Europe Non-dairy Yogurt Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Plain Yogurt and Flavored Yogurt), By Source (Almond-based Yogurt, Soy-based Yogurt and Coconut-based Yogurt) By Distribution Channel (Supermarkets and hypermarkets, Convenience stores, Online retail and Specialty stores), and Europe Non-dairy Yogurt Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesEurope Non-dairy Yogurt Market Insights Forecasts to 2035

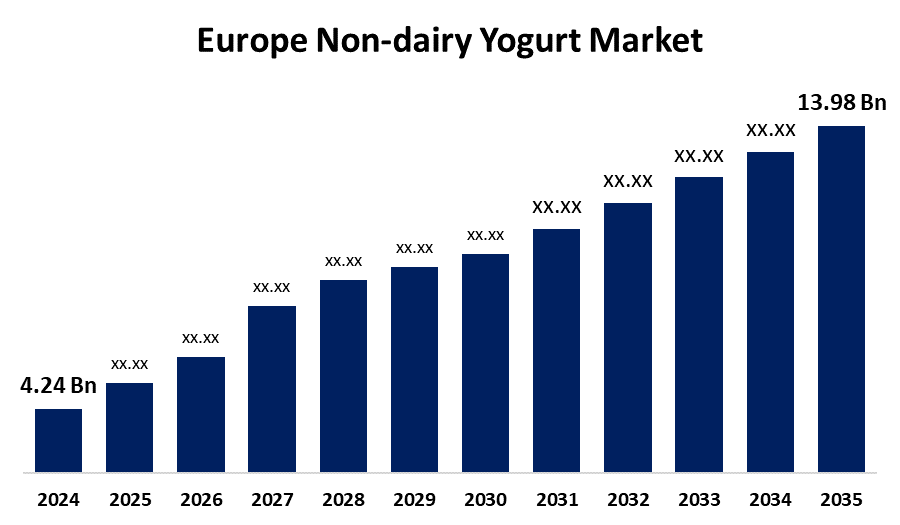

- The Europe Non-dairy Yogurt Market Size was estimated at USD 4.24 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 11.46% from 2025 to 2035

- The Europe Non-dairy Yogurt Market Size is Expected to Reach USD 13.98 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Europe non-dairy yogurt market size is anticipated to reach USD 13.98 Billion by 2035, growing at a CAGR of 11.46% from 2025 to 2035. The Europe non-dairy yogurt market is fueled by increasing lactose intolerance, expanding vegan and flexitarian diets, rising health consciousness, the need for sustainable and ethical offerings, ongoing innovation in texture and flavor, and increasing availability through supermarkets and online stores.

Market Overview

The Europe non-dairy yogurt industry is the regional industry of producing, distributing, and consuming yogurt alternatives without the use of animal-based milk. They are commonly sourced from plant-based ingredients like soy, almond, coconut, oat, rice, and cashew. They are formulated to replicate the flavor, texture, and nutritional content of the traditional dairy-based yogurt but are lactose-free, vegan, and sometimes gluten-free. These products support broader environmental objectives by offering lower carbon footprints compared to conventional dairy, aligning with Europe’s sustainability goals. Non-dairy yogurt encompasses its appropriateness for various dietary requirements, probiotic properties for healthy digestion, and its nutritional profile, which is frequently fortified in calcium, vitamin D, and B12. These yogurts also serve to alleviate ethical issues about animal welfare and are generally free from cholesterol and saturated fats, promoting general well-being. Increasing consumer interest in clean-label and allergen-free products also increases their popularity. Furthermore, innovation is also helping the growth of the market significantly. Food manufacturers are producing products with better taste, texture, and functionality through the use of ingredients such as oats, almonds, and coconut. New flavors, protein-rich forms, and probiotic-enriched versions are increasing the scope of the market and attracting a wider consumer base.

Report Coverage

This research report categorizes the market for Europe non-dairy yogurt market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe non-dairy yogurt market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe non-dairy yogurt market.

