoing research in the pharmaceutical field, new and more effective antidotes continue to emerge, improving patient care and recovery outcomes. The healthcare system's emphasis on rapid intervention and improving treatment protocols for poisoning cases ensures that antidote therapies remain a critical component of emergency medicine in France.

Report Coverage

This research report categorizes the market for the France antidote market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France antidote market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France antidote market.

France Antidote Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 103.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.97% |

| 2035 Value Projection: | USD 218.07 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 264 |

| Tables, Charts & Figures: | 112 |

| Segments covered: | By Type and By Route of Administration |

| Companies covered:: | Pfizer, Hikma Pharmaceuticals, Dr. Reddy’s Laboratories Ltd., Novartis, Baxter International Inc., Zydus Lifesciences Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The France antidote market is propelled by a rise in poisoning cases, including those from pharmaceuticals, chemicals, and environmental toxins, demanding faster and more precise treatments. Innovations in antidote formulations, providing enhanced efficacy and specificity, are also key drivers. Furthermore, increased awareness among healthcare providers and the general public about the critical role of timely antidote intervention in emergency care has elevated the demand, ensuring broader adoption of advanced antidote therapies across clinical and hospital settings.

Restraining Factors

Limited awareness and training among healthcare providers about certain antidotes, along with the complexity of diagnosing poisoning cases in time, can delay treatment. Additionally, the high cost of research and development for new antidotes, combined with market access barriers, can hinder progress.

Market Segmentation

The France antidote market share is classified into type and route of administration.

- The chemical antidote segment held a significant market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The France antidote market is segmented by type into chemical antidote, physical antidote, and pharmacological antidote. Among these, the chemical antidote segment held a significant market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The growth in this segment is due to its broad application in neutralizing a variety of toxins and poisons. Chemical antidotes, such as activated charcoal and chelating agents, are highly effective in emergency medical situations, where rapid intervention is critical.

- The injectable segment held a major market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France antidote market is segmented by route of administration into oral, topical, and injectable. Among these, the injectable segment held a major market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Injectable antidotes are preferred in emergency situations due to their rapid onset of action and direct delivery into the bloodstream, making them highly effective for treating severe poisonings or overdoses. Their ability to provide immediate therapeutic effects is a key factor driving their dominance in the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France antidote market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Pfizer

- Hikma Pharmaceuticals

- Dr. Reddy's Laboratories Ltd.

- Novartis

- Baxter International Inc.

- Zydus Lifesciences Ltd.

- Others

Recent Developments:

- In August 2022, American Regent Inc. launched an atropine sulfate injection, USP. This injectable drug is used as an antidote for organophosphorus or muscarinic mushroom poisoning and to treat bradyasystolic cardiac arrest.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France antidote market based on the below-mentioned segments:

France Antidote Market, By Type

- Chemical Antidote

- Physical Antidote

- Pharmacological Antidote

France Antidote Market, By Route of Administration

- Oral

- Topical

- Injectable

France Antidote Market Insights Forecasts to 2035

- The France Antidote Market Size was estimated at USD 103.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.97% from 2025 to 2035

- The France Antidote Market Size is Expected to Reach USD 218.07 Million by 2035

The France Antidote Market Size is anticipated to reach USD 218.07 Million by 2035, growing at a CAGR of 6.97% from 2025 to 2035. The France antidote market is experiencing significant growth due to a surge in poisoning cases, along with advancements in the development of targeted antidote therapies.

Market Overview

The France antidote market encompasses the development, production, and distribution of substances used to neutralize or counteract the effects of toxic substances, such as poisons, drugs, and chemicals. Antidotes are crucial in medical emergencies, offering life-saving treatments for conditions like drug overdoses, chemical poisoning, and venomous bites. These therapies work by either binding to the toxic agents, blocking their effects, or facilitating their removal from the body. The market includes a wide range of antidotes, from those used for common poisons to specialized treatments for specific toxins. With ongoing research in the pharmaceutical field, new and more effective antidotes continue to emerge, improving patient care and recovery outcomes. The healthcare system's emphasis on rapid intervention and improving treatment protocols for poisoning cases ensures that antidote therapies remain a critical component of emergency medicine in France.

Report Coverage

This research report categorizes the market for the France antidote market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France antidote market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France antidote market.

Driving Factors

The France antidote market is propelled by a rise in poisoning cases, including those from pharmaceuticals, chemicals, and environmental toxins, demanding faster and more precise treatments. Innovations in antidote formulations, providing enhanced efficacy and specificity, are also key drivers. Furthermore, increased awareness among healthcare providers and the general public about the critical role of timely antidote intervention in emergency care has elevated the demand, ensuring broader adoption of advanced antidote therapies across clinical and hospital settings.

Restraining Factors

Limited awareness and training among healthcare providers about certain antidotes, along with the complexity of diagnosing poisoning cases in time, can delay treatment. Additionally, the high cost of research and development for new antidotes, combined with market access barriers, can hinder progress.

Market Segmentation

The France antidote market share is classified into type and route of administration.

- The chemical antidote segment held a significant market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The France antidote market is segmented by type into chemical antidote, physical antidote, and pharmacological antidote. Among these, the chemical antidote segment held a significant market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The growth in this segment is due to its broad application in neutralizing a variety of toxins and poisons. Chemical antidotes, such as activated charcoal and chelating agents, are highly effective in emergency medical situations, where rapid intervention is critical.

-

The injectable segment held a major market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France antidote market is segmented by route of administration into oral, topical, and injectable. Among these, the injectable segment held a major market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Injectable antidotes are preferred in emergency situations due to their rapid onset of action and direct delivery into the bloodstream, making them highly effective for treating severe poisonings or overdoses. Their ability to provide immediate therapeutic effects is a key factor driving their dominance in the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France antidote market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Pfizer

- Hikma Pharmaceuticals

- Dr. Reddy's Laboratories Ltd.

- Novartis

- Baxter International Inc.

- Zydus Lifesciences Ltd.

- Others

Recent Developments:

- In August 2022, American Regent Inc. launched an atropine sulfate injection, USP. This injectable drug is used as an antidote for organophosphorus or muscarinic mushroom poisoning and to treat bradyasystolic cardiac arrest.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France antidote market based on the below-mentioned segments:

France Antidote Market, By Type

- Chemical Antidote

- Physical Antidote

- Pharmacological Antidote

France Antidote Market, By Route of Administration

- Oral

- Topical

- Injectable

Need help to buy this report?