Europe Ready to Drink Tea Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Sweetened RTD Tea, Unsweetened RTD Tea, Herbal Tea, Green Tea, Black Tea, Specialty Flavored Tea and Organic Tea), By Packaging Type (Aseptic Packages, Glass Bottles, Metal Can and PET Bottles) By Distribution Channel (Off-trade and On-trade), and Europe Ready to Drink Tea Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesEurope Ready to Drink Tea Market Insights Forecasts to 2035

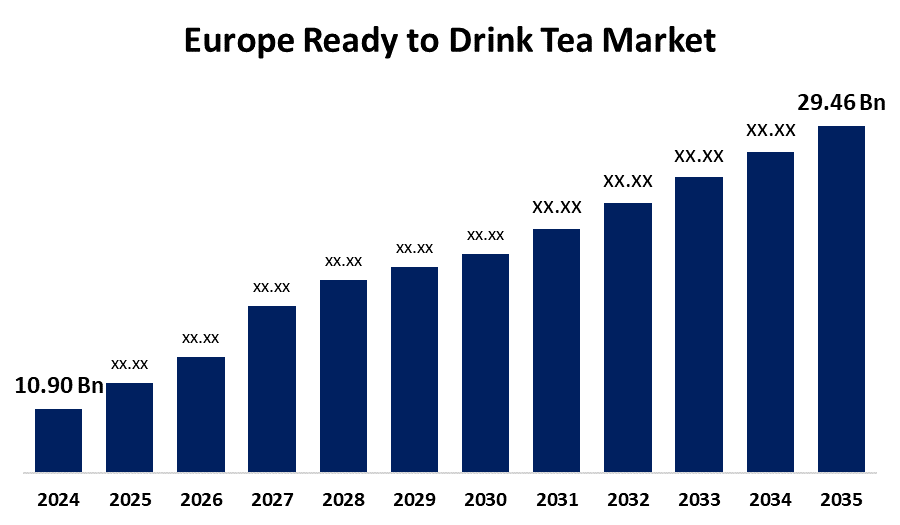

- The Europe Ready to Drink Tea Market Size was Estimated at USD 10.90 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.46% from 2025 to 2035

- The Europe Ready to Drink Tea Market Size is Expected to Reach USD 29.46 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Europe Ready to Drink Tea Market Size is anticipated to reach USD 29.46 Billion by 2035, Growing at a CAGR of 9.46% from 2025 to 2035. The Europe ready-to-drink tea market is primarily driven by increasing health consciousness, the need for low-calorie drinks, the convenience of drinking on the go, and increased preference for natural ingredients. Flavor innovations and functional teas are also among the factors fueling rising consumer interest and market growth.

Market Overview

The Europe ready to drink tea market is the portion of the beverage sector dealing with pre-packaged tea commodities which are brewed and designed to be consumed straight away without any form of preparation. People in Europe have also grown to demand healthier beverages, and RTD tea has also become one of the demanded beverages. With its natural ingredients and low sugar compared to the carbonated soft drinks, RTD tea attracts health-conscious consumers. Moreover, the convenience factor of RTD tea has also contributed to its surge in popularity. Busy lifestyles and on-the-go consumption habits have made RTD tea an attractive option for consumers looking for a quick and refreshing drink. Moreover, European consumers are willing to pay a premium for high-quality and ethically sourced products. This has created opportunities for niche brands that specialize in organic ingredients, sustainable packaging, and fair-trade practices. Consumers' need for healthier and greener alternatives drives premium and organic RTD tea demand.

Report Coverage

This research report categorizes the market for Europe ready to drink tea market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe ready to drink tea market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe ready to drink tea market.