Europe Non-dairy Yogurt Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.24 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 11.46% |

| 2035 Value Projection: | USD 13.98 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | By Product Type, By Source and By Distribution Channel |

| Companies covered:: | Blue Diamond Growers, Califia Farms LLC, Coconut Collaborative Ltd, Danone SA, Ecotone, Oatly Group AB, Otsuka Holdings Co. Ltd, The Hain Celestial Group Inc., Triballat Noyal SAS, Valsoia SpA., and Others |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

More and more Europeans are diagnosed with dairy allergies or lactose intolerance, driving demand for dairy-free alternatives such as non-dairy yogurt. These products offer a safe, digestible option for those unable to consume traditional dairy products, supporting consistent market expansion. In addition, consumers are more and more looking for functional foods that promote gut health, weight control, and immunity. Dairy-free yogurts enriched with probiotics, vitamins, and minerals address this need with their increasingly popular clean-label, gluten-free, and low-sugar alternatives.

Restraining Factors

Non-dairy yogurts tend to be more expensive than traditional dairy yogurts owing to plant-based ingredient costs, expert processing, and diminished economies of scale. This price difference restricts affordability for price-conscious consumers and inhibits broad market penetration, particularly in price-sensitive areas of Europe.

Market Segmentation

The Europe non-dairy yogurt market share is classified into product type, source, and distribution channel.

- The flavored segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Europe non-dairy yogurt market is segmented by product type into plain yogurt and flavored yogurt. Among these, the flavored segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is due to flavored yogurts' appeal to a wide variety of taste profiles, positioning them as more desirable for both plant-based and conventional dairy consumers. Traditional flavor profiles such as strawberry, vanilla, and mango facilitate the switch to non-dairy alternatives by enhancing market take-up among flexitarians, vegetarians, and health-oriented consumers.

- The soy-based yogurt segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe non-dairy yogurt market is segmented by source into almond-based yogurt, soy-based yogurt, and coconut-based yogurt. Among these, the soy-based yogurt segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth is driven by soy yogurt provides comparable levels of protein to regular dairy yogurt and thus is a desirable option for wellness-oriented consumers. The nutritional profile appeals to individuals seeking plant-based alternatives without compromising on protein intake, especially athletes and vegans who prioritize muscle maintenance and satiety in their diets.

- The supermarkets and hypermarkets segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The Europe non-dairy yogurt market is segmented by distribution channel into supermarkets and hypermarkets, convenience stores, online retail, and specialty stores. Among these, the supermarkets and hypermarkets segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth is attributed to supermarkets and hypermarkets providing a wide variety of non-dairy yogurt brands and flavors, which appeal to various diets and taste preferences. Such variety appeals to consumers who value one-stop shopping and want to try several plant-based items under one roof, fueling greater sales volumes in these formats.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved in the Europe non-dairy yogurt market. It also includes a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Blue Diamond Growers

- Califia Farms LLC

- Coconut Collaborative Ltd

- Danone SA

- Ecotone

- Oatly Group AB

- Otsuka Holdings Co. Ltd

- The Hain Celestial Group Inc.

- Triballat Noyal SAS

- Valsoia SpA.

- Others

Recent Developments:

- In July 2024, The Coconut Collab introduced a high-protein soy and almond protein-fortified vegan yogurt that contains all nine essential amino acids. It is gluten-free, low in sugar, and live-culture fermented for gut health.

- In March 2024, Müller Vitality launched its plant-based yogurt variants into the UK out-of-home market, its first foray into food service. They are sold in a 3kg bulk pouch and mix-in sauce, designed to provide flexibility for chefs and operators.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe non-dairy yogurt market based on the below-mentioned segments:

Europe Non-dairy Yogurt Market, By Product Type

- Plain Yogurt

- Flavored Yogurt

Europe Non-dairy Yogurt Market, By Source

- Almond-based Yogurt

- Soy-based Yogurt

- Coconut-based Yogurt

Europe Non-dairy Yogurt Market, By Distribution Channel

- Supermarkets and hypermarkets

- Convenience stores

- Online retail

- Specialty stores

Need help to buy this report?