France Aerospace Forging Market Size, Share, and COVID-19 Impact Analysis, By Material (Aluminum, Steel, and Titanium), By Aircraft (Commercial and Military), and France Aerospace Forging Market Insights, Industry Trend, Forecasts to 2035.

Industry: Advanced MaterialsFrance Aerospace Forging Market Insights Forecasts to 2035

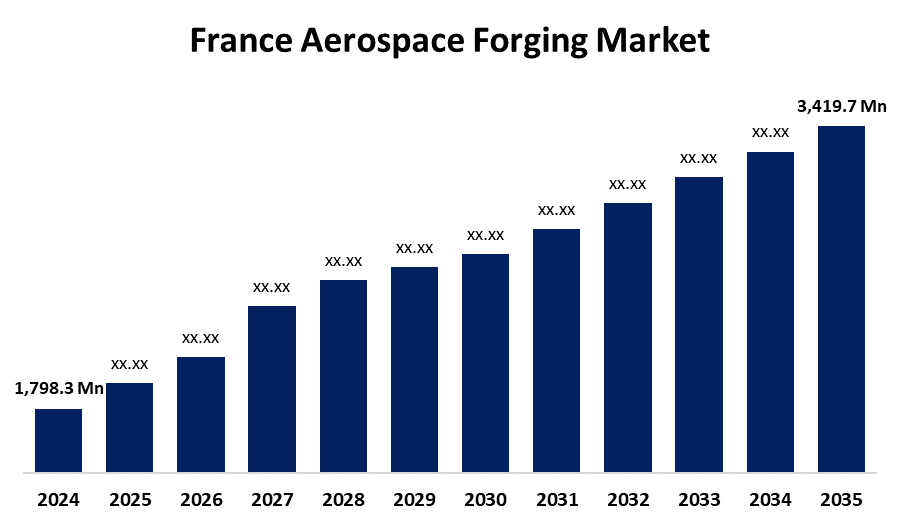

- The France Aerospace Forging Market Size was estimated at USD 1,798.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.02% from 2025 To 2035

- The France Aerospace Forging Market Size is Expected to Reach USD 3,419.7 Million By 2035

Get more details on this report -

The France Aerospace Forging Market Size is Anticipated to reach USD 3,419.7 Million By 2035, Growing at a CAGR of 6.02% from 2025 To 2035. Key drivers include the demand for lightweight, fuel-efficient components, particularly in commercial aviation, and the adoption of advanced materials like titanium and aluminum alloys.

Market Overview

The France aerospace forging market is a key component of the country’s aerospace manufacturing industry, specializing in the production of high-strength metal parts used in aircraft and spacecraft. Forging is a manufacturing process that involves shaping metal using localized compressive forces, typically by hammering or pressing. In aerospace applications, this method ensures structural integrity and resistance to extreme operational conditions. In France, aerospace forging serves both commercial and military aviation, supporting the production of critical components such as engine parts, landing gear, and structural assemblies. The industry is closely integrated with leading aerospace manufacturers and suppliers, and benefits from a well-established infrastructure, skilled labor force, and dedicated aerospace clusters such as Aerospace Valley. French forging companies often adhere to rigorous international standards, ensuring compliance with aerospace requirements for safety and performance. The market includes a mix of large corporations and specialized small and medium-sized enterprises (SMEs), contributing to its overall stability and innovation.

Report Coverage

This research report categorizes the market for the France aerospace forging market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France aerospace forging market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France aerospace forging market.

France Aerospace Forging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1,798.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.02% |

| 2035 Value Projection: | USD 3,419.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Material, By Aircraft and COVID-19 Impact Analysis |

| Companies covered:: | Mecachrome S.A.S., Manoir Industries, Aubert & Duval, Forgital Group, Figeac Aero, Safran S.A., Thales S.A., Dediène Aerospace, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of commercial aviation and defense modernization programs boosts the need for advanced forged parts. Technological advancements in forging techniques, such as isothermal and precision forging, enhance product quality and performance. Additionally, the strong presence of major aerospace players like Airbus and Safran, along with robust government support for research and development, further stimulates market growth. Rising exports and global partnerships also contribute to expanding market opportunities.

Restraining Factors

The France aerospace forging market faces several restraining factors, including high production costs associated with advanced materials like titanium and the energy-intensive forging process. Stringent regulatory standards and certification requirements can delay product development and market entry.

Market Segmentation

The France aerospace forging market share is classified into material and aircraft.

- The aluminum segment held the highest market share in 2024 and is expected to grow at a substantial CAGR during the forecast period.

The France aerospace forging market is segmented by material into aluminum, steel, and titanium. Among these, the aluminum segment held the highest market share in 2024 and is expected to grow at a substantial CAGR during the forecast period. The dominance is attributed to aluminum's favorable strength-to-weight ratio, corrosion resistance, and cost-effectiveness, making it ideal for aircraft structures and components. Its widespread use in both commercial and military aircraft further reinforces its leading position in the market.

- The commercial segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France aerospace forging market is segmented by aircraft into commercial and military. Among these, the commercial segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth is driven by increasing air passenger traffic, fleet expansion by major airlines, and rising demand for fuel-efficient aircraft. The commercial sector's continuous investment in new-generation aircraft and maintenance of existing fleets further contributes to the segment’s dominant position in the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France aerospace forging market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mecachrome S.A.S.

- Manoir Industries

- Aubert & Duval

- Forgital Group

- Figeac Aero

- Safran S.A.

- Thales S.A.

- Dediène Aerospace

- Others

Recent Developments:

- In May 2024, Forgital Group entered into a multi-year agreement with Safran Aircraft Engines, focusing on the joint pursuit of CFM International LEAP-1A/-1B and GE9X programs. This collaboration aims to advance aerospace technologies and enhance the performance and reliability of aircraft engines. The partnership underscores a shared commitment to innovation and excellence in the aerospace industry.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France aerospace forging market based on the below-mentioned segments

France Aerospace Forging Market, By Material

- Aluminum

- Steel

- Titanium

France Aerospace Forging Market, By Aircraft

- Commercial

- Military

Need help to buy this report?