Europe Intumescent Coatings Market Size, Share, and COVID-19 Impact Analysis, By Technology (Water-based, Solvent-based, and Epoxy-based), By End-Use Technology (Construction, Oil & Gas, Automotive and Others), By Application (Cellulosic and Hydrocarbon), and Europe Intumescent Coatings Market Insights, Industry Trends, Forecast to 2035.

Industry: Chemicals & MaterialsEurope Intumescent Coatings Market Insights Forecasts to 2035

- The Europe Intumescent Coatings Market Size Was Estimated at USD 281.38 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.1% from 2025 to 2035

- The Europe Intumescent Coatings Market Size is Expected to Reach USD 486.5 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Europe Intumescent Coatings Market size is anticipated to reach USD 486.5 Million by 2035, growing at a CAGR of 5.1% from 2025 to 2035. The market is driven due to their ability to offer effective fire protection without disturbing, and aesthetically appealing finishes are most applicable to the uncovered architectural steel in the present high-rise and infrastructure projects.

Market Overview

The fire-protection coating layer that isolates the steel substrates from fire is called an intumescent coating. When these coatings are exposed to flames or very high temperatures, they react chemically and this results in a drastic increase in their volume and finally, the inseparable thick layer of char that has the property of being a good insulator is formed. The expanded layer acts as a heat barrier and it also inhibits the passing of heat to the substrate, making it last longer before the structure collapses.

PPG disclosed the introduction of its PPG STEELGUARD 951 epoxy intumescent fireproofing coating to the Americas in 2024. This groundbreaking product, in particular, addresses the fire protection needs of the most demanding manufacturing processes, such as semiconductor plants, electric vehicle battery facilities, data centers, and other commercial infrastructures.

In November 2025, Carboline introduced Thermo-Sorb HB, a two-component, high-build, elastomeric intumescent coating applicable for shop or field use and rated for a maximum of 3.5 hours of fire resistance for structural steel, either placed inside or outside.

