Europe Sugar Confectionery Market Size, Share, and COVID-19 Impact Analysis, By Confectionary Variant (Hard Candy, Lollipops, Mints, Pastilles, Gummies, and Jellies, Toffees and Nougats, Others), By Distribution Channel (Convenience Store, Online Retail Store, Supermarket/Hypermarket, Others), and Europe Sugar Confectionery Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesEurope Sugar Confectionery Market Insights Forecasts to 2035

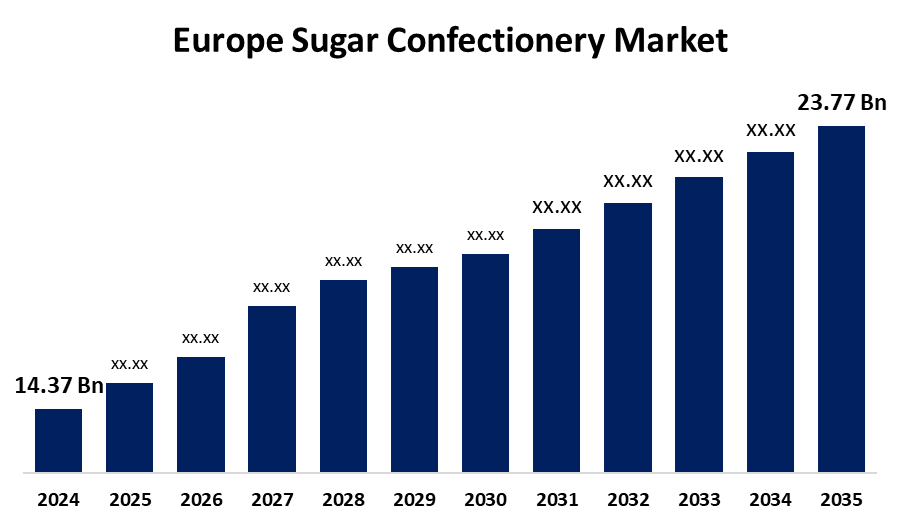

- The Europe Sugar Confectionery Market Size Was Estimated at USD 14.37 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.68% from 2025 to 2035

- The Europe Sugar Confectionery Market Size is Expected to Reach USD 23.77 Billion by 2035

Get more details on this report -

According to a Research Report Published By Spherical Insights & Consulting, The Europe sugar Confectionery Market Size is anticipated to reach USD 23.77 Billion by 2035, Growing at a CAGR of 4.68% from 2025 to 2035. The European sugar confectionery market is fueled by increasing consumer appetite for indulgent sweets, novel product launches, premiumization, and seasonal gift trends. Comprehensive retail networks, increased tourism, and cultural preference for sweets further drive sustained growth in the regional market.

Market Overview

The Europe sugar confectionery market is the business engaged in the manufacture, distribution, and sale of sweet-flavored, sugar-based goods in European nations. The goods are consumed across all ages due to Europe's long-standing snacking culture and seasonal occasions. Sugar confectionery provides indulgent, convenient, and affordable pleasure, usually associated with emotional moments, celebrations, and social occasions. The industry is supported by high consumer loyalty, regular flavor and texture innovation, and a growing premium segment for gifting. Additionally, flavor, texture, and status ingredient innovation are a driving force in the sugar confectionery industry. Manufacturers bring new and innovative flavors, sugar-free formats, and functional sweets that appeal to changing consumer tastes. These new developments address the need for diversity and appeal to health-conscious and adventurous customers, keeping brands competitive and engaging consumers throughout the year. Overall, the market remains on the rise because of its flexibility, emotional attractiveness, and innovative product formats that appeal to contemporary consumer tastes throughout Europe.

Report Coverage

This research report categorizes the market for Europe sugar confectionery market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe sugar confectionery market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe sugar confectionery market.

Europe Sugar Confectionery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 14.37 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.68% |

| 2035 Value Projection: | USD 23.77 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Confectionary Variant, By Distribution Channel |

| Companies covered:: | Perfetti Van Melle, August Storck KG, Toms International, Vanparys Confiserie, HARIBO Holding GmbH & Co. KG, Nestle SA, Ricola AG, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Europe boasts a long-standing snacking culture, with sugar confectionery being a popular treat. Gummies, hard candies, and mints are popular across all age groups. Such a cultural affinity for sweet confections guarantees consistent demand, particularly around social gatherings, festivals, and everyday life, fueling continuous market growth. Additionally, sugar confectionery items are widely available through extensive retail channels in the form of supermarkets, hypermarkets, convenience stores, and online platforms. This availability on a wide scale improves consumer access, stimulates impulse buying, and guarantees product visibility in rural areas as well as urban centers, enabling regular market coverage.

Restraining Factors

Increased health concerns of excessive sugar consumption, like obesity, diabetes, and tooth decay have prompted many consumers to cut down or eliminate sugar confectionery. This change in healthier food consumption is reducing demand for conventional sweet products throughout Europe.

Market Segmentation

The Europe sugar confectionery market share is classified into confectionery variant and distribution channel.

- The pastilles, gummies, and jellies segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Europe sugar confectionery market is segmented by confectionery variant into hard candy, lollipops, mints, pastilles, gummies, jellies, toffees, and nougats, and others. Among these, the pastilles, gummies, and jellies segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth is attributed to gummies and jellies are popular with kids and adults alike because they are soft to eat, fruity in taste, and fun shapes. That wide-based popularity creates steady demand in all age groups, making them a standard in households and a convenient treat option for both regular and celebratory uses.

- The supermarket/hypermarket segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe sugar confectionery market is segmented by distribution channel into convenience store, online retail store, supermarket/hypermarket, and others. Among these, the supermarket/hypermarket segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is due to supermarkets and hypermarkets providing large shelf space, enabling a broad range of sugar confectionery products to be stocked. Consumers like the convenience of buying several product categories under one roof. Supermarkets and hypermarkets offer one-stop shopping for snacks, drinks, and confectionery, making them ideal for stocking up on sugar-based treats during routine grocery visits or special occasions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe sugar confectionery market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Perfetti Van Melle

- August Storck KG

- Toms International

- Vanparys Confiserie

- HARIBO Holding GmbH & Co. KG

- Nestle SA

- Ricola AG

- Others

Recent Developments:

- In August 2024, Terry's, famous for its chocolate orange, launched the "norange"—a plain milk chocolate sphere. This is a bid to widen its product line and attract more customers outside the festive period.

- In March 2024, Europraliné added some new products to their portfolio, such as the Chest Trap box of chocolates and Trapa Collection 100% cocoa tablet. Their chocolates, Sublime Trap and Sublime Trap 0% Added Sugars, won the 2024 Flavor of the Year awards.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe sugar confectionery market based on the below-mentioned segments:

Europe Sugar Confectionery Market, By Confectionery Variant

- Hard Candy

- Lollipops

- Mints

- Pastilles, Gummies, and Jellies

- Toffees and Nougats

- Others

Europe Sugar Confectionery Market, By Distribution Channel

- Convenience Store

- Online Retail Store

- Supermarket/Hypermarket

- Others

Need help to buy this report?