Europe Nutraceutical Market Size, Share, and COVID-19 Impact Analysis, By Product (Dietary Supplements, Functional Food, Functional Beverages, and Infant Formula), By Distribution Channel (Offline and Online), and Europe Nutraceutical Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareEurope Nutraceutical Market Insights Forecasts to 2035

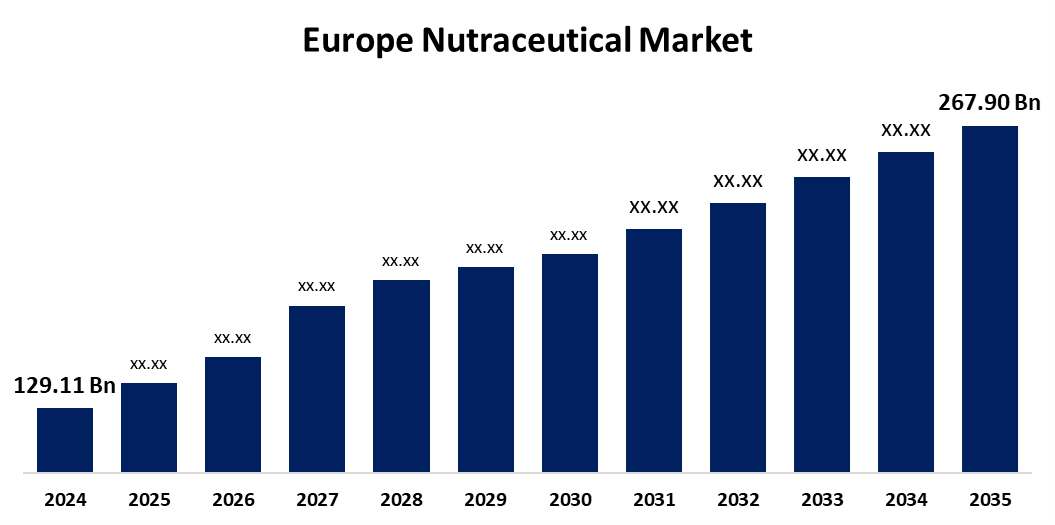

- The Europe Nutraceutical Market Size was estimated at USD 129.11 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.86% from 2025 to 2035

- The Europe Nutraceutical Market Size is Expected to Reach USD 267.90 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Europe Nutraceutical Market Size is anticipated to Reach USD 267.90 Billion by 2035, Growing at a CAGR of 6.86% from 2025 to 2035. Growing health consciousness, increased aging population, and rising chronic diseases propel the nutraceutical market in Europe. Sustained innovation in products and growing online retail boost availability and consumer participation, propelling the market's growth by addressing various health needs with easy-to-use, efficient, and specific nutraceutical solutions.

Market Overview

The Europe Nutraceutical Industry is the industry that produces, distributes, and sells products that offer benefits for health that go above normal nutrition. These include dietary supplements, functional foods, beverages, and infant formulas aimed at enhancing general well-being, preventing diseases, and facilitating particular body functions, spurred by an increasing awareness of consumer health and demand for preventive healthcare among consumers. Nutraceutical foods provide many advantages, including immune system enhancement, enhanced digestion, increased energy levels, and cognitive and joint health support. They are a convenient method for consumers to supplement their lifestyles and meet certain nutritional needs or ailments, helping create a healthier society. Furthermore, innovations through AI and data science enable companies to see what consumers want and adjust products accordingly. In total, Europe's nutraceutical market continues to grow with the provision of innovative, convenient, and health-oriented products that mirror changing consumer lifestyles and regulatory requirements, facilitating long-term well-being and preventive health care.

Report Coverage

This research report categorizes the market for Europe nutraceutical market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe nutraceutical market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe nutraceutical market.

Europe Nutraceutical Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 129.11 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.86% |

| 2035 Value Projection: | USD 267.90 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Product, By Distribution Channel |

| Companies covered:: | Amway Corp., Emmi AG, Dr. Schar AG/S.p. A, Danone, Nestle S.A., Arla Foods Group, Glanbia plc, Herbalife Nutrition Ltd., Orkla, Haleon Group of companies, Unilever Plc, GlaxoSmithKline plc., and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Growing consumer consciousness regarding health, wellness, and preventive healthcare is a key catalyst. Consumers are actively embracing nutraceuticals to boost immunity, enhance digestion, and overall well-being, thereby propelling demand for the products in all age categories. Further, growing incidences of lifestyle diseases like diabetes, cardiovascular disease, and obesity prompt consumers to turn towards natural, preventive solutions for health. Nutraceuticals are perceived as safer substitutes or adjuncts to pharmaceuticals, driving market demand.

Restraining Factors

Europe imposes strict rules on nutraceutical products, such as safety, labeling, and health claims. High compliance costs and extended approval times can hinder product launches and raise manufacturers' costs, constraining market growth. Additionally, high-quality ingredients and innovative formulations tend to make nutraceutical products costly. Premium prices can limit penetration among consumers, particularly price-sensitive ones, and thus decelerate market growth.

Market Segmentation

The Europe nutraceutical market share is classified into product and distribution channel.

- The dietary supplements segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Europe Nutraceutical market is segmented by product into dietary supplements, functional food, functional beverages and infant formula. Among these, the dietary supplements segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth is attributed due to rising consumer emphasis on preventive medicine and well-being propels demand for dietary supplements. Individuals look for easy methods of enhancing immunity, plugging nutritional gaps, and responding to health issues, thus making supplements the choice for everyday maintenance of health.

- The offline segment accounted for the highest share in

- 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The Europe nutraceutical market is segmented by distribution channel into offline and online. Among these, the offline segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth is due to most consumers purchasing nutraceutical products offline because of the opportunity to touch and feel products, receive guidance from knowledgeable staff, and get instant access. Personalized shopping instills trust, leading to repeat purchases and high sales, which keeps the offline segment occupying a large market share.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved in the Europe nutraceutical market. It also includes a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Amway Corp.

- Emmi AG

- Dr. Schär AG/S.p. A

- Danone

- Nestlé S.A.

- Arla Foods Group

- Glanbia plc

- Herbalife Nutrition Ltd.

- Orkla

- Haleon Group of companies

- Unilever Plc

- GlaxoSmithKline plc.

- Others

Recent Developments:

- In April 2024, At Vitafoods Europe 2024, Naturacare introduced four new nutraceutical products like Vital Extend, Bacti Serenity, Electrolytes, Ovo Immune. Naturacare also promoted its Contract Development and Manufacturing Organization (CDMO) expertise, including R&D, packaging, and manufacturing in facilities in France, Belgium, the Netherlands, and Italy.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe nutraceutical market based on the below-mentioned segments:

Europe Nutraceutical Market, By Product

- Dietary Supplements

- Functional Food

- Functional Beverages

- Infant Formula

Europe Nutraceutical Market, By Distribution Channel

- Offline

- Online

Need help to buy this report?