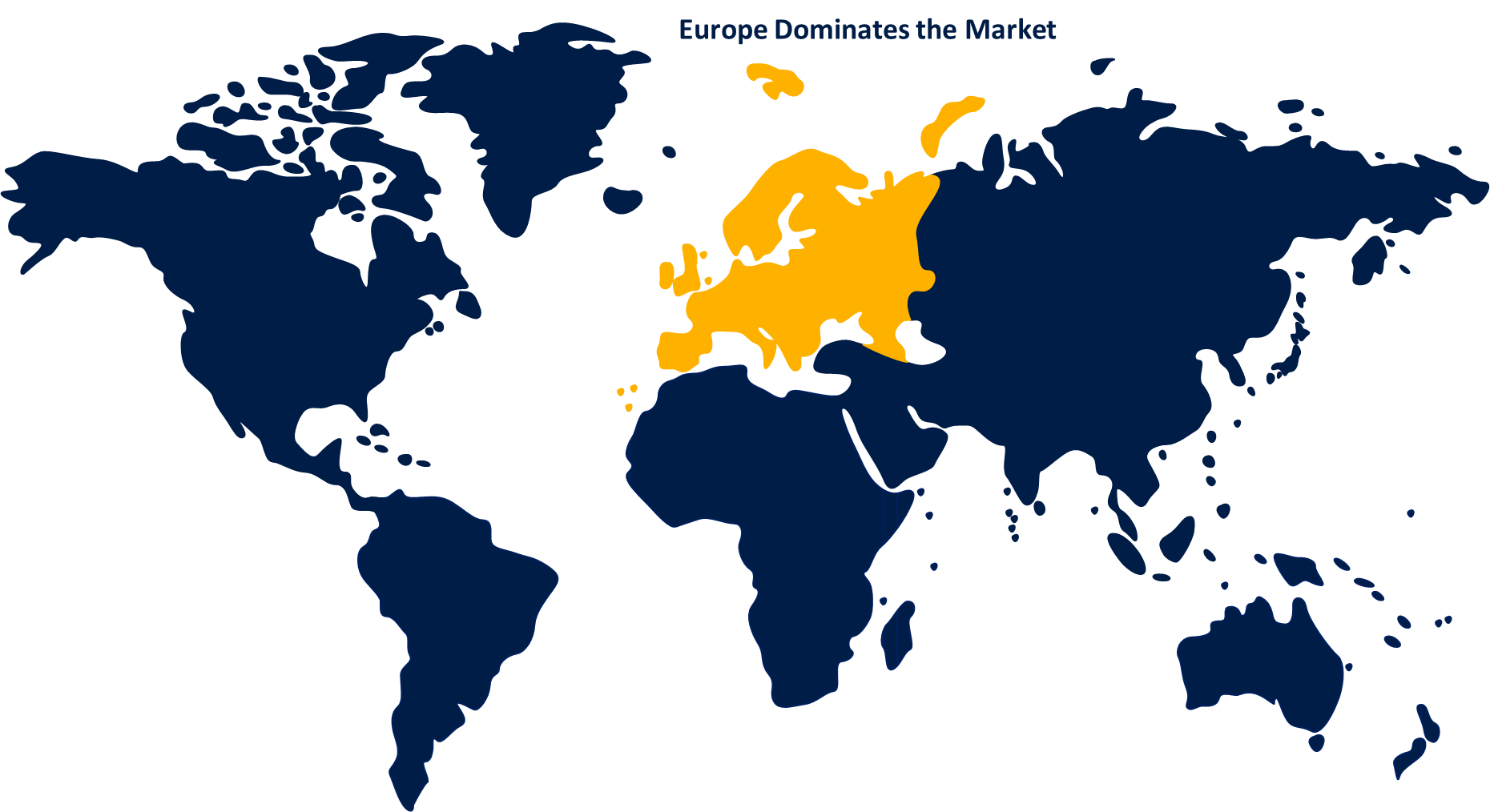

In 2024, the intumescent coatings market in Europe accounted for 30.2% of the global market share, which was attributed to its strict regulatory framework and the presence of mature construction and industrial sectors. The establishment of Eurocode regulations for fire safety measures, along with the growing favor for environmentally friendly and low-VOC coatings, resulted in the region's rapid acceptance of water-based and hybrid intumescent solutions.

Report Coverage

This research report categorizes the market for the Europe intumescent coatings market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe Intumescent coatings market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe intumescent coatings market.

Europe Intumescent Coatings Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 281.38 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 5.1% |

| 2035 Value Projection: | USD 486.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | NKT A/S, Contango Holdings PLC, Akzo Nobel NV, Sika AG, Fire Protection Specialists, Aleron Fire Protection, GSI Contract Services, Fire Integrity Ltd, Intumescent Chemicals Ltd, CJ Coatings Nationwide, Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The intumescent coatings market in Europe is driven by growth owing to the mining of conventional oil and gas resources, revealing the demand for energy, shale gas, tight gas, and coal bed methane (CBM), leading the market growth. The country has seen an upsurge in the application of intumescent coatings in the above-mentioned sectors, which include especially new buildings and refurbishment projects, the most common being commercial offices, airports and public transit. Market penetration, especially in high-performance thin-film systems, has been growing due to domestic manufacturers of coatings fostering innovation and forming partnerships with architects.

Restraining Factors

The intumescent coatings market in Europe is restrained by the volatilities in the costs of primary materials, like epoxy resins, which can be one of the reasons that the growth will not take place. Additionally, it is thought that a number of laws will come into effect that would prevent the use of volatile organic compounds (VOCs) in formulations beyond a certain amount. The unawareness of the product’s benefits in developing countries and the presence of cheap alternatives are also other reasons for the decline.

Market Segmentation

The Europe intumescent coatings market share is categorised into technology, end user technology, and application.

- The epoxy-based segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe intumescent coatings market is segmented by technology into water-based, solvent-based, and epoxy-based. Among these, the epoxy-based segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the slow-burning fires will demand large-scale protection for commercial and residential steel. The coatings give noticeable high moisture resistance and are superbly durable and chemically stable, making them hot spots in places that are very hard and where the oil is offshored, the petrochemical and industrial plants. Among the choice of intumescent epoxy coatings, the ones based on epoxy are particularly popular because of their ability to cope with tough conditions while at the same time retaining their fire protection capacity for long periods.

- The oil & gas segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on end user technology, the Europe intumescent coatings market is segmented into construction, oil & gas, automotive and others. Among these, the oil & gas segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by investments in exploration, deep-water projects, and the development of marginal fields are all on the rise, along with an increase in refining capacity. Furthermore, heightened exploration activities in the sector and increased government pressure for adherence to stringent fire safety rules are also contributing factors.

- The cellulosic segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe intumescent coatings market is segmented by application into cellulosic and hydrocarbon. Among these, the cellulosic segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by offering heat-resistant layers; cellulosic intumescent coatings are mainly used in the construction sector to protect overlaid steel structures and facilitate evacuation during fire occurrences. The construction sector's increasing demand for fire protection, especially in the case of industrial and commercial buildings, has also contributed to the growth of the intumescent coatings market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe intumescent coatings market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- NKT A/S

- Contango Holdings PLC

- Akzo Nobel NV

- Sika AG

- Fire Protection Specialists

- Aleron Fire Protection

- GSI Contract Services

- Fire Integrity Ltd

- Intumescent Chemicals Ltd

- CJ Coatings Nationwide

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In November 2025, Clariant launched its next-generation melamine-free flame retardant, a safer and forward-thinking solution that provides superior fire resistance and meets the stringent demands of modern industries.

In January 2025, Isolatek International, the global leader in passive fireproofing solutions, announced the launch of FireSolve SB, a revolutionary solvent-based intumescent fireproofing product redefining industry standards for durability, application efficiency and environmental safety.

In May 2025, Huntsman, one of the leading global companies in polyurethane-based solutions, launched a new intumescent polyurethane coating system developed for automotive applications, which can provide passive fire protection to metal and composite substrates used in electric vehicles, without compromising design flexibility.

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe Intumescent Coatings Market based on the below-mentioned segments:

Europe Intumescent Coatings Market, By Technology

- Water-based

- Solvent-based

- Epoxy-based

Europe Intumescent Coatings Market, By End User Technology

- Construction

- Oil & Gas

- Automotive and Others

Europe Intumescent Coatings Market, By Application

- Cellulosic

- Hydrocarbon

Need help to buy this report?