Europe Premium Chocolate Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Dark Premium Chocolate and White/ Milk Premium Chocolates), By Application (Supermarkets/Hypermarkets, Convenience Stores, Online Retail Stores, Others), and Europe Premium Chocolate Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesEurope Premium Chocolate Market Insights Forecasts to 2035

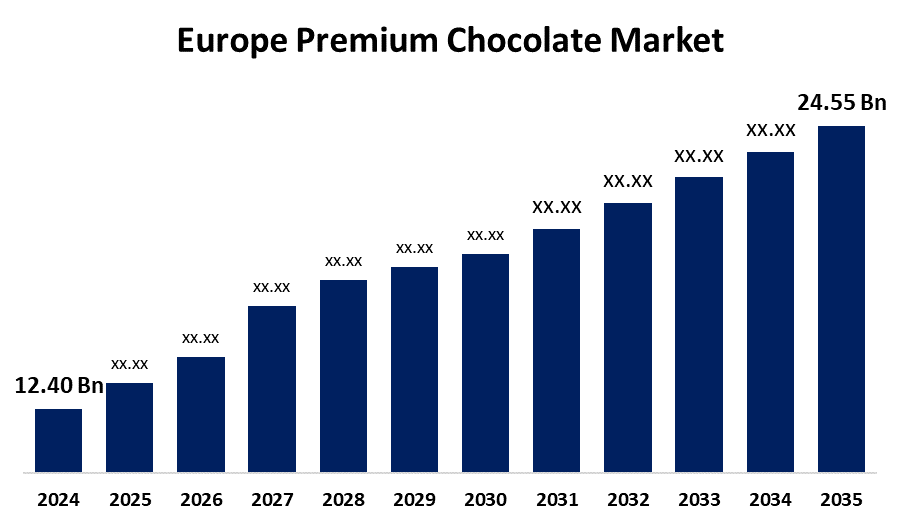

- The Europe Premium Chocolate Market Size was Estimated at USD 12.40 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.41% from 2025 to 2035

- The Europe Premium Chocolate Market Size is Expected to Reach USD 24.55 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Europe Premium Chocolate Market Size is anticipated to reach USD 24.55 Billion by 2035, Growing at a CAGR of 6.41% from 2025 to 2035. Growing consumer need for premium chocolates, health-oriented demand for dark chocolate, expansion of online channels, focus on ethical sourcing and sustainability, and ongoing innovation in terms of flavor and packaging fuel the rise in Europe's premium chocolate market.

Market Overview

The Europe premium chocolate industry is the part of the European chocolate business that deals with high-end, luxury chocolates produced from superior ingredients, frequently with distinctive flavors, artisanal quality, and responsible sourcing. The merchandise addresses sophisticated consumers who desire indulgence, sophistication, and ethical production. Premium chocolates tend to have greater cocoa content, featuring antioxidant benefits and reduced sugar content, which meet rising health awareness. Furthermore, the focus on sustainable sourcing aids fair trade and environmental stewardship, appealing to socially conscious consumers. Increased health consciousness has spurred demand for dark chocolates, valued for their antioxidant properties and lower sugar levels. The proliferation of online retail channels has increased convenience and accessibility, allowing consumers to shop around for a variety of brands and specialty products. Additionally, innovations in the marketplace target unique taste profiles through the use of exotic ingredients, textures, and limited-edition offerings. Packaging innovations are centered around eco-friendliness and luxury design to attract style-aware and environmentally friendly consumers. Combined, these elements set the Europe premium chocolate market up for long-term growth based on changing consumer habits and lifestyles.

Report Coverage

This research report categorizes the market for the Europe premium chocolate market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe premium chocolate market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe premium chocolate market.

Europe Premium Chocolate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 12.40 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 6.41% |

| 2035 Value Projection: | USD 24.55 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 267 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Product Type and By Application |

| Companies covered:: | Chocoladefabriken Lindt & Sprungli AG, Mondelez International, Nestle, Ferrero, Mars, Barry Callebaut, Valrhona, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

European consumers look for superior, indulgent chocolate experiences more and more. Rising disposable incomes and changing tastes have fueled demand for premium chocolates with rich flavor, differentiated ingredients, and handcrafted artisanal products. This trend drives sales as consumers are prepared to pay premium prices for luxury and exclusivity. Additionally, manufacturers continuously launch new, innovative flavors, limited-launch products, and appealing packaging to engage consumers. Distinct mixtures, like fruit, spice, or foreign ingredients, and pleasing to the eyes designs add to the high-end appeal and invite repeat purchases.

Restraining Factors

High-end chocolate relies on superior cocoa, usually ethically or single-origin. Cocoa price volatility due to climate change, geopolitical unrest, and supply shocks raises the cost of production. These increased costs are transferred to consumers, which can restrict affordability and lower demand, particularly in periods of economic downturn. Further, even though dark chocolate is perceived as healthier, most high-end ones are still high in sugar and fat. Growing consumer concern regarding obesity, diabetes, and processed food hazards has resulted in lower consumption of chocolate among health-conscious consumers, exerting pressure on the premium chocolate market.

Market Segmentation

The Europe Premium Chocolate Market Share is classified into product type and distribution channel.

- The dark premium chocolate segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Europe premium chocolate market is segmented by product type into dark premium chocolate and white/ milk premium chocolates. Among these, the dark premium chocolate segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth due to dark chocolate is attributed to the fact that dark chocolate is viewed as a healthier treat because it has a high content of cocoa, which is antioxidant-rich and contains less sugar than milk or white chocolate. Increasing awareness of well-being and nutrition in Europe means that consumers are increasingly opting for dark chocolate as an acceptable, health-conscious alternative to classic treats.

- The supermarkets/hypermarkets segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The Europe premium chocolate market is segmented by distribution channel into supermarkets/hypermarkets, convenience stores, online retail stores, and others. Among these, the supermarkets/hypermarkets segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth is attributed to supermarkets and hypermarkets drawing large and varied customer bases every day. Their locations and heavy traffic make it possible for premium chocolate brands to reach a wider population quickly. This visibility stimulates impulse buying and raises consumer awareness, making these stores convenient for both established and new premium chocolate brands.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved in the Europe premium chocolate market. It also includes a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Chocoladefabriken Lindt & Sprungli AG

- Mondelez International

- Nestle

- Ferrero

- Mars

- Barry Callebaut

- Valrhona

- Others

Recent Developments:

- In June 2025, Aldi introduced a Pound 3.99 variant of the popular 'Dubai-style' chocolate bar, with creamy pistachio layers, crunchy kadayif pastry, and milk chocolate. The item, included in Aldi's Specialbuys range, sold quickly in the UK, reflecting robust consumer demand for innovative chocolate products.

- In February 2025, Nestle launched a new mocha-flavored KitKat in the UK, and it includes espresso, milk, and chocolate. The two-finger-sized bar in a multi-pack has a distinctive flavor with coffee fans in mind.

- In March 2024, Europraline extended its portfolio with the introduction of the Trapa Collection 100% cocoa tablet, which is free from hydrogenated fats, trans fatty acids, and palm oil and is gluten-free. The new product caters to the increasing consumer trend towards healthier and more sustainable chocolate.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe premium chocolate market based on the below-mentioned segments:

Europe Premium Chocolate Market, By Product Type

- Dark Premium Chocolate

- White/ Milk Premium Chocolates

Europe Premium Chocolate Market, By Application

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail Stores

- Others

Need help to buy this report?