Global Feeding Systems Market Size, Share, and COVID-19 Impact Analysis, By Type (Rail-Guided, Conveyor Belt, and Self-Propelled), By Livestock (Ruminants, Poultry, and Swine), By Offering (Hardware, Software, and Services), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032.

Industry: AgricultureGlobal Feeding Systems Market Insights Forecasts to 2032

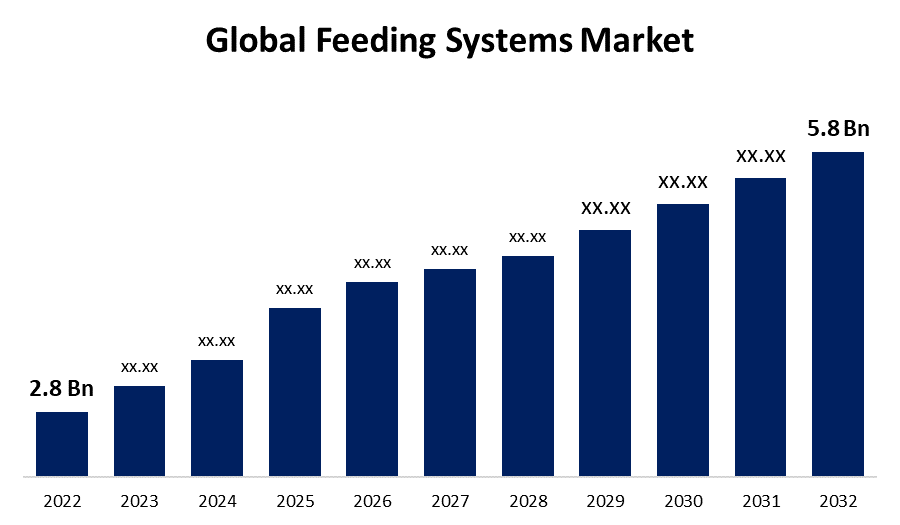

- The Global Feeding Systems Market Size was valued at USD 2.8 Billion in 2022.

- The Market is Growing at a CAGR of 7.5% from 2022 to 2032

- The Worldwide Feeding Systems Market Size is expected to reach USD 5.8 Billion by 2032

- Asia Pacific is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Feeding Systems Market Size is projected to exceed USD 5.8 Billion by 2032, Growing at a CAGR of 7.5% from 2022 to 2032. The global feeding systems market is witnessing substantial growth due to the increasing demand for automation, emphasis on animal health and nutrition, technological advancements, and the expansion of livestock production. As the agriculture and livestock industries continue to evolve, feeding systems will play a crucial role in improving efficiency, sustainability.

Market Overview

The global feeding systems market encompasses various equipment and technologies used in the automation of animal feeding processes across livestock and aquaculture industries. These systems aim to enhance feeding efficiency, improve animal health and welfare, and optimize overall production. Feeding systems comprise a range of equipment such as automated feeders, conveyors, feed mixers, silos, and feed storage systems. These devices are designed to deliver precise amounts of feed to animals, reduce feed wastage, and ensure uniform distribution. Advanced feeding systems often incorporate software solutions and sensors to monitor and control feed consumption, feeding schedules, and feed quality. These technologies enable real-time data collection, analysis, and adjustment of feeding parameters, ensuring optimal nutrition and performance. These systems are widely used in various sectors such as dairy farming, poultry farming, swine farming, and aquaculture.

The global feeding systems market is highly competitive and fragmented. Key players in the market include DeLaval Inc., GEA Group AG, Lely Industries N.V., Fancom B.V., Agrologic Ltd., Trioliet B.V., Cormall AS, Rovibec Agrisolutions Inc., Bauer Technics A.S., and Roxell NV, among others. These companies focus on continuous product innovation, strategic partnerships, and mergers and acquisitions to strengthen their market position.

For instance, in November 2022, DeLaval has introduced a new feed pusher robot to improve productivity. The machine uses a twin-spiralled spinning auger and adaptable drive function to mix a range of forage types to make it more palatable while decreasing waste.

Report Coverage

This research report categorizes the market for the global feeding systems market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the feeding systems market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the feeding systems market.

