Europe Health Drinks Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Fruit and Vegetable Juices, Sports Drinks, Energy Drinks, Kombucha Drinks, Functional and Fortified Bottled Water, Dairy and Dairy Alternative Drinks, RTD Tea and Coffee), By Distribution Channel (On-trade and Off-trade), and Europe Health Drinks Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesEurope Health Drinks Market Insights Forecasts to 2035

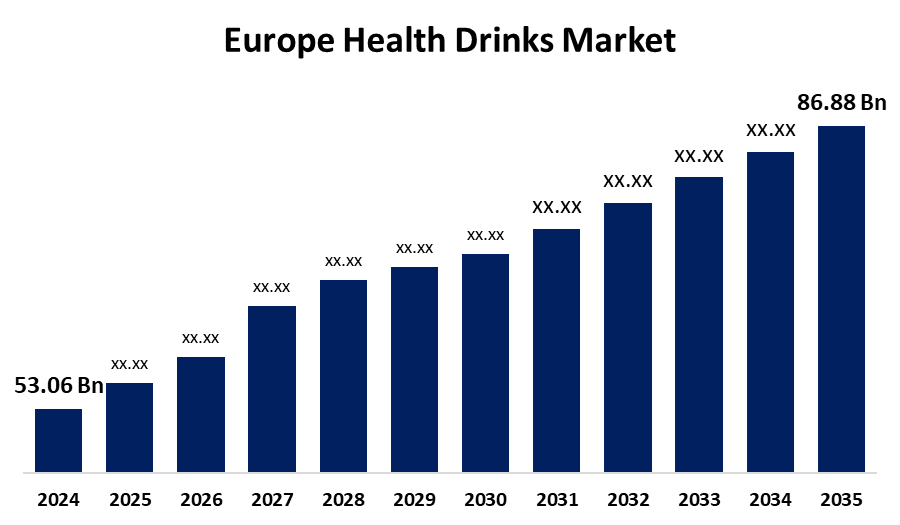

- The Europe Health Drinks Market Size was Estimated at USD 53.06 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.58% from 2025 to 2035

- The Europe Health Drinks Market Size is Expected to Reach USD 86.88 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Europe Health Drinks Market Size is anticipated to Reach USD 86.88 Billion by 2035, Growing at a CAGR of 4.58% from 2025 to 2035. Increased health consciousness, increasing demand for organic and natural products, creativity in functional ingredients such as vitamins and probiotics, and the development of new online channel expansions are major driving factors that are increasing the growth and popularity of the Europe health drinks market.

Market Overview

The Europe Health Drinks Market Size is the portion of the beverage market size dedicated to the manufacture and distribution of drinks that help to enhance health and well-being. Such beverages aim to offer nutritional value, assist in boosting immunity, improve physical performance, and address the increasing demand for healthy living among consumers. As awareness of health increases in Europe, consumers are increasingly turning to functional beverages that offer particular health advantages, including antioxidants, vitamins, probiotics, and minerals. The appeal of health drinks is that they can provide key nutrients and assist with different aspects of health. They can increase immune function, digest food properly, improve mental concentration, maintain hydration, and help with physical recovery. Furthermore, they provide a sugar substitute or artificially flavored beverages, which complement consumers' preferences for clean-label and natural products. Furthermore, companies introduce new flavors, enhance nutritional profiles, and embrace sustainable packaging formats to address changing consumer demands. Green packaging and new delivery forms like single-serve bottles and powders also improve convenience and sustainability. Overall, Europe health drinks market is changing swiftly, spurred by increasing attention to preventive health and wellness lifestyles.

Report Coverage

This research report categorizes the market size for Europe health drinks market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe health drinks market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe health drinks market.

Europe Health Drinks Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 53.06 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.58% |

| 2035 Value Projection: | USD 86.88 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 218 |

| Tables, Charts & Figures: | 111 |

| Segments covered: | By Product Type, By Distribution Channel |

| Companies covered:: | Nestle S.A., PepsiCo Inc., Red Bull GmbH, Danone S.A., The Coca-Cola Company, Alpro, Enervit S.p.A., A.G. Barr p.l.c., and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

European consumers are more health- and wellness-conscious, pushing demand for healthy and functional drinks. Increased interest in immunity, fitness, and preventive care supports the consumption of vitamin-, antioxidant-, and probiotic-rich health drinks to drive market growth. In addition, consumer demand for clean-label, natural, and organic drinks is growing rapidly. European consumers demand chemical-free, organically sourced health beverages, compelling companies to innovate and provide organic fruit juices, plant-based beverages, and preservative-free ones, fueling the market growth.

Restraining Factors

Premium health drinks, organic and functional beverages in particular, usually have premium pricing in comparison with traditional beverages. This creates a barrier of affordability for price-conscious consumers, particularly in the lower-income market, thus hindering overall market growth despite rising health consciousness throughout Europe. In addition, the stringent regulations on product safety, packaging, and health claims by Europe's stricter regimes place challenges on companies. It heightens production costs and lengthens time-to-market, most notably affecting smaller businesses and slowing down quick product innovation and expansion.

Market Segmentation

The Europe health drinks market share is classified into product type and distribution channel.

- The fruit and vegetable juices segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Europe health drinks market is segmented by product type into fruit and vegetable juices, sports drinks, energy drinks, kombucha drinks, functional and fortified bottled water, dairy and dairy alternative drinks, rtd tea, and coffee. Among these, the fruit and vegetable juices segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth is attributed to fruit and vegetable juices being full of essential vitamins, minerals, and antioxidants and fulfilling consumers' desire for natural, nutrient-rich drinks. Enhanced health awareness and emphasis on immunity and detoxification have pushed demand for these juices as everyday health enhancers, making them market leaders.

- The off-trade segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The Europe health drinks market is segmented by distribution channel into on-trade and off-trade. Among these, the off-trade segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth is due to off-trade channels such as supermarkets, convenience stores, and online shops offering convenient and pervasive availability of health drinks. Customers like to buy them in the course of regular shopping or by home delivery, which saves time and effort. This convenience fosters frequent and bulk buying, influencing higher sales volumes in the off-trade channel than the on-trade channels, which are based on out-of-home consumption occasions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved in the Europe health drinks market. It also includes a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nestle S.A.

- PepsiCo Inc.

- Red Bull GmbH

- Danone S.A.

- The Coca-Cola Company

- Alpro

- Enervit S.p.A.

- A.G. Barr p.l.c.

- Others

Recent Developments:

- In May 2025, Danone introduced a new protein shake under its Oikos yogurt line, representing the company's move into the $7 billion market for protein shakes. The product has five grams of fiber that is good for the digestive system and is geared towards addressing consumers' growing demand for protein and nutritionally richer food.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe health drinks market based on the below-mentioned segments:

Europe Health Drinks Market, By Product Type

- Fruit and Vegetable Juices

- Sports Drinks

- Energy Drinks

- Kombucha Drinks

- Functional and Fortified Bottled Water

- Dairy and Dairy Alternative Drinks

- RTD Tea and Coffee

Europe Health Drinks Market, By Distribution Channel

- On-trade

- Off-trade

Need help to buy this report?