Europe Power Rental Market Size, Share, and COVID-19 Impact Analysis, By Fuel Type (Diesel, Natural Gas, Others), By Equipment Type (Generator, Transformer, Load Bank, Others), By Power Rating (Up to 50 kW, 51 - 500 kW, 501 - 2,500 kW, above 2,500 kW), By Application (Peak Shaving, Standby Power, Base Load/Continuous Power), and Europe Power Rental Market Insights Forecasts to 2033

Industry: Energy & PowerEurope Power Rental Market Size Insights Forecasts to 2033

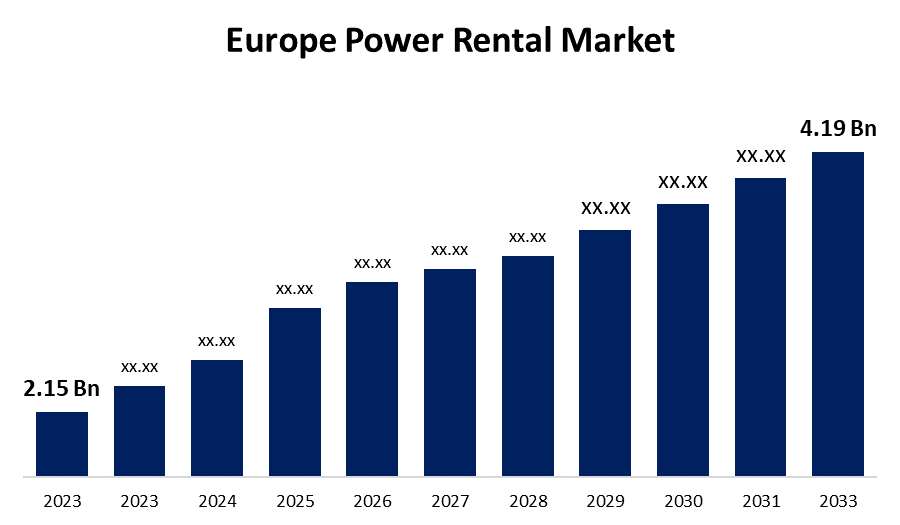

- The Europe Power Rental Market Size was valued at USD 2.15 Billion in 2023.

- The Market Size is Growing at a CAGR of 6.9 % from 2023 to 2033.

- The Europe Power Rental Market Size is Expected to Reach USD 4.19 Billion by 2033.

Get more details on this report -

The Europe Power Rental Market Size is Expected to Reach USD 4.19 Billion by 2033, at a CAGR of 6.9 % During the Forecast period 2023 to 2033.

Market Overview

Power rental is a flexible solution for providing temporary energy to industrial sites, entails renting power plants or generators. This process incorporates scalable components into power plants, providing a variety of power functions. It is well-known for its dependability, flexibility, speed, and cost-effectiveness, making it an essential tool for businesses dealing with brief power outages. Beyond simply bridging energy gaps, it improves grid stability and provides additional energy to industries, fostering community support. This versatile solution has numerous applications in a variety of industries, including construction, mining, and oil and gas, where the need for temporary power solutions is frequent. Its strategic implementation addresses immediate energy needs while also ensuring operational continuity and critical infrastructure support across multiple industries. Its adaptability and efficiency make it an essential resource, allowing businesses to navigate dynamic energy demands with resilience while also ensuring uninterrupted operations during grid outages or planned maintenance. The market in Europe is primarily driven by rising demand from various industries, such as construction, manufacturing, and events. In line with this, the flexibility and scalability provided by these solutions are critical in assisting these sectors during peak demand periods, planned maintenance, or unplanned power outages.

Report Coverage

This research report categorizes the market for Europe power rental market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe power rental market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Europe power rental market.

