Europe Hot Sauce Market Size, Share, and COVID-19 Impact Analysis, By Type (Tabasco Pepper Sauce, Habanero Pepper Sauce, Jalapeño Sauce, Sweet and Spicy Sauce, and Others), By Distribution Channel (Mass Merchandisers, Specialist Retailers, Convenience Stores, Online Retail, and Others), and Europe Hot Sauce Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesEurope Hot Sauce Market Size Insights Forecasts to 2035

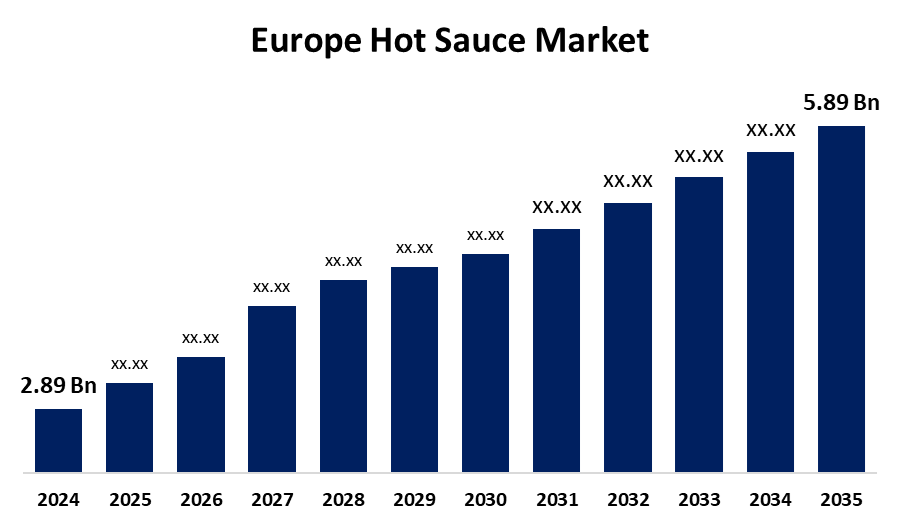

- The Europe Hot Sauce Market Size was Estimated at USD 2.89 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.69% from 2025 to 2035

- The Europe Hot Sauce Market Size is Expected to Reach USD 5.89 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the Europe Hot Sauce Market Size is anticipated to reach USD 5.89 Billion by 2035, growing at a CAGR of 6.69% from 2025 to 2035. The increasing popularity of spicy world cuisines, the health advantages of capsaicin, social media impact, new flavor innovation, and expanding online retail availability are fueling demand. Customers are looking for strong flavor, wellness, convenience, and variety, driving fast market expansion in Europe.

Market Overview

The Europe Hot Sauce Industry denotes the business of producing, distributing, and selling hot spicy sauces that are produced chiefly with chili peppers and other foods. Hot sauces generally have chili peppers, vinegar, and other components to provide a diversity of heat value and flavor profiles. The market serves customers wanting to add bolder, spicier flavors to cooking and culinary experiences in homes, restaurants, and food service establishments. Hot sauces are also consistent with health trends because they contain capsaicin, with perceived health benefits such as metabolism support and pain reduction, providing functional value to consumers. Additionally, innovation is key, with manufacturers creating distinctive formulas, such as sweet-hot combos, exotic pepper types, and limited-production varieties. Packaging innovations enhance convenience and attractiveness, appealing to a wider consumer base. In addition, the dramatic expansion of online sales channels provides consumers with access to a greater number of hot sauces, both niche and global brands, speeding up market expansion and consumer connection across Europe.

Report Coverage

This research report categorizes the market for Europe hot sauce market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe hot sauce market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe hot sauce market.

Europe Hot Sauce Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.89 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.69% |

| 2035 Value Projection: | USD 5.89 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 176 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | Chilli No. 5, Daddy Cool’s Chilli Sauce, East Coast Chilli Company, Goch & Co., Mclhenny Company, Pip’s Hot Sauce, The Kraft Heinz Company, Unilever PLC., Doctor Salsas, Crazy Bastard Sauce, Others, and key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

European consumers are adopting varied global cuisines such as Mexican, Indian, and Thai, where there is an integration of spicy flavors. This culinary adventure fuels the demand for real hot sauces that taste like the traditional ways. As more individuals begin testing bold flavors at home and at restaurants, hot sauce usage increases, fostering market growth and prompting manufacturers to increase their spicy product lines. Manufacturers are introducing new product lines of hot sauce with distinctive taste profiles, different levels of heat, and innovative packaging to appeal to niche consumers. This includes innovations such as sweet-spicy combinations, global pepper infusions, and limited-time offerings that blend well with adventurous foodies and traditional buyers. Diversification of products increases consumer optionality, ensures repeat buying, and differentiates brands in a competitive European market.

Restraining Factors

Most European consumers have a long-standing preference for milder flavors and are less familiar with spicy foods. This cultural bias restricts the mass acceptance and use of hot sauces, particularly highly spicy ones, thereby suppressing the overall market development. In addition, premium hot sauces are frequently accompanied by premium prices. Cost-conscious consumers may forego these products in favor of cheaper condiments, which restricts the market penetration of premium hot sauces and suppresses revenue growth.

Market Segmentation

The Europe hot sauce market share is classified into type and distribution channels.

- The tabasco pepper sauce segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Europe hot sauce market is segmented by type into tabasco pepper sauce, habanero pepper sauce, jalapeno sauce, sweet and spicy sauce, and others. Among these, the tabasco pepper sauce segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is due to tabasco's historic origins, traced back to 1868, which provides it with an unparalleled brand history. Such heritage fosters consumer confidence and familiarity, allowing it to be a household and trusted name for hot sauce enthusiasts. Consumers tend to favor established brands, particularly when they use hot sauces for the first time, which confirms Tabasco's dominance in the market.

- The mass merchandisers segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The Europe hot sauce market is segmented by distribution channel into mass merchandisers, specialist retailers, convenience stores, online retail, and others. Among these, the mass merchandisers segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth is attributed to mass merchandisers carrying a wide range of hot sauce brands and flavors, supporting a variety of consumer tastes. Such a wide range of offerings attracts a broad base of customers, ranging from occasional buyers to hot sauce aficionados, so shoppers can find mainstream as well as specialty products within one location increasing overall sales and share of the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved in the Europe hot sauce market. It also includes a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Chilli No. 5

- Daddy Cool’s Chilli Sauce

- East Coast Chilli Company

- Goch & Co.

- Mclhenny Company

- Pip’s Hot Sauce

- The Kraft Heinz Company

- Unilever PLC.

- Doctor Salsas

- Crazy Bastard Sauce

- Others

Recent Developments:

- In November 2024, Aldi UK released two Christmas-themed sauces: Brussels Sprouts Hot Sauce and Spiced Cranberry Hot Honey Sauce, both for £3.49. The products were created in partnership with Sauce Shop and have received a lukewarm response from consumers.

- In October 2024, Brooklyn Beckham introduced his high-end hot sauce business, Cloud 23, in the UK. He sells Hot Habanero and Sweet Jalapeño flavors in £15 premium bottles, fitting with the expanding trend of food products endorsed by celebrities.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe hot sauce market based on the below-mentioned segments

Europe Hot Sauce Market, By Type

- Tabasco Pepper Sauce

- Habanero Pepper Sauce

- Jalapeño Sauce

- Sweet and Spicy Sauce

- Others

Europe Hot Sauce Market, By Distribution Channel

- Mass Merchandisers

- Specialist Retailers

- Convenience Stores

- Online Retail

- Others

Need help to buy this report?