Global Feeding Systems Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 2.8 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 7.5 |

| 2032 Value Projection: | USD 5.8 Billion |

| Historical Data for: | 2020-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Livestock, By Offering, By Region. |

| Companies covered:: | DeLaval, Lely, GEA Group Aktiengesellschaft, VDL Agrotech, ScaleAQ, Trioliet B.V., Pellon Group Oy, Dairymaster, BouMatic, Rovibec Agrisolutions, CTB, Inc., Afimilk Ltd., HETWIN Automation System GmbH, Maskinfabrikken Cormall A/S, JH AGRO A/S, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Automation helps in reducing labor costs and increasing operational efficiency. Feeding systems automate tasks such as feed distribution, portion control, and feeding schedules, eliminating the need for manual labor. This results in cost savings for farmers and allows them to allocate resources to other important aspects of their operations. Feeding systems provide precise and accurate feeding solutions. They ensure consistent portion sizes and feeding intervals, avoiding overfeeding or underfeeding. This precision contributes to better animal health, growth, and productivity. Automated systems can also adjust feed rations based on factors such as animal weight, age, and nutritional requirements, further enhancing accuracy. Automation in feeding systems enables real-time monitoring of feeding activities and animal behavior. Sensors and data analytics tools can track feeding patterns, feed consumption, and health indicators. This data helps farmers identify any abnormalities or deviations from normal feeding behavior, enabling timely intervention and prevention of potential health issues.

Restraining Factors

Feeding systems require specialized equipment such as automated feeders, sensors, control panels, and data management systems. Additionally, infrastructure modifications may be needed to accommodate the installation of feeding systems, including the construction or modification of feeding stations, feed storage units, and connectivity infrastructure. These equipment and infrastructure costs can be substantial, especially for small and medium-scale farmers with limited capital resources. Adopting feeding systems necessitates training farm personnel to operate and maintain the equipment. Training programs, workshops, or hiring skilled personnel can incur additional costs. The need for ongoing technical support and updates further adds to the expenses associated with skill development.

Market Segmentation

The Global Feeding Systems Market share is classified into type, livestock, and offering.

- The self-propelled segment is expected to hold the largest share of the global feeding systems market during the forecast period.

Based on the type, the global feeding systems market is divided into rail-guided, conveyor belt, and self-propelled. Among these, the self-propelled segment is expected to hold the largest share of the global feeding systems market during the forecast period. The growth can be attributed due the benefits of self-propelled feeding systems including flexibility, reduced labor costs, and maximum feeding optimization. The self-propelled segment comprises feeding systems that are equipped with their propulsion mechanism, allowing them to move autonomously within the farming facility. These systems typically feature advanced navigation technologies to navigate through barns or enclosures and distribute feed accurately. Self-propelled feeding systems offer flexibility and adaptability in terms of feed distribution, especially in complex or irregularly shaped farming environments.

- The ruminant segment is expected to hold the largest share of the global feeding systems market during the forecast period.

Based on the livestock, the global feeding systems market is divided into ruminants, poultry, and swine. Among these, the ruminant segment is expected to hold the largest share of the global feeding systems market during the forecast period. In the global feeding systems market, the ruminants segment refers to feeding systems specifically designed for cattle, sheep, and goats. These systems cater to the unique digestive system of ruminants, which require a steady supply of high-quality forage, such as grass or hay. Feeding systems for ruminants often involve feeders and troughs that allow for controlled access to forage and may incorporate technologies like automated feeding or ration balancing to optimize nutrition and animal health.

- The hardware segment is expected to hold the largest share of the global feeding systems market during the forecast period.

On the basis of the offering, the global feeding systems market is segmented into hardware, software, and services. Among these, the hardware segment is expected to hold the largest share of the global feeding systems market during the forecast period. The growth can be attributed due to the significant presence of physical components and equipment in feeding systems. This includes feeders, troughs, conveyors, sensors, control panels, and other mechanical or electronic devices that are integral to the functioning of feeding systems. Hardware components are designed to facilitate efficient and accurate feed delivery, monitor feeding parameters, and ensure optimal feed utilization in agricultural operations.