Europe Power Rental Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.15 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.9 % |

| 2033 Value Projection: | USD 4.19 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Fuel, By Equipment, By Power Rating, and COVID-19 Impact Analysis |

| Companies covered:: | Aggreko plc, United Rentals, Inc., Sunbelt Rentals, Inc., Herc Holdings Inc., Caterpillar Inc., Cummins Inc., APR Energy, Atlas Copco AB, Zeppelin Rental GmbH & Co. KG, and |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Rapid technological advancements are creating numerous opportunities in the market. Technological advancements have ushered in a new era of power rental solutions that are more efficient, sustainable, and reliable, making them more appealing to a wide range of industries. Integrating smart technologies, IoT (Internet of Things) capabilities, and advanced monitoring systems has transformed the delivery of these services. One noticeable impact of technological advancements is increased equipment efficiency. Modern generators and power systems are engineered to be more fuel efficient, lowering business operating costs. Smart monitoring and control systems also allow for real-time power usage tracking, which improves the precision of power solutions deployed in response to demand fluctuations. Moreover, the growing emphasis on emergency preparedness is driving the market. In an era of increased climate-related uncertainties and the possibility of grid failures, industries and communities understand the critical importance of reliable backup power solutions. With its rapid deployment capabilities and scalability, the market perfectly aligns with the need for emergency preparedness. Industries ranging from critical infrastructure facilities to healthcare institutions are increasing their efforts to ensure a continuous power supply during emergencies.

Restraining Factors

The initial investment required to purchase power generation equipment for rental purposes can be substantial. This factor may limit the entry of new players and hamper market growth. Moreover, the power rental industry is under increasing pressure to follow strict environmental regulations and emissions standards. Compliance with these regulations may result in additional costs for rental companies, affecting profitability.

Market Segment

- In 2023, the diesel segment accounted for the largest revenue share over the forecast period.

Based on the fuel type, the Europe power rental market is segmented into diesel, natural gas, and others. Among these, the diesel segment has the largest revenue share over the forecast period. Diesel-powered generators provide a dependable and adaptable source of temporary power, especially when grid power is unavailable or inadequate. Their durability and ability to produce a high-power output make them ideal for industrial operations, construction sites, events, and emergencies. They are well-known for their speed and efficiency, allowing them to respond quickly to unexpected power demands.

- In 2023, the generator segment accounted for the largest revenue share over the forecast period.

Based on the equipment type, the Europe power rental market is segmented into generator, transformer, load bank, and others. Among these, the generator segment has the largest revenue share over the forecast period. Generators are an essential component of the power rental market, serving as a linchpin for meeting temporary or supplemental power requirements in a variety of industries. Their widespread use and versatility make them a driving force in market growth.

- In 2023, the 51 - 500 kW segment accounted for the largest revenue share over the forecast period.

Based on the power rating, the Europe power rental market is segmented into up to 50 kW, 51 - 500 kW, 501 - 2,500 kW, and above 2,500 kW. Among these, the 51 - 500 kW segment has the largest revenue share over the forecast period. The 51 - 500 kW power rating segment propels the market forward, demonstrating its critical role in meeting diverse energy requirements across industries. This power range strikes a balance between portability and high-power output, making it appropriate for a wide range of applications, including construction sites, events, and industrial operations. The 51 - 500 kW power rating meets mid-range power requirements, providing an ideal solution for situations requiring a moderate but dependable power supply.

- In 2023, the base load/continuous power segment accounted for the largest revenue share over the forecast period.

Based on the application, the Europe power rental market is segmented into peak shaving, standby power, and base load/continuous power. Among these, the base load/continuous power segment has the largest revenue share over the forecast period. The base load/continuous power provides a constant and uninterrupted power supply, making it an essential solution for industries and operations that require continuous energy. Baseload or continuous power is used in a variety of industries, including manufacturing, data centers, utilities, and critical infrastructure, to ensure that equipment, processes, and services run smoothly.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe power rental market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Aggreko plc

- United Rentals, Inc.

- Sunbelt Rentals, Inc.

- Herc Holdings Inc.

- Caterpillar Inc.

- Cummins Inc.

- APR Energy

- Atlas Copco AB

- Zeppelin Rental GmbH & Co. KG

- Loxam SAS

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In March 2019, Caterpillar introduced digital services to its rental customers. The company established an online platform for product research and purchasing. This platform contributes to the company's digital capabilities while also providing customers with simple and convenient ways to obtain products and services.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the Europe power rental market based on the below-mentioned segments:

Europe Power Rental Market, By Fuel Type

Natural Gas

Europe Power Rental Market, By Equipment Type

- Generator

- Transformer

- Load Bank

- Others

Europe Power Rental Market, By Power Rating

- Up to 50 kW

- 51 - 500 kW

- 501 - 2,500 kW

- Above 2,500 kW

Europe Power Rental Market, By Application

- Peak Shaving

- Standby Power

- Base Load/Continuous Power

Need help to buy this report?