France Aesthetic Lasers and Energy Device Market Size, Share, And COVID-19 Impact Analysis, By Product (Laser Resurfacing Devices, Body Contouring Devices, and Aesthetic Ophthalmology Devices), By Technology (Laser-Based Technology, Light-Based Technology, and Energy-Based Technology), And France Aesthetic Lasers and Energy Device Market Insights, Industry Trend, Forecasts To 2035

Industry: HealthcareFrance Aesthetic Lasers and Energy Device Market Insights Forecasts to 2035

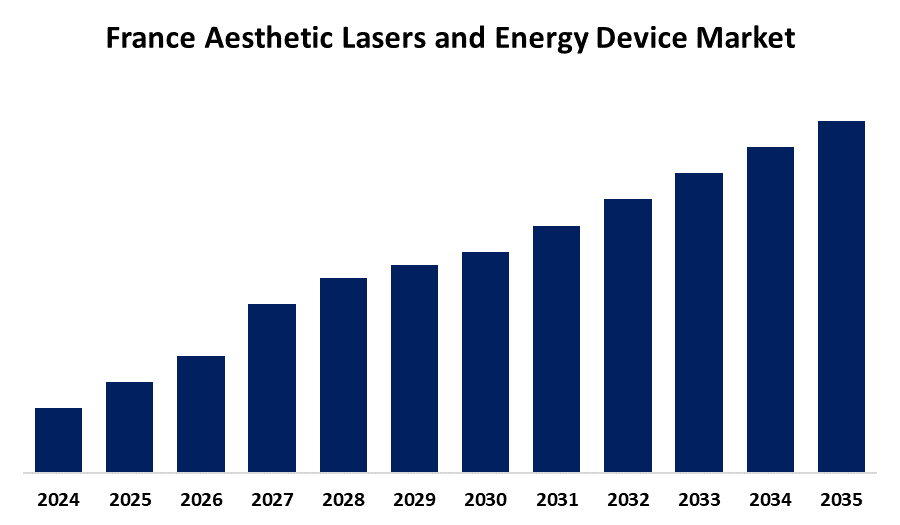

- The France Aesthetic Lasers and Energy Device Market Size is Expected to Grow at a CAGR of around 6.8% from 2025 to 2035

- The France Aesthetic Lasers and Energy Device Market Size is Expected to Hold a Significant Share by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the France Aesthetic Lasers and Energy Device Market Size is Anticipated to Hold a Significant Share by 2035, Growing at a CAGR of 6.8% from 2025 to 2035. The France aesthetic lasers and energy device market is driven by rising demand for minimally invasive and non-invasive cosmetic procedures, increasing awareness about aesthetic treatments, and the growing aging population seeking anti-aging solutions.

Market Overview:

Medical devices utilized for the therapy of cosmetic issues through the application of energy are energy devices and aesthetic lasers. Aesthetic lasers use light energy to target specific skin pigments or tissues. Aesthetic lasers are applied to correct different skin flaws, including sun spots, wrinkles, acne marks, and unwanted hair. Energy devices use all kinds of energy sources, including light, radiofrequency, laser, or ultrasound, to give non-invasive or minimally invasive treatments. Mostly, energy devices and aesthetic lasers are combined in a bid to offer the ideal treatment. They are safe for every skin type and are a new method of rejuvenating the skin. The aesthetic laser and energy devices market is moving towards greater growth rates, given technology advancements, growth in demand for non-surgical treatments, and greater public awareness of aesthetic procedures. The sector comprises lasers, light-based technologies, radio-frequency, and ultrasound technologies, applied in treatments such as the removal of wrinkles, reduction of hair, and liposuction, among others. There is high innovation and expansion of new products, with the major players vying to be competitive in the market.

Report Coverage:

This research report categorizes the France aesthetic lasers and energy device market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France aesthetic lasers and energy device market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France aesthetic lasers and energy device market.

The market for energy devices and aesthetic lasers has shown steady revenue growth since the introduction of new treatment technologies. An additional element propelling the market is the rise in individuals seeking cosmetic surgery because of the improved results and lower health risks involved. Social media's stimulation of a renewed focus on facial beauty has made aesthetic procedures more popular, and more people are selecting them. Increased use in other areas, such as body sculpting and vascular lesions, including tattoos, and a larger prevalence of skin problems are other concerns.

France Aesthetic Lasers and Energy Device Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 6.8% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Product, By Technology, And COVID-19 Impact Analysis. |

| Companies covered:: | Mentor Corporation, Lumenis Ltd., Cynosure Inc., AbbVie Inc., Aerolase, Candela, Lumenis Be. Ltd., Alma Lasers, Hologic and Others. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Restraining Factor

The unnecessarily high cost of treatment is inconvenient to patients and expensive for small clinics. Legal and safety regulations have the effect of deterring new product development and take an interest in products' side effects to the market. Competition compels organisations to seek product specialisation to try to maintain profit, while at the same time being vigilant for competitors. In addition, emerging market unawareness and volatility also hurt demand as consumers curbed purchases of luxury and beauty treatments during downturns.

Market Segmentation

The France aesthetic lasers and energy device market share is classified into product and technology.

- The laser resurfacing devices segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period

The France aesthetic lasers and energy device market is segmented by product into laser resurfacing devices, body contouring devices, and aesthetic ophthalmology devices. Among these, the laser resurfacing devices segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmented expansion can be attributed to the increasing need for anti-aging and rejuvenation of the skin. Since laser resurfacing has proven so effective in erasing wrinkles, fine lines, scars, and hyperpigmentation, patients are eagerly awaiting this procedure as the answer to achieving the skin that appears youthful and healthy. The invention of fractional and ablative lasers, among others, has improved the safety and efficiency of treatments, thus making them popular.

- The energy-based technology segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period

The France aesthetic lasers and energy device market is segmented by technology into laser-based technology, light-based technology, and energy-based technology. Among these, the energy-based technology segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental expansion can be attributed to its versatility and effectiveness in a variety of cosmetic uses, such as hair removal, body sculpting, and skin tightening. Because they provide non-invasive or minimally invasive solutions with less recovery time, these technologies, which include radiofrequency, ultrasound, and light-based systems, are becoming more and more well-liked by both patients and professionals.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France aesthetic lasers and energy device market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mentor Corporation

- Lumenis Ltd.

- Cynosure Inc.

- AbbVie Inc.

- Aerolase

- Candela

- Lumenis Be. Ltd.

- Alma Lasers

- Hologic

- Others

Recent Developments

- In June 2024, Lumenis Be. Ltd. launched FoLix, a groundbreaking fractional laser system for treating hair loss, which is now the first FDA-cleared option in the U.S. for safe, effective, and natural hair loss treatment for both men and women.

- In March 2024, Alma, a Sisram Medical company and a global leader in energy-based medical and aesthetic solutions, announced the launch of a special edition of Soprano Titanium to enable faster and more efficient hair removal sessions.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France aesthetic lasers and energy device market based on the below-mentioned segments:

France Aesthetic Lasers and Energy Device Market, By Product

- Laser Resurfacing Devices

- Body Contouring Devices

- Aesthetic Ophthalmology Devices

France Aesthetic Lasers and Energy Device Market, By Technology

- Laser-Based Technology

- Light-Based Technology

- Energy-Based Technology

Need help to buy this report?