Europe Specialty Generics Market Size, Share, and COVID-19 Impact Analysis, By Route of Administration (Injectables, Oral, Others), By Indication (Oncology, Autoimmune Diseases, Infectious Diseases, Others), By Distributional Channel (Retail Pharmacies, Specialty Pharmacies, Hospital Pharmacies, Others), By Country (Germany, UK, France, Italy, Spain, Russia, Rest of Europe), and Europe Specialty Generics Market Insights Forecasts to 2032

Industry: HealthcareEurope Specialty Generics Market Insights Forecasts to 2032

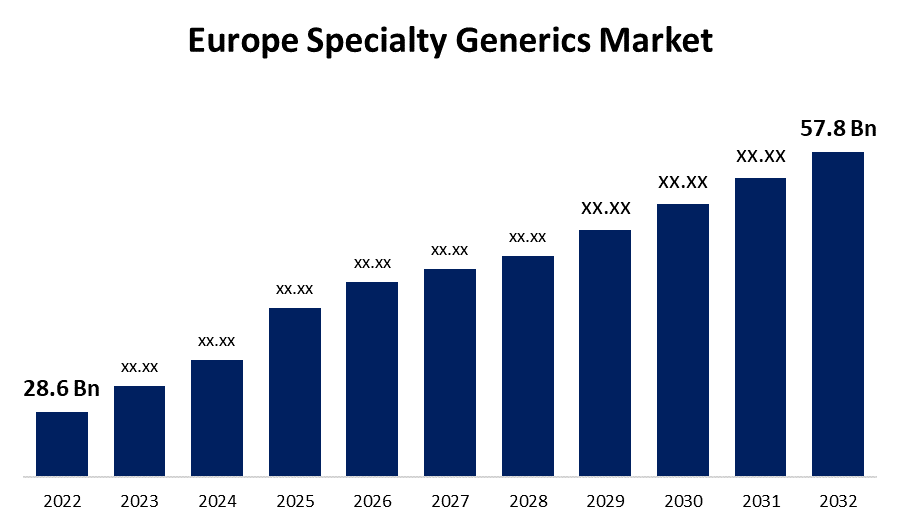

- The Europe Specialty Generics Market Size was valued at USD 28.6 Billion in 2022.

- The market is Growing at a CAGR of 7.3% from 2022 to 2032.

- The Europe Specialty Generics Market Size is expected to reach USD 57.8 Billion by 2032.

- Europe is expected to grow the fastest during the forecast period.

Get more details on this report -

The Europe Specialty Generics Market Size is expected to reach USD 57.8 Billion by 2032, at a CAGR of 8.2% during the forecast period 2022 to 2032.

Market Overview

Specialty generics are low-cost generic equivalents of high-priced branded medications designed to treat complex or unusual illnesses. Unlike regular generics, which are frequently aimed at common diseases, specialty generics target particular therapeutic areas and may necessitate specialist handling, administration, or patient management. Because of the rising prevalence of chronic and complex disorders, as well as the high cost of specialty branded pharmaceuticals, there is a growing demand for specialty generics. Europe's specialty generics industry fills an important gap in the pharmaceutical landscape by providing generic substitutes for high-cost, branded specialty medications. These drugs, which target difficult or rare disorders, offer a more cost-effective alternative without sacrificing treatment efficacy or safety. Europe has a strong regulatory structure that is principally overseen by the European Medicines Agency (EMA). The EMA ensures that specialty generics satisfy the same high quality, safety, and efficacy standards as branded drugs. As more branded specialty medicine patents expire in the future years, chances for the introduction of more specialty generics in Europe are expected to emerge.

Report Coverage

This research report categorizes the market for Europe Specialty Generics Market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe Specialty Generics Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Europe Specialty Generics Market.

