Europe Ready Meals Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Frozen Ready Meals, Chilled Ready Meals, Canned Ready Meals, Dried Ready Meals), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail Stores, Others), and Europe Ready Meals Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesEurope Ready Meals Market Insights Forecasts to 2035

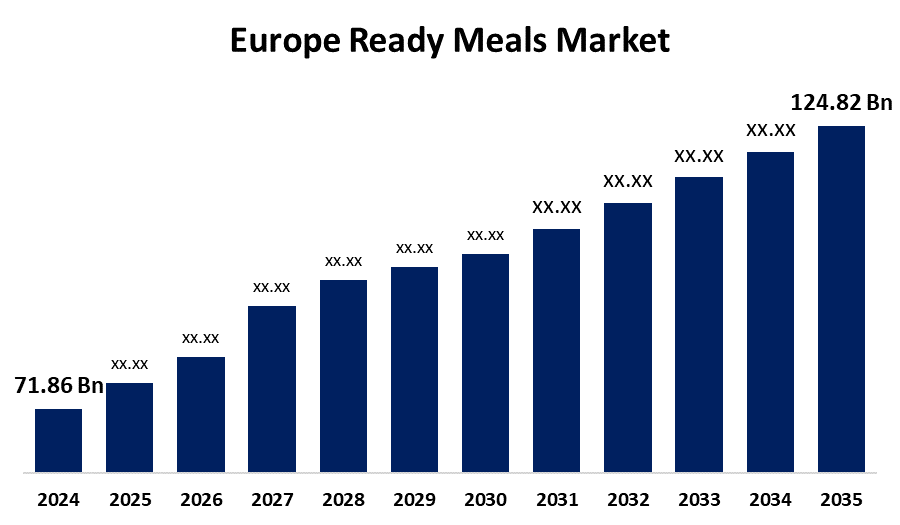

- The Europe Ready Meals Market Size was Estimated at USD 71.86 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.15% from 2025 to 2035

- The Europe Ready Meals Market Size is Expected to Reach USD 124.82 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the Europe Ready Meals Market Size is Anticipated to Reach USD 124.82 Billion by 2035, Growing at a CAGR of 5.15% from 2025 to 2035. Active lifestyles, increasing urbanization, product innovation with healthier and more varied offerings, wider channels of distribution, and increased health consciousness propel the market for ready meals in Europe through rising demand for convenient, healthy, and readily available meal solutions.

Market Overview

The Europe ready meals industry encompasses the manufacturing, distribution, and sale of pre-cooked food items that have minimal cooking or reheating requirements before they are consumed. The meals come in forms such as frozen, chilled, canned, and dried, intended to offer quick, convenient, and varied meal alternatives to consumers. The overall purpose of this industry is to address the increasing need for time-efficient food alternatives without sacrificing taste, nutrition, or variety. Ready meals have a lot of advantages, such as convenience for busy households and individuals, significantly lowering meal preparation time. Ready meals avoid food wastage by being portion-controlled and having an extended shelf life, particularly for frozen foods. Ready meals are also diverse enough to appeal to various consumer interests by providing a broad variety of cuisines, nutritional requirements, and dietary profiles, ranging from healthier and organic choices. Moreover, food manufacturers continually improve product taste, nutrition, and quality with clean-label ingredients and ethnic flavors. Cutting-edge packaging technology enhances shelf life and sustainability by attending to environmental issues. Furthermore, personalized diet and nutrition-related ready meals, including gluten-free, vegan, and reduced-calorie meals, are on the rise. These trends are fulfilling changing consumer needs and making the Europe ready meals market competitive and dynamic.

Report Coverage

This research report categorizes the market for Europe ready meals market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe ready meals market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe ready meals market.

Europe Ready Meals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 71.86 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 5.15% |

| 2035 Value Projection: | USD 124.82 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Distribution Channel and COVID-19 Impact Analysis. |

| Companies covered:: | HelloFresh SE, Nomad Foods Inc., Orkla ASA, Kerry Group PLC, Bell Food Group AG, Fjorland AS and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

Busy lives and rising work commitments leave you with fewer hours to spare for cooking. Ready meals are speedy, convenient solutions with little preparation and cleanup needed. They appeal to working individuals, students, and families, driving demand as consumers seek time-efficient food without sacrificing taste and nutrition. In addition, manufacturers continually create healthier, organic, ethnic, and gourmet ready meals. Better taste, nutritional value, and variety appeal to a wider range of consumers, such as health-focused and adventurous consumers. This change enhances market appeal and stimulates sales growth.

Restraining Factors

Some consumers are becoming increasingly cautious about ready meals as they fear excessive levels of preservatives, sodium, and unhealthy fats. Health concerns instill in some shoppers a preference for fresh or home cooking, restricting growth in the ready meal market. Further, ready meals, particularly higher-end or frozen ones, tend to be pricier than cooking from scratch. Price-conscious shoppers might steer clear of these items, limit broader take-up, and hinder market growth.

Market Segmentation

The Europe ready meals market share is classified into product type and distribution channel.

- The frozen ready meals segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Europe ready meals market is segmented by product type into frozen ready meals, chilled ready meals, canned ready meals, and dried ready meals. Among these, the frozen ready meals segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth is attributed to frozen ready meals having a far greater shelf life than chilled or canned meals, avoiding food wastage and enabling consumers to stock up easily. With this longer usability, frozen meals are extremely popular among working households.

- The supermarkets/hypermarkets segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The Europe ready meals market is segmented by distribution channel into supermarkets/hypermarkets, convenience stores, online retail stores, and others. Among these, the supermarkets/hypermarkets segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth is due to supermarkets and hypermarkets providing a wide range of ready meals to suit different consumer tastes, ranging from different cuisines, and diet specifications, to price levels. This wide range draws in more consumers, boosting sales and reinforcing their market leadership role.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved in the Europe ready meals market. It also includes a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- HelloFresh SE

- Nomad Foods Inc.

- Orkla ASA

- Kerry Group PLC

- Bell Food Group AG

- Fjorland AS

- Others

Recent Developments:

- In September 2024, Nestle Stouffer's launched its inaugural shelf-stable item, Stouffer's Supreme Shells & Cheese, a strategic expansion beyond its frozen food business. Designed to take on Kraft's boxed macaroni and cheese, the product is available in two flavors Cheddar Cheese and Three Cheese (cheddar, gouda, parmesan), and contains 10% more cheese sauce than store brands.

- In August 2023, HelloFresh launched its ready-to-eat (RTE) offering, Factor, in Europe, initially in the Netherlands and Belgian Flanders region in August 2023. Factor, which HelloFresh acquired in 2020, has been a huge success in the U.S. market with a 60% market share in the RTE segment. European launch hopes to follow suit by providing chef-cooked, dietitian-endorsed meals that cater to different dietary lifestyles, including flexitarian, pescatarian, vegetarian, and keto lifestyles. About 25% of the meals are vegan or vegetarian.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe ready meals market based on the below-mentioned segments:

Europe Ready Meals Market, By Product Type

- Frozen Ready Meals

- Chilled Ready Meals

- Canned Ready Meals

- Dried Ready Meals

Europe Ready Meals Market, By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail Stores

- Others

Need help to buy this report?