Europe Rubber Market Size, Share, and COVID-19 Impact Analysis, By Type (Natural Rubber, Synthetic Rubber), By Molecule (Styrene Butadiene, Polybutadiene, Butyl, Ethylene Propylene, Nitrile Elastomers, Natural Rubber, Poly cis isoprene), By Application (Tire, Medical, Industrial Hose, Footwear, Conveyor Belts, Others) By Region (Germany, UK, France, Italy, Spain, Russia, Rest of Europe), and Europe Rubber Market Insights Forecasts 2023 - 2033

Industry: Chemicals & MaterialsEurope Rubber Market Insights Forecasts to 2033

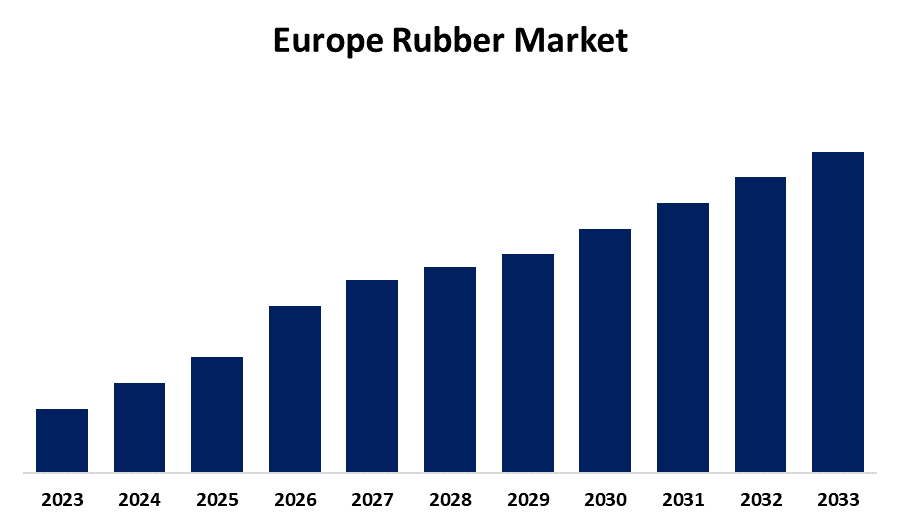

- The Market Size is Growing at a CAGR of 8.4% from 2023 to 2033.

- The Europe Rubber Market Size Expected to Hold a Significant Share by 2033.

Get more details on this report -

The Europe Rubber Market Size is expected to hold a significant Share by 2033, at a CAGR of 8.4% during the forecast period 2023 to 2033.

Market Overview

Rubber is a stretchable substance that does not allow water to pass through it. Its elastic properties are obtained by coagulating the milky juice of a variety of tropical plants. Natural rubber is derived from latex, a milky liquid found in the latex vessels or cells of rubber-producing plants. Taping is the process of making incisions into the bark and collecting the fluid into vessels attached to the rubber trees. The liquid is a sticky milky sap known as latex. It is one of the most natural polymers and is used in medical devices, aircraft and car tyers, pacifiers, clothes, toys, and others. The rubber market in Europe is an important segment of the rubber industry, with strong demand from the region's automotive, construction, and medical sectors. Despite not being a major producer due to climatic constraints, Europe relies heavily on rubber imports from key producing countries to meet its industrial needs. Region trends and climatic conditions, as well as regional policies, trade agreements, and advancements in rubber processing technologies, all have an impact on market dynamics. The European market is also showing an increasing interest in sustainable and bio-based rubber to address growing environmental and sustainability concerns.

Report Coverage

This research report categorizes the market for Europe rubber market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe rubber market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe rubber market.

Europe Rubber Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.4% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Molecule, By Application, ) By Region |

| Companies covered:: | Versalis S.p.A. (Polymer Europa), Lanxess AG, Dynasol Elastomers SA, Sibur International GmbH, Omsk Kauchak OAO, Styron Asia Ltd., Synthos SA, Michelin Corp., Trinseo SA, Exxon Mobil Chemical Company, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The European rubber market is expanding rapidly, driven by rising demand in the automotive and healthcare sectors, advances in rubber manufacturing technologies, and the effects of European economic growth and urbanization. The market is substantial and continues to grow. The primary drivers of the rubber market include rising automotive demand, technological advancements in rubber manufacturing, rising healthcare demand for rubber products, and Europe's economic growth and urbanization trends. Innovations in synthetic rubber production and sustainable manufacturing practices are significant technological advancements in the rubber industry, contributing to product quality and environmental sustainability. The transition to electric vehicles the demand for specialized rubber components, the increased use of natural rubber for gloves and medical devices, and a growing emphasis on sustainability and eco-friendly rubber manufacturing processes are all key trends in the rubber market. Furthermore, rubber is widely used in the tire, non-tire automotive, footwear, and industrial goods industries, with tires being the largest segment, followed by non-tire automotive.

