France Aminoglycosides Market Size, Share, and COVID-19 Impact Analysis, By Product (Neomycin, Tobramycin, and Gentamicin), By Route of Administration (Injectables, Feed and Intra-mammary), and France Aminoglycosides Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareFrance Aminoglycosides Market Insights Forecasts to 2035

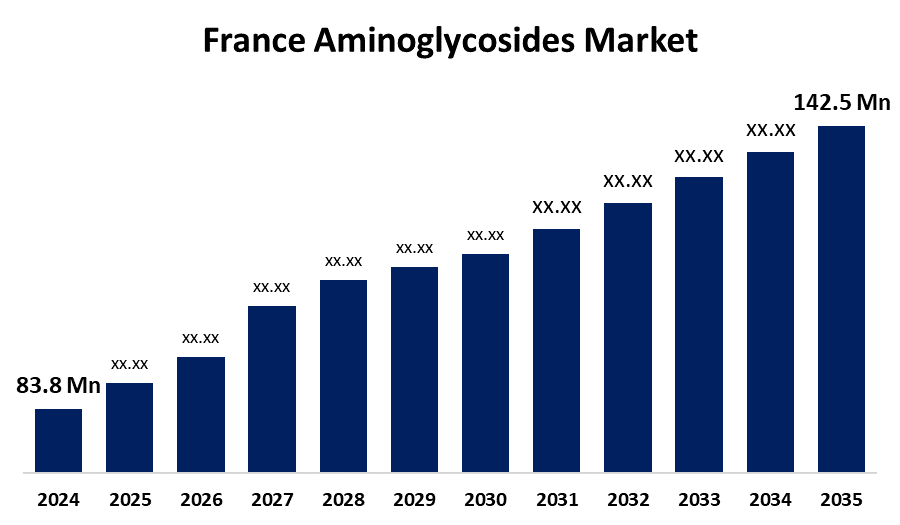

- The France Aminoglycosides Market Size was Estimated at USD 83.8 Million in 2024

- he Market Size is Expected to Grow at a CAGR of around 4.94% from 2025 to 2035

- The France Aminoglycosides Market Size is Expected to Reach USD 142.5 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The France Aminoglycosides Market Size is anticipated to reach USD 142.5 Million by 2035, growing at a CAGR of 4.94% from 2025 to 2035. This is due to the increasing demand for both prescribed and dispensed antibiotics drives market growth.

Market Overview

The France aminoglycosides market is concerned with the supply and consumption of aminoglycoside antibiotics within the territory, including the manufacture, distribution, sale, and consumption of the product. Aminoglycosides are generally bactericidal antibiotics that destroy the bacterial cell by inhibiting protein synthesis. Aminoglycosides are mainly used against aerobic gram-negative bacteria. The demand for aminoglycoside antibiotics is expected to increase due to a rise in bacterial infections caused by bacteria belonging to specific families of Gram-positive and Gram-negative bacteria. Infections that occur within the walls of the hospital can bear similar illness and death rates as the very serious conditions, such as pneumonia or HIV/AIDS, therefore making treatment selection very critical as clinical incidence or response to treatment is established. The increasing demand for both prescribed and dispensed antibiotics drives market growth. Other factors include improved diagnostics and genomics that enable specialists to ascertain the most effective aminoglycoside for any one patient, enabling less risk for ototoxicity and nephrotoxicity.

Report Coverage

This research report categorizes the market for the France aminoglycosides market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France aminoglycosides market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France aminoglycosides market.

France Aminoglycosides Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 83.8 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 4.94% |

| 2035 Value Projection: | USD 142.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 277 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product and By Route of Administration |

| Companies covered:: | Pfizer Inc., Cipla Limited, Aurobindo Pharma, Sun Pharmaceutical Industries, Viatris Inc., AbbVie Inc., Lupin Limited, Teva Pharmaceutical Industries, Fresenius Kabi, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The France aminoglycosides market is driven by the pharmaceutical companies, and regulators are making changes that are improving the monitoring and safety of aminoglycosides. New procedures and guidelines to enhance dosing and minimize adverse effects are providing momentum to the market. As well as the growth of combination therapies with aminoglycosides are being used to improve treatment effects and circumvent antibiotic resistance. By giving antibiotics with aminoglycosides, clinicians can interact with various bacterial mechanisms, allowing for an overall reduction in resistance to antibiotics. The increasing demand for antibiotics that are more prescribed and delivered is driving the market. In addition, new diagnostic and genomics technologies are now helping providers to choose the right aminoglycoside for the right patient. This provides the least chance of causing ototoxicity and nephrotoxicity.

Restraining Factors

The France aminoglycosides market faces challenges such as toxicity, regulatory barriers, and the increasing emergence of drug resistance. As stated above, toxicity, especially nephrotoxicity and ototoxicity, is a significant limitation affecting prescription and growth rates. Regulatory bodies and the high cost of development and clinical trials also affect market growth.

Market Segmentation

The France Aminoglycosides Market share is classified into product and route of administration.

- The gentamicin segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France aminoglycosides market is segmented by product into neomycin, tobramycin, and gentamicin. Among these, the gentamicin segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. New options with improved efficacy, delivery, and tolerability have been introduced by the substantial evolution of gentamicin advancements. For example, Cerament G, a resorbable ceramic bone void filler that elutes gentamicin, was authorized by the Food and Drug Administration (FDA) for use in patients with skeletal maturity.

- The injectables segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France aminoglycosides market is segmented by route of administration into injectables, feed, and intra-mammary. Among these, the injectables segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. People with severe or acute infections prefer injectable medications because these frequently offer quick and efficient infection relief.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France aminoglycosides market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Pfizer Inc.

- Cipla Limited

- Aurobindo Pharma

- Sun Pharmaceutical Industries

- Viatris Inc.

- AbbVie Inc.

- Lupin Limited

- Teva Pharmaceutical Industries

- Fresenius Kabi

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France Aminoglycosides Market based on the below-mentioned segments:

France Aminoglycosides Market, By Product

- Neomycin

- Tobramycin

- Gentamicin

France Aminoglycosides Market, By Route of Administration

- Injectables

- Feed

- Intra-mammary

Need help to buy this report?