Europe Halal Foods and Beverages Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Halal Food, Halal Beverages, and Halal Supplements), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, and Others), and Europe Halal Foods and Beverages Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesEurope Halal Foods and Beverages Market Insights Forecasts to 2035

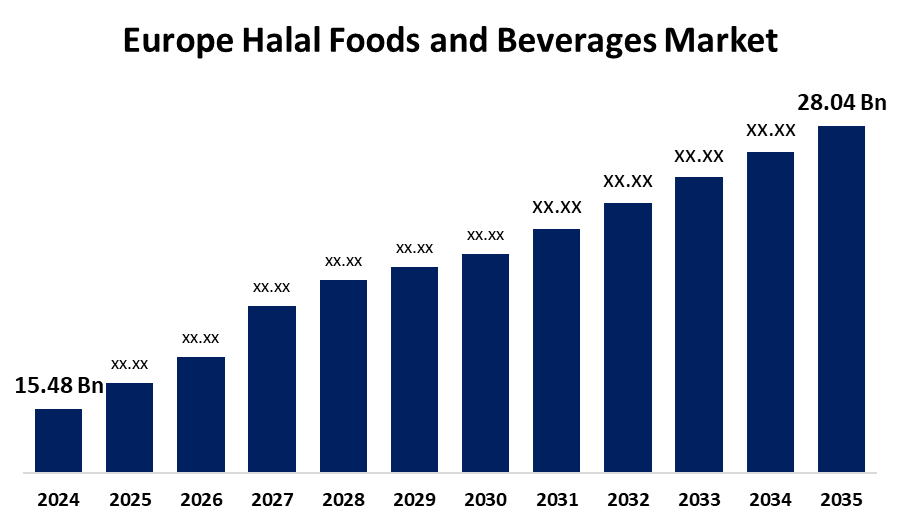

- The Europe Halal Foods and Beverages Market Size was Estimated at USD 15.48 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.55% from 2025 to 2035

- The Europe Halal Foods and Beverages Market Size is Expected to Reach USD 28.04 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Europe Halal Foods and Beverages Market Size is anticipated to reach USD 28.04 Billion by 2035, Growing at a CAGR of 5.55% from 2025 to 2035. The Europe Halal Foods and Beverages Market Size is propelled by the growing Muslim population, the mounting demand for certified halal products, advancing health and hygiene awareness, the broadening halal food certifications, and the impact of multiculturalism enforcing diverse dietary habits within the region.

Market Overview

The Europe Halal Food and Drink sector is part of the European food and beverage sector that manufactures, markets, and retails products that are Halal compliant with Islamic dietary regulations. The products are made, processed, and handled by the standards of halal certification to make them Halal consumable to Muslim consumers. The primary objective of the market is to offer a wide and diversified assortment of halal-certified foods and drinks that meet religious standards while offering consumer acceptability in terms of taste, convenience, and nutrition. Europe's growing Muslim population, growing awareness and acceptance of halal foods, availability of wider channels of retailing, and facilitatory government regulations. Sanitized halal certification processes also build consumer confidence, which boosts demand. In addition, firms are expanding halal product portfolios with the launch of ready-to-eat foods, snacks, drinks, and supplements that are compatible with contemporary lifestyles. Improvements in packaging, ingredient procurement, and product formulations guarantee that halal foods keep pace with changing customer needs, driving the Europe halal foods and beverages market.

Report Coverage

This research report categorizes the market for Europe's halal foods and beverages market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe halal foods and beverages market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe halal foods and beverages market.

Europe Halal Foods and Beverages Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 15.48 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.55% |

| 2035 Value Projection: | USD 28.04 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Product Type, By Distribution Channel |

| Companies covered:: | Nestle SA, Tahira Foods, Ferrero International SA, KQF Foods, Ummah Foods, Bilal Group, LDC Group, and Other Key Comapnies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing number of Muslims across European countries is driving higher demand for halal-certified foods and beverages. As more consumers seek authentic halal options for daily consumption, the market continues to expand to meet this growing population’s dietary needs. Moreover, increasing numbers of non-Muslim consumers are looking beyond halal food's quality, hygiene, and ethical standards, increasing its appeal. This broader acceptance propels manufacturers and retailers to enhance the halal supply, thereby furthering market growth beyond the confines of the Muslim market.

Restraining Factors

The halal certification procedure includes strict examination to ascertain that the products comply with Islamic dietary regulations. The divergence of certification criteria between nations provides challenges for manufacturers and importers, raising costs and making entry into the market more complex, which inhibits the expansion of halal food and beverage companies. In addition, the manufacture of halal-certified foodstuffs tends to demand independent supply chains, specialized processing, and specialized facilities to prevent cross-contamination. These needs add to operational expenses, which may drive retail prices higher and restrict affordability for certain consumers, thus slowing overall market growth.

Market Segmentation

The Europe halal foods and beverages market share is classified into product type and distribution channel.

- The halal food segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Europe halal foods and beverages market is segmented by product type into halal food, halal beverages, and halal supplements. Among these, the halal food segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is due to halal food encompasses the vast majority of common items like fresh meat, frozen foods, snacks, and ready meals, which are regularly consumed by households. Halal foods are prepared with utmost care to Islamic dietary requirements, bolstering trust and loyalty for certified halal food products. This strong cultural basis is responsible for consumer loyalty, which makes halal food the largest as well as most trusted segment.

- The supermarkets/hypermarkets segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The Europe halal foods and beverages market is segmented by distribution channel supermarkets/hypermarkets, convenience stores, specialty stores, and others. Among these, the supermarkets/hypermarkets segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth is attributed to supermarkets and hypermarkets carrying a wide range of halal-certified food and beverages, ranging from fresh meat to prepared meals and snacks. This assortment captures various customer demands under one shopping facility, which makes customers opt for the big stores over smaller ones that only provide limited halal products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved in the Europe halal foods and beverages market. It also includes a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nestle SA

- Tahira Foods

- Ferrero International SA

- KQF Foods

- Ummah Foods

- Bilal Group

- LDC Group

- Others

Recent Developments:

- In June 2022, Halal Food Company introduced five ready meals in the UK's Sainsbury's. The range included beef lasagna, shepherd's pie, macaroni pasta with meatballs, snack pot chicken curry with basmati rice, and peri-peri stir fry with grilled chicken, to meet the increasing demand for convenience halal meal options.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe halal foods and beverages market based on the below-mentioned segments:

Europe Halal Foods and Beverages Market, By Product Type

- Halal Food

- Halal Beverages

- Halal Supplements

Europe Halal Foods and Beverages Market, By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Others

Need help to buy this report?