Global Flight Simulator Market Size By Product (Full Flight Simulator (FFS), Fixed Flight Training Devices (FTD)), By Application (Military & Defence, Civil), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Aerospace & DefenseGlobal Flight Simulator Market Insights Forecasts to 2033

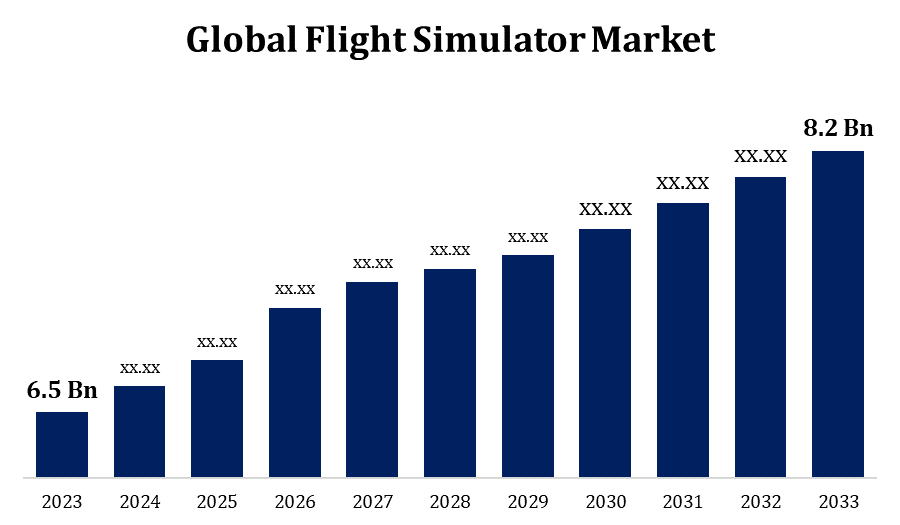

- The Global Flight Simulator Market Size was valued at USD 6.5 Billion in 2023.

- The Market Size is Growing at a CAGR of 2.35% from 2023 to 2033

- The Worldwide Flight Simulator Market Size is expected to reach USD 8.2 Billion by 2033

- Asia Pacific is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Flight Simulator Market Size is expected to reach USD 8.2 Billion by 2033, at a CAGR of 2.35% during the forecast period 2023 to 2033.

The burgeoning global air travel market was putting increasing pressure on the aviation sector to provide pilot training. In order to provide realistic training scenarios without requiring actual flight time, flight simulators are essential. Since flight simulators eliminate the requirement for real flight hours and related costs, they provide a more affordable option for pilot training than traditional techniques. Adoption was being fueled by this cost-effectiveness, particularly in areas where there was a pilot shortage. Flight simulators were widely utilised for training military pilots in addition to commercial aviation. Governments everywhere were spending money on cutting-edge simulation technologies to make sure their air forces were ready. Virtual reality technology were starting to be incorporated into flight simulators.

Flight Simulator Market Value Chain Analysis

Research and development organisations concentrate on creating cutting-edge hardware, software, and technologies for flight simulation. This covers developments in virtual reality integration, physics modelling, and visuals. This category includes businesses that produce the actual flight simulator parts, like motion systems, cockpit panels, control interfaces, and visual displays. The flight simulator's simulation software is created by software developers. This covers realistic circumstances, environmental factors, and flight dynamics. These businesses are always striving to make the simulation experience more realistic and accurate. Complete flight simulator systems are constructed by assembling different hardware and software components together by integration and assembly-focused businesses. The distribution of flight simulator equipment to end customers involves distributors and resellers. They may provide sales and support services while working directly with manufacturers or serving as middlemen in the supply chain. For pilot training and competency testing, commercial airlines and military institutions buy and use flight simulators. To guarantee that flight simulators continue to work, maintenance and support services are necessary.

Flight Simulator Market Opportunity Analysis

For makers of flight simulators, the growing global air transport market and expanding fleet are creating a major demand for qualified pilots. The sector may profit from this need by offering sophisticated, reasonably priced training programmes. The training experience is improved by the incorporation of VR and AR technology into flight simulators, which offer more realistic scenarios and immersive settings. Digital twin technology presents prospects for producing highly realistic and configurable virtual reproductions of aircraft and their systems through development and application in flight simulation. For flight simulator manufacturers, the military market presents a considerable opportunity. There is a constant need for high-fidelity simulators since governments all over the world are spending money on cutting-edge simulation technologies for military pilot training.

