Europe Food Safety Testing Market Size, Share, and COVID-19 Impact Analysis, By Contaminant Testing (Pathogen Testing, Pesticide, and Residue Testing, Mycotoxin Testing, GMO Testing, Allergen Testing, and Others), By Application (Pet Food, Animal Feed, and Food), and Europe Food Safety Testing Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesEurope Food Safety Testing Market Size Insights Forecasts to 2035

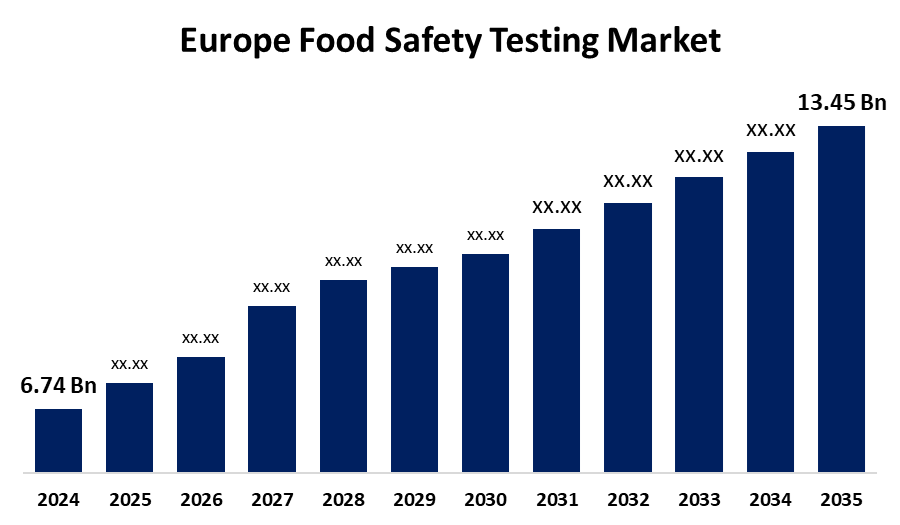

- The Europe Food Safety Testing Market Size was Estimated at USD 6.74 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.48% from 2025 to 2035

- The Europe Food Safety Testing Market Size is Expected to Reach USD 13.45 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the Europe Food Safety Testing Market Size is anticipated to reach USD 13.45 Billion by 2035, growing at a CAGR of 6.48% from 2025 to 2035. The Europe food safety testing market is prompted by strict regulations, consumer awareness, technological innovation in swift and precise testing techniques, growing demand from the food industry, and rising emphasis on food traceability and transparency for guaranteeing product quality and safety.

Market Overview

The Europe Food Safety Testing Market Size is the business that conducts analysis of food products in Europe to identify contaminants including pathogens, pesticides, allergens, mycotoxins, and genetically modified organisms (GMOs). This market guarantees that food adheres to strict safety standards, preserves public health, and satisfies consumer requirements for safe, high-quality food products by applying state-of-the-art testing technologies and services. The major objective of the food safety testing market is to avoid foodborne disease by detecting harmful substances in food products prior to them being consumed by consumers. It ensures compliance with regulatory standards and assists food companies and retailers in sustaining product quality and brand image. The market also facilitates traceability and transparency in the food supply chain, essential for food fraud and contamination concerns. Market innovations are centered on creating quicker, more sensitive, and affordable testing techniques, such as digital platforms for real-time compliance monitoring, environmental-friendly testing kits, and the incorporation of artificial intelligence to analyze data. These innovations are crafting a strong and vibrant food safety testing market that secures Europe's food supply as safe, trustworthy, and competitively placed on the international market.

Report Coverage

This research report categorizes the market for the Europe food safety testing market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe food safety testing market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe food safety testing market.

Europe Food Safety Testing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6.74 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.48% |

| 2035 Value Projection: | USD 13.45 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 123 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Contaminant Testing, By Application and COVID-19 Impact Analysis |

| Companies covered:: | ALS Limited, Campden BRI, NFS International, SGS SA, Eurofins Scientific, Intertek Group PLC, Tuv Sud, Fera Science Limited, INSTITUT Merieux, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The European Union also imposes high food safety regulations by bodies such as the European Food Safety Authority (EFSA). The regulations involve routine testing for contaminants including pathogens, pesticides, and allergens, which keeps food products at a safety level. This regulatory pressure creates a steady demand for sophisticated food safety testing services throughout Europe. In addition, technologies like fast pathogen detection, next-generation sequencing (NGS), and sophisticated chemical analysis have enhanced testing speed, accuracy, and efficiency. These technologies facilitate more accurate food safety monitoring and minimize testing turnaround times, stimulating market growth.

Restraining Factors

Advanced food testing for safety utilizes highly advanced equipment, experienced staff, and large laboratory facilities, which increase the costs of doing business. SMEs might not be able to afford these costs, which restricts their capacity to carry out frequent full-scale testing and constrains overall market development. Additionally, certain testing procedures, particularly for pathogens and contaminants, take long to complete, causing the delayed release of products and affecting supply chains. This restricts quick decision-making and tends to discourage certain firms from broad testing, holding back market adoption.

Market Segmentation

The Europe food safety testing market share is classified into contaminant testing and application.

- The pathogen testing segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Europe food safety testing market is segmented by contaminant testing into pathogen testing, pesticide and residue testing, mycotoxin testing, GMO testing, allergen testing, and others. Among these, the pathogen testing segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is due to pathogens such as Salmonella, Listeria, and E. coli that induce severe foodborne diseases and outbreaks. Testing for these microbes is crucial to avert health risks and provide consumer safety. Governments are keen on pathogen testing in order to minimize disease occurrence, boosting strong demand and making this segment the largest in the European food safety market.

- The food segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The Europe food safety testing market is segmented by application into pet food, animal feed, and food. Among these, the food segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth is attributed to the European Union mandates stringent food safety standards mandating extensive testing to avoid contamination and ensure public health. Food items are constantly analyzed for pathogens, pesticides, and chemical residues, fueling increased demand for testing services. This regulatory climate places food safety testing at the top of its agenda, and thus the food segment reigns supreme in the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved in the Europe food safety testing market. It also includes a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ALS Limited

- Campden BRI

- NFS International

- SGS SA

- Eurofins Scientific

- Intertek Group PLC

- Tuv Sud

- Fera Science Limited

- INSTITUT Merieux

- Others

Recent Developments:

- In November 2024, Bureau Veritas introduced a new European certification scheme for sustainable food supply chains, which involves testing for pesticide residues and verifying food authenticity. In November 2024, the company upgraded its food testing laboratory in Spain to encompass advanced genomic foodborne pathogen testing, meeting EU pathogen control protocols.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe food safety testing market based on the below-mentioned segments:

Europe Food Safety Testing Market, By Contaminant Testing

- Pathogen Testing

- Pesticide and Residue Testing

- Mycotoxin Testing

- GMO Testing

- Allergen Testing

- Others

Europe Food Safety Testing Market, By Application

- Pet Food

- Animal Feed

- Food

Need help to buy this report?