Europe Ethylene Vinyl Acetate Market Size, Share, and COVID-19 Impact Analysis, By Type (Low-Density, Medium-Density, and High-Density), By End User (Photovoltaic Panels, Footwear, Foams, Packaging, and Agriculture), and Europe Ethylene Vinyl Acetate Market Insights, Industry Trends, Forecast to 2035.

Industry: Chemicals & MaterialsEurope Ethylene Vinyl Acetate Market Insights Forecasts to 2035

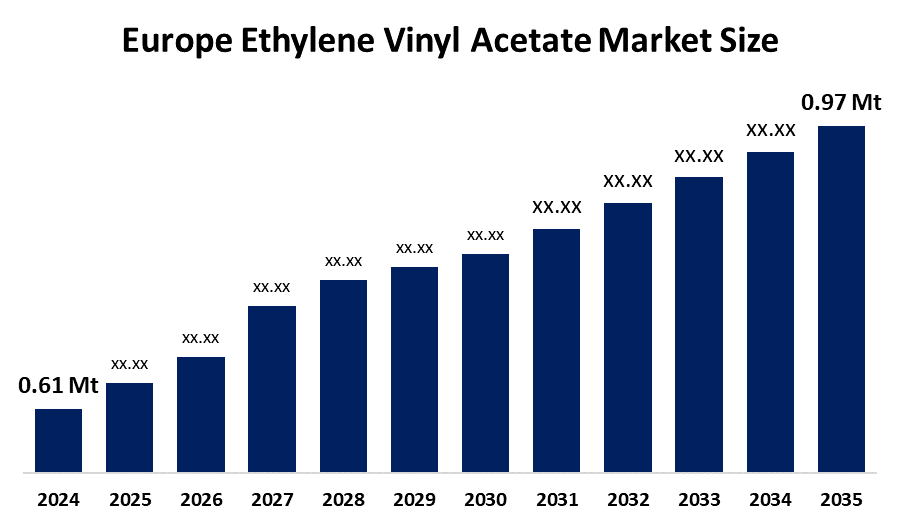

- The Europe Ethylene Vinyl Acetate Market Size Was Estimated at 0.61 Million Tonnes in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.31% from 2025 to 2035

- The Europe Ethylene Vinyl Acetate Market Size is Expected to Reach 0.97 Million Tonnes by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Europe Ethylene Vinyl Acetate Market size is anticipated to reach 0.97 million tonnes by 2035, growing at a CAGR of 4.31% from 2025 to 2035. The market is driven by the demand for ethylene vinyl acetate in Europe is expected to grow at an accelerating pace due to rising demand for the chemical in the packaging and renewable energy industry.

Market Overview

Ethylene-Vinyl Acetate (EVA) functions as an elastomeric copolymer that produces rubber-like materials through the combination of its two components, ethylene and vinyl acetate. The elastomeric polymer ethylene vinyl acetate provides materials with three main properties which include durability, crack resistance and flexibility. The material functions as an encapsulating agent that protects photovoltaic (PV) solar cells from moisture and UV radiation while maintaining their ability to transmit light. Europe remains the leading region for this particular application. The material displays excellent cushioning and shock absorption capabilities, which makes it a popular choice for use in shoe midsoles, sandals and sports equipment.

Germany's CropEnergies has approved construction plans for its renewable ethyl acetate facility at the Zeitz Chemical and Industrial Park in Elseraue. Total investment will be between €120-130 million, paid from the company’s cash reserve.

Repsol has added a range of chemically recycled ethylene vinyl acetate (EVA) copolymers to its Reciclex portfolio. The Spanish petrochemical giant says this is the first product on the market to incorporate 100% circular AV from chemical recycling in 2023. Braskem S.A. leads the biopolymer market and has expanded its distribution agreement with FKuR Kunststoff GmbH to include additional products from the I'm greenTM bio-based portfolio.

Report Coverage

This research report categorises the European ethylene vinyl acetate market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe ethylene vinyl acetate market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe ethylene vinyl acetate market.

Europe Ethylene Vinyl Acetate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 0.61 Million Tonnes |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 4.31% |

| 2035 Value Projection: | 0.97 Million Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 117 |

| Segments covered: | By Type,By End User |

| Companies covered:: | Arkema S.A., Versalis, Borealis AG, Trocellen, Primacel, Nora Systems GmbH, EvaLine, Wacker Chemie AG,and Other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The ethylene vinyl acetate market in Europe is driven by EVA, which functions as a protective layer that protects solar cells from both moisture and ultraviolet radiation. The German solar market, which represents the solar market in the region, requires more than 25% of its total EVA supply for solar encapsulation purposes. The region experiences increased demand for lightweight EVA materials that automotive manufacturers use in interior design and wire insulation for electric vehicle development. Repsol and Borealis introduced circular and renewable-based EVA products to comply with existing sustainability requirements which they must follow.

Restraining Factors

The ethylene vinyl acetate market in Europe is restrained by the EU Green Deal and Single-Use Plastics Directive have established plastic waste reduction targets that require a 50% decrease in plastic waste by 2025, leading to a transition from conventional EVA materials which do not break down naturally. EVA production faces major cost challenges because ethylene and VAM prices depend on unpredictable crude oil market movements.

Market Segmentation

The Europe ethylene vinyl acetate market share is categorised into type and end user.

- The high-density segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe ethylene vinyl acetate market is segmented by type into low-density, medium-density, and high-density. Among these, the high-density segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by its superior strength, with its higher stiffness and better thermal stability creating its status as the most suitable material for solar photovoltaic encapsulation, durable foams, multilayer packaging systems and industrial high-performance components. The solar photovoltaic sector is the largest demand center for high-density EVA, as it delivers strong cross-linking capability, UV resistance, and long-term reliability in module lamination.

- The foams segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on end user, the Europe ethylene vinyl acetate market is segmented into photovoltaic panels, footwear, foams, packaging, and agriculture. Among these, the foams segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the foams in the midsoles of footwear, sports equipment, automotive interiors, and packaging inserts. The footwear industry remains the major driver, particularly in Asia. The segment continues to grow because people want comfort materials and fitness products, and they need packaging materials that withstand impacts.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe ethylene vinyl acetate market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Arkema S.A.

- Versalis

- Borealis AG

- Trocellen

- Primacel

- Nora Systems GmbH

- EvaLine

- Wacker Chemie AG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe Ethylene Vinyl Acetate Market based on the below-mentioned segments:

Europe Ethylene Vinyl Acetate Market, By Type

- Low-Density

- Medium-Density

- High-Density

Europe Ethylene Vinyl Acetate Market, By End User

- Photovoltaic Panels

- Footwear

- Foams

- Packaging

- Agriculture

Need help to buy this report?