Europe Ready to Drink Tea Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 10.90 Billion |

| Forecast Period: | 2025 - 2035 |

| Forecast Period CAGR 2025 - 2035 : | 9.46% |

| 2035 Value Projection: | USD 10.90 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 189 |

| Tables, Charts & Figures: | 110 |

| Companies covered:: | Ting Hsin International, Coca-Cola, ITO EN Inc., Suntory Holdings Limited, JDB Group, Uni-President Enterprises, Unilever, Arizona Beverage Company, OISHI GROUP, Ting Hsin International, Rauch Fruchtsäfte GmbH & Co OG, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Healthier drinks are being preferred by European consumers over sodas with added sugars. RTD teas, particularly green, herbal, and unsweetened teas, present as natural and low-calorie, resonating with health-conscious trends. Their clean-label compositions and antioxidant qualities further increase demand from consumers looking for functional and refreshing beverages. Brands are also creating differentiating flavors like hibiscus, matcha, peach, and citrus variations, along with functional ingredients like vitamins, collagen, or electrolytes. These innovations appeal to both risk-taking and health-oriented consumers, distinguishing goods on shelves and broadening market opportunities among a greater, trend-conscious European consumer base.

Restraining Factors

Most RTD teas, particularly the sweetened ones, have high sugar content. In response to increasing awareness of obesity, diabetes, and other lifestyle ailments, health-conscious customers are cutting down on sugary drinks. This trend is decelerating demand for conventional sweetened RTD teas in European markets. Further, the RTD tea category also draws strong competition from other healthier and functional beverages such as kombucha, flavored water, cold brews, and energy drinks. These alternatives tend to present more health benefits or distinctive positioning, thus making it difficult for conventional RTD tea brands to capture consumer attention.

Market Segmentation

The Europe ready to drink tea market share is classified into product type, packaging type, and distribution channel.

- The sweetened RTD tea segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Europe ready to drink tea market is segmented by product type into sweetened RTD tea, unsweetened RTD tea, herbal tea, green tea, black tea, specialty flavored tea, and organic tea. Among these, the sweetened RTD tea segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is due to sweetened RTD teas closely resemble traditional soft drinks in terms of taste, providing a comforting and palatable taste experience. This resonates with a wide range of consumers, particularly those making the move from sugary sodas to tea-based drinks, thus creating greater demand and contributing to the leading market share of the segment.

- The PET bottles segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe ready to drink tea market is segmented by packaging type into aseptic packages, glass bottles, metal can, and PET bottles. Among these, the PET bottles segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth is driven by PET bottles are light and convenient, making them highly suitable for on-the-go use. The fact that they are resealable also presents consumers with extra convenience, further propelling sales as they easily slide into hectic lifestyles. PET bottles give clear visibility of the contents of the drink, enabling enhanced product differentiation and branding. This visibility assists in establishing consumer confidence and facilitates informed purchasing decisions, further enhancing the segment's popularity.

- The off-trade segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The Europe ready to drink tea market is segmented by distribution channel into off-trade and on-trade. Among these, the off-trade segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth is attributed to consumers opting for the off-trade segment as it provides convenience in that they can buy RTD tea at their ease. Off-trade channels offer a wider variety of RTD tea flavors and brands. Competition among various retailers and brands leads to affordable prices, promotions, and bulk offers, making it viable for consumers to buy RTD tea products, thus expanding the market share of the segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved in the Europe ready to drink tea market. It also includes a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ting Hsin International

- Coca-Cola

- ITO EN Inc.

- Suntory Holdings Limited

- JDB Group

- Uni-President Enterprises

- Unilever

- Arizona Beverage Company

- OISHI GROUP

- Ting Hsin International

- Rauch Fruchtsäfte GmbH & Co OG

- Others

Recent Developments:

- In April 2025, Coca-Cola combined its RTD tea brands under the Fuze Tea brand within Spain with the goal of DE establishing consumption and fostering new consumption moments. New taste and innovation launches, including Fuze Tea Fusion and Fuze Tea Sabor Original, emphasize wellness and naturalness, mainly targeting young adults.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe ready to drink tea market based on the below-mentioned segments:

Europe Ready to Drink Tea Market, By Product Type

- Sweetened RTD Tea

- Unsweetened RTD Tea

- Herbal Tea

- Green Tea

- Black Tea

- Specialty Flavored Tea

- Organic Tea

Europe Ready to Drink Tea Market, By Packaging Type

- Aseptic Packages

- Glass Bottles

- Metal Can

- PET Bottles

Europe Ready to Drink Tea Market, By Distribution Channel

- Off-trade

- On-trade

Need help to buy this report?