Global Flight Simulator Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 6.5 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 2.35% |

| 2033 Value Projection: | USD 8.2 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Application, By Region, and Covid -19 impact Analysis. |

| Companies covered:: | Collins Aerospace, Boeing Company, Raytheon Company, Flight Safety International, Precision Flight Controls, CAE, SIMCOM Aviation Training, TRU Simulation Airbus Group, Frasca International, L-3 Communications, and Others |

| Growth Drivers: | Rising demand for better and more effective pilot training |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Flight Simulator Market Dynamics

Rising demand for better and more effective pilot training

There is a growing demand for qualified pilots as a result of the aviation industry's continual expansion on a global scale. An increasing number of passengers on airlines is driving them to increase their fleets, which in turn creates a need for efficient pilot training programmes. An affordable substitute for conventional pilot training techniques, which mostly rely on real flight hours, are flight simulators. Pilots can rehearse a vast array of situations in a safe setting using simulators, all without the costs connected with actual aircraft operations. The use of flight simulators is essential for improving aviation safety. Pilots can practise in a risk-free yet realistic environment, covering a range of emergency scenarios, inclement weather, and system malfunctions. As a result, pilot competency and safety criteria are raised.

Restraints & Challenges

High-fidelity flight simulator development and production come with hefty upfront expenses. For smaller businesses or training facilities wishing to invest in cutting-edge simulation technology, this can be a hurdle. Innovation in technology is happening quite quickly in the aviation sector. For their simulations to remain competitive and relevant, flight simulator producers must remain at the forefront of these advancements. This may make it difficult to invest continuously in R&D and to stay up to date with new technology. Numerous models are produced by aircraft manufacturers, each with distinctive features of its own. It is challenging to create flight simulators that faithfully simulate the flight characteristics of many aircraft models, especially as new aircraft are introduced.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Flight Simulator Market from 2023 to 2033. Some of the biggest and most powerful aerospace and aviation corporations in the world are based in North America, especially the United States. Major airlines, defence contractors, and aircraft manufacturers are present, which creates a strong environment for the development and use of flight simulators. Both military and commercial pilots are heavily represented in the area. Many flight training facilities and aviation schools are outfitted with cutting-edge flight simulation equipment to satisfy the training requirements of this pilot pool. Military aviation is a major priority in North America, and the country's defence services make significant investments in cutting-edge technologies for training and simulation. Mission planning, operational preparation, and pilot training are all conducted in military flight simulators.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The rise of the aviation sector worldwide has been significantly fueled by the Asia-Pacific area. The aviation industry has grown as a result of rising economic prosperity, greater urbanisation, and an expanding middle class, which have all increased demand for air travel. The Asia-Pacific region's aviation industry is expanding, which has raised the need for qualified pilots. In pilot training programmes, flight simulators are essential because they provide a practical and economical means of training pilots without requiring a large number of actual flight hours. Air traffic in the region is heavy, encompassing both domestic and international aircraft. As a result, there is a need for efficient training programmes to guarantee that pilots are equipped to handle a variety of flying situations.

Segmentation Analysis

Insights by Product

The FFS segment accounted for the largest market share over the forecast period 2023 to 2033. Among flight simulators, FFS provides the best level of authenticity and realism. With remarkable precision, these simulators imitate the cockpit and flying characteristics of particular aircraft models, offering a realistic training environment that is very similar to real flying. A large variety of training scenarios, such as routine and emergency procedures, unfavourable weather, and difficult manoeuvres, can be simulated using FFS. In a controlled setting that closely resembles actual circumstances, pilots can hone their skills. Compared to using real aircraft for training, the cost per training hour for full flight simulators is typically less, despite the simulators' substantial initial investment. FFS eliminates the requirement for actual flying hours, enabling more effective and economical pilot training.

Insights by Application

The civil segment accounted for the largest market share over the forecast period 2023 to 2033. The key driver of the civil segment is the ongoing expansion of the global air transport industry. The demand for qualified pilots is rising as more people travel by air, and flight simulators are essential to pilot training programmes. One of the issues facing the aviation sector, particularly commercial airlines, is the lack of pilots. Flight simulators offer an economical and effective way to teach new pilots and improve the abilities of current pilots, which helps to address this problem. When training pilots, civil flight simulators are a more affordable option than operating real aircraft. Airlines can save money by using simulators instead of real aircraft training, which requires costly flying hours, fuel, and maintenance expenditures.

Recent Market Developments

- In May 2023, the new miniFCU autopilot control interface has been launched by miniCOCKPIT, a firm that specialises in flight simulator accessories.

Competitive Landscape

Major players in the market

- Collins Aerospace

- Boeing Company

- Raytheon Company

- Flight Safety International

- Precision Flight Controls

- CAE

- SIMCOM Aviation Training

- TRU Simulation Airbus Group

- Frasca International

- L-3 Communications

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Flight Simulator Market, Product Analysis

- Full Flight Simulator (FFS)

- Fixed Flight Training Devices (FTD)

Flight Simulator Market, Application Analysis

- Military & Defence

- Civil

Flight Simulator Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Need help to buy this report?