Restraining Factors

Raw material price volatility is a significant restraining factor affecting rubber market growth. Rubber production is heavily reliant on natural resources such as rubber tree latex and synthetic polymers. Fluctuations in the availability and cost of these materials have an impact on manufacturing costs and, ultimately, product pricing. Economic shifts, geopolitical factors, and environmental concerns can all disrupt supply chains and cause price instability. Such uncertainty makes it difficult for manufacturers to maintain consistent profit margins and may jeopardize long-term plans. Mitigation strategies, such as diversifying supply sources and implementing efficient inventory management systems, are required to navigate price fluctuations and maintain market stability.

Market Segment

- In 2023, the synthetic rubber segment accounted for a significant revenue share over the forecast period.

Based on type, the Europe rubber market is segmented into natural rubber and synthetic rubber. Among these, the synthetic rubber segment has a significant revenue share over the forecast period. Synthetic rubber, known for its superior properties such as heat resistance, durability, and flexibility, is used to manufacture vehicle tires, hoses, and belts. Synthetic rubber's versatility and consistent quality make it ideal for automotive applications requiring high performance and reliability. The increase in vehicle production and the shift to electric vehicles, which require specialized rubber parts, strengthen this segment's position in the rubber market.

- In 2023, the styrene-butadiene segment is witnessing the largest growth over the forecast period.

Based on the molecule, the Europe rubber market is segmented into styrene butadiene, polybutadiene, butyl, ethylene propylene, nitrile elastomers, natural rubber, and poly cis isoprene. Among these, the styrene-butadiene segment is witnessing the largest growth over the forecast period. This synthetic rubber is widely preferred for a variety of applications, including tires, belts, hoses, gaskets, and even footwear, due to its ability to perform admirably in harsh conditions. SBR's remarkable versatility allows it to withstand varying temperatures, making it appropriate for both hot and cold climates. Its inherent abrasion resistance ensures long-term durability, even in high-stress situations. Furthermore, SBR has excellent tensile strength, allowing it to withstand heavy loads and high pressures without losing structural integrity.

- In 2023, the tire segment accounted for a significant revenue share over the forecast period.

Based on application, the Europe rubber market is segmented into the tire, medical, industrial hose, footwear, conveyor belts, and others. Among these, the tire segment has a significant revenue share over the forecast period. Rubber plays an important role in the manufacture of tires for various vehicles. This dominance is fueled by an ongoing increase in vehicle production, the need for tire replacement in existing vehicles, and rising consumer demand for high-performance, long-lasting tires. The tire segment's expansion is made possible by the burgeoning automotive sector, which includes both traditional and electric vehicles, where tire quality and reliability are critical for safety and performance.

- Germany is projected to have the largest share of the Europe rubber market over the forecast period.

Based on region, the United States is projected to have the largest share of the Europe rubber market over the forecast period. With its strong presence in the automotive industry and advanced manufacturing sector, the country has seen an unprecedented increase in demand for rubber. This increase can be attributed to a number of factors, including Germany's unwavering commitment to innovation, meticulous attention to quality, and relentless pursuit of excellence. One of the main reasons for Germany's dominance in the European rubber market is its strong R&D capabilities. German companies invest heavily in cutting-edge technologies and are constantly striving to improve the performance and durability of rubber products. This commitment to innovation has enabled them to stay ahead of the competition while meeting the ever-changing needs of their customers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe rubber market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Versalis S.p.A. (Polymer Europa)

- Lanxess AG

- Dynasol Elastomers SA

- Sibur International GmbH

- Omsk Kauchak OAO

- Styron Asia Ltd.

- Synthos SA

- Michelin Corp.

- Trinseo SA

- Exxon Mobil Chemical Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the Europe rubber market based on the below-mentioned segments:

Europe Rubber Market, By Flute Type

- Natural Rubber

- Synthetic Rubber

Europe Rubber Market, By Molecule

- Styrene Butadiene

- Polybutadiene

- Butyl

- Ethylene Propylene

- Nitrile Elastomers

- Natural Rubber

- Poly cis isoprene

Europe Rubber Market, By Application

- Tire

- Medical

- Industrial Hose

- Footwear

- Conveyor Belts

- Others

Europe Rubber Market, By Region

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

Need help to buy this report?