Regional Segment Analysis of the Global Feeding Systems Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

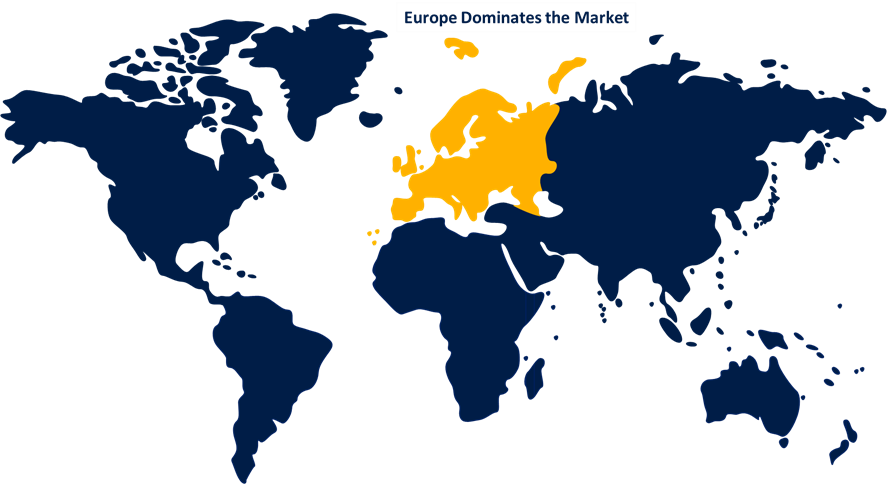

Europe is estimated to hold the largest share of the global feeding systems market over the predicted timeframe.

Get more details on this report -

Europe is expected to hold the largest share of the global feeding systems market during the forecast period. Europe has a strong agricultural sector and a high emphasis on sustainable and efficient farming practices. The region is characterized by a diverse range of livestock production, including dairy, poultry, and swine. European countries have stringent regulations regarding animal welfare, which drives the adoption of advanced feeding systems that ensure precise feed delivery, nutritional optimization, and environmental sustainability.

Asia Pacific is expected to grow at the fastest pace in the global feeding systems market during the forecast period. The Asia Pacific region has a substantial livestock population, particularly in countries like China, India, and Japan. Rising meat consumption, urbanization, and a shift towards intensive livestock farming practices are driving the demand for feeding systems in this region. The market in the Asia Pacific is characterized by a mix of small and large-scale farming operations, with a growing focus on automation, digitization, and smart farming technologies.

Latin America is a significant player in the global livestock industry, with countries like Brazil, Argentina, and Mexico being major contributors. The region has a diverse agricultural landscape, including extensive cattle ranching, poultry production, and swine farming. The adoption of feeding systems in Latin America is driven by factors such as increasing meat exports, modernization of farming practices, and the need for efficient feed management in large-scale operations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global feeding systems along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- DeLaval

- Lely

- GEA Group Aktiengesellschaft

- VDL Agrotech

- ScaleAQ

- Trioliet B.V.

- Pellon Group Oy

- Dairymaster

- BouMatic

- Rovibec Agrisolutions

- CTB, Inc.

- Afimilk Ltd.

- HETWIN Automation System GmbH

- Maskinfabrikken Cormall A/S

- JH AGRO A/S

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2023, DeLaval has introduced the new robot as a module in its DeLaval Optimat complete automated feeding solution. This all-in-one feeding solution handles everything from weighing, cutting, and mixing feed to delivering it to the feed table.

- In October 2021, BouMatic purchased SAC Group (Denmark). The acquisition of SAC Group is a clear strategic fit for BouMatic, allowing the newly combined company to grow as one of the few global full-line dairy solutions suppliers.

- In February 2021, The AKVA Group acquired 33.7% of Observe Technologies Ltd. in order to strengthen its digital strategy. AKVA Group has been working with the company on the development and implementation of its AI feeding system since 2018.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Feeding Systems Market based on the below-mentioned segments:

Global Feeding Systems Market, By Type

- Rail-Guided

- Conveyor Belt

- Self-Propelled

Global Feeding Systems Market, By Livestock

- Ruminants

- Poultry

- Swine

Global Feeding Systems Market, By Offering

- Hardware

- Software

- Services

Global Feeding Systems Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?