Europe Poultry Meat Market Size, Share, and COVID-19 Impact Analysis, By Form (Canned, Fresh / Chilled, Frozen and Processed), By Distribution Channel (Off-Trade and On-Trade), and Europe Poultry Meat Market Insights, Industry Trend, Forecasts to 2035.

Industry: Food & BeveragesEurope Poultry Meat Market Insights Forecasts to 2035

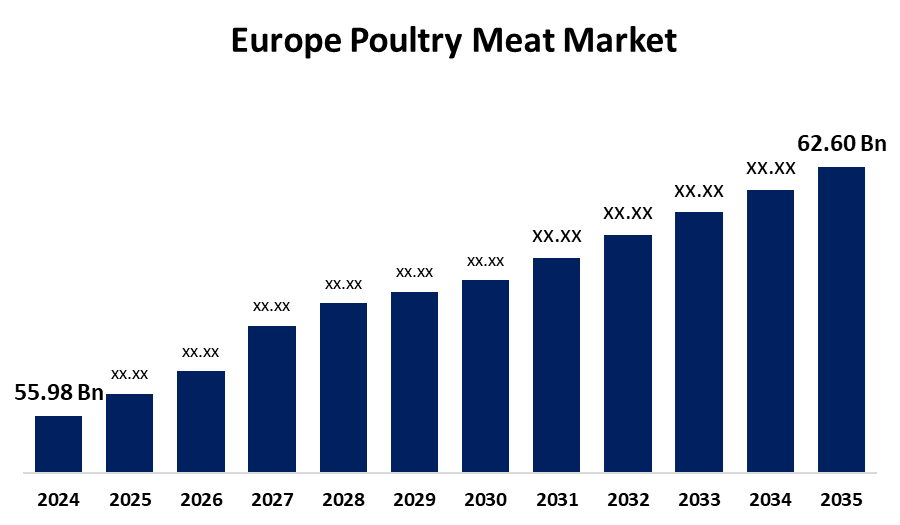

- The Europe Poultry Meat Market Size Was estimated at USD 55.98 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 1.02% from 2025 to 2035

- The Europe Poultry Meat Market Size is Expected to Reach USD 62.60 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Europe Poultry Meat market is anticipated to reach USD 62.60 Billion by 2035, growing at a CAGR of 1.02% from 2025 to 2035. The Europe poultry meat market is driven by increasing consumer preference for lean protein, rising health consciousness, cost-effectiveness of poultry, growth in quick-service restaurants, advancements in poultry farming, and strong demand for convenient, ready-to-eat meat products.

Market Overview

The Europe poultry meat market refers to the comprehensive sector involved in the production, processing, distribution, and consumption of meat derived from domesticated birds within European countries. This primarily includes chicken, turkey, duck, geese, guinea fowl, and sometimes other species like quail and ostrich, raised specifically for meat or eggs. Poultry meat provides several advantages such as being a lean protein, typically lower in fat than red meat, and being applicable for a variety of food uses. To consumers, it is a cheap and convenient meat choice. To producers and retailers, poultry meat has lower production cycles, better feed conversion rates, and scalability, which can mean profit and market expansion. Moreover, technology-driven processing methods enhance product quality and shelf life. Additionally, the development of value-added and convenience products, such as marinated, pre-cooked, and ready-to-cook poultry, caters to evolving consumer preferences. Digital platforms for supply chain transparency and traceability are increasingly adopted to ensure trust and compliance. Overall, the Europe poultry meat market is a dynamic sector focused on balancing consumer demands, sustainability, and technological progress to secure its future growth.

Report Coverage

This research report categorizes the market for Europe poultry meat market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe Poultry Meat market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe Poultry Meat market.

Europe Poultry Meat Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 55.98 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 1.02% |

| 2035 Value Projection: | USD 62.60 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 170 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Form, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | LDC Group, Danish Crown, Clemens Food Group, Plukon Food Group, 2 Sisters Food Group, Svenska Fågel AB, Grupo Fuertes and other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

European consumers are increasingly health-conscious, leading to a noticeable shift away from red meats (beef, pork) towards leaner protein sources. Poultry meat, particularly chicken, is favored for its lower fat content and high protein density, aligning with these dietary preferences. Poultry is recognized for providing essential nutrients, making it a popular choice for balanced diets and weight management. Poultry meat generally remains more affordable compared to other animal proteins like beef and pork. This makes it an attractive option for consumers across various income levels, especially during periods of economic pressure. Poultry is highly versatile in cooking, allowing for a wide range of dishes and preparation methods. This adaptability makes it a staple in both household cooking and the diverse European foodservice sector.

Restraining Factors

Continuous outbreaks of highly pathogenic avian influenza (HPAI), also referred to as bird flu, generate massive disruption. They result in large-scale culling of flocks, trade bans, and a large economic loss for producers, drastically affecting supply and consumer confidence. Furthermore, poultry meat is threatened by competition from other protein sources. Increasing availability and promotion of plant-based alternatives, dietary change towards other meats, can restrict poultry market growth.

Market Segmentation

The Europe poultry meat market share is classified into form and distribution channel.

- The fresh/chilled segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Europe poultry meat market is segmented by product into canned, fresh/chilled, frozen, and processed. Among these, the fresh/chilled segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is due to fresh chilled poultry retaining its natural texture, flavor, and moisture better than frozen alternatives, offering consumers a superior eating experience. The absence of freezing prevents ice crystal formation, which can damage meat fibers, making fresh chilled poultry highly preferred for home cooking and restaurants focusing on quality.

- The off-trade segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The Europe poultry meat market is segmented by distribution channel into off-trade and on-trade. Among these, the off-trade segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth is attributed to off-trade channels, such as supermarkets and hypermarkets, which have expanded significantly across Europe. These outlets offer wide product selections, better pricing, and convenience, attracting more consumers. Their strong distribution networks and promotional campaigns make poultry meat more accessible, leading to increased sales volumes through these channels compared to traditional on-trade options like restaurants.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved in the Europe Poultry Meat market. It also includes a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- LDC Group

- Danish Crown

- Clemens Food Group

- Plukon Food Group

- 2 Sisters Food Group

- Svenska Fågel AB

- Grupo Fuertes

- Others

Recent Developments:

- In August 2023, Cherkizovo Group expanded its product portfolio, introducing over 200 new items across its Cherkizovo and Cherkizovo Premium brands. This extensive launch includes a diverse range of cooked and smoked sausages, dry sausages, and various deli meats.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe poultry meat market based on the below-mentioned segments:

Europe Poultry Meat Market, By Form

- Canned

- Fresh / Chilled

- Frozen

- Processed

Europe Poultry Meat Market, By Distribution Channel

- Off-Trade

- On-Trade

Need help to buy this report?