Europe Specialty Generics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 28.6 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 7.3% |

| 2032 Value Projection: | USD 57.8 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Route of Administration, By Indication, By Distribution Channel, By Country |

| Companies covered:: | Teva Pharmaceutical Industries Ltd, Sun Pharmaceutical Industries Ltd., Dr. Reddy’s Laboratories Ltd., Sandoz International GmbH, Perrigo Company plc, Endo International plc., GlaxoSmithKline plc, Fresenius Kabi AG, Wockhardt, Viatris, Inc., Apotex, Inc., Lupin, Sanofi, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Europe specialty generics market is a booming segment of the pharmaceutical industry, offering a cost-effective alternative to high-priced, branded specialty medications that treat difficult or rare disorders. The market is gaining traction as a result of Europe's improved healthcare infrastructure and an aging population. The region's aging population, combined with the increased prevalence of chronic conditions, drives demand for specialized generics. This demand is fueled by both the efficacy of these medications and their low cost in comparison to branded alternatives. Specialty generics are a long-term solution that provides high-quality care while lowering healthcare costs. The market addresses some of the continent's most pressing healthcare requirements by encompassing a wide range of therapeutic categories such as oncology, neurology, cardiovascular illnesses, and autoimmune disorders. The European Medicines Agency (EMA) plays an essential role in ensuring that specialty generics fulfill the same rigorous safety, effectiveness, and quality standards as original specialty pharmaceuticals. With several branded specialty medications nearing patent expiration, new potential for increasing the specialty generics industry in Europe is arising.

Market Segment

- In 2022, the oral segment is expected to hold the largest share of Europe Specialty Generics market during the forecast period.

Based on the route of administration, the Europe Specialty Generics Market is classified into injectables, oral, and others. Among these, the oral segment is expected to hold the largest share of the Europe Specialty Generics market during the forecast period. Because of the simplicity of consumption, pain avoidance, and patient compliance, oral administration is the most common and favored route. It also allows for a slower, more sustained drug release, which can be beneficial for maintaining therapeutic levels. The ease of administration, combined with advances in medication formulation that provide improved bioavailability, makes it the favored choice for both patients and healthcare providers.

- In 2022, the oncology segment accounted for the largest revenue share of more than 42.3% over the forecast period.

On the basis of indication, the Europe Specialty Generics Market is segmented into oncology, autoimmune diseases, infectious diseases, and others. Among these, the oncology segment dominates the market with the highest revenue share of 42.3% over the forecast period. This section highlights specialty generics used to treat various types of cancer. These medications target specific processes or cells involved in the growth and spread of cancer. With increased cancer incidence rates in Europe and a greater need for effective therapies, demand for oncology generics has risen, particularly as brand-name patents expire.

- In 2022, the grid connected segment accounted for the largest revenue share over the forecast period.

On the basis of Distributional Channel, the Europe Specialty Generics Market is segmented into retail pharmacies, specialty pharmacies, hospital pharmacies, and others. Among these, the grid connected segment has the largest revenue share over the forecast period. These are common pharmacies or drugstores located in commercial districts, towns, and cities. They sell generic medications, over-the-counter (OTC) medications, and other health-related products. Retail pharmacies are the first point of contact for most people wishing to buy drugs. Patients' preferred distribution channel is retail pharmacies. They play an important role in the distribution of specialty generics, ensuring that patients get their prescription medications effortlessly.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe Specialty Generics Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Teva Pharmaceutical Industries Ltd

- Sun Pharmaceutical Industries Ltd.

- Dr. Reddy’s Laboratories Ltd.

- Sandoz International GmbH

- Perrigo Company plc

- Endo International plc.

- GlaxoSmithKline plc

- Fresenius Kabi AG

- Wockhardt

- Viatris, Inc.

- Apotex, Inc.

- Lupin

- Sanofi

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the Europe Specialty Generics Market based on the below-mentioned segments:

Europe Specialty Generics Market, By Route of Administration

- Injectables

- Oral

- Others

Europe Specialty Generics Market, By Indication

- Oncology

- Autoimmune Diseases

- Infectious Diseases

- Others

Europe Specialty Generics Market, By Distributional Channel

- Retail Pharmacies

- Specialty Pharmacies

- Hospital Pharmacies

- Others

Europe Specialty Generics Market, By Country

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

Need help to buy this report?