Europe Dental Implants Market Size, Share, and COVID-19 Impact Analysis, By Part (Fixture and Abutment), By Material (Titanium Implants and Zirconium Implants), By Country (Germany, United Kingdom, France, Spain, Italy, Russia, & Rest of Europe), and Europe Dental Implants Market Insights, Industry Trend, Forecasts to 2032.

Industry: HealthcareEurope Dental Implants Market Insights Forecasts to 2032

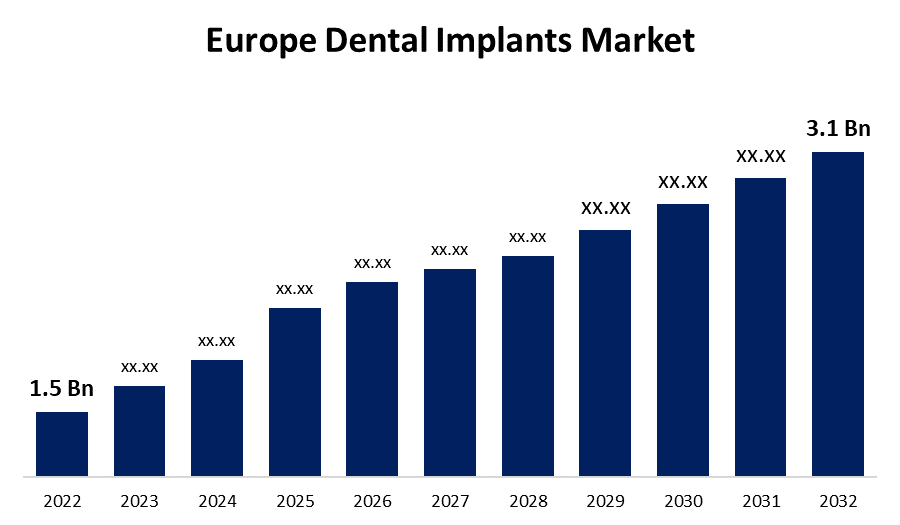

- The Europe Dental Implants Market Size was valued at USD 1.5 Billion in 2022.

- The Market is growing at a CAGR of 7.53% from 2022 to 2032.

- The Size is expected to reach USD 3.1 Billion by 2032.

Get more details on this report -

The Europe Dental Implants Market Size was valued at USD 1.5 Billion in 2022 and is expected to grow to USD 3.1 Billion by 2032, at a CAGR of 7.53% during the forecast period (2022-2032).

Market Overview

A dental implant is a surgical component that connects with the jaw or skull bone to support dental prostheses such as dentures, bridges, crowns, or facial prostheses, or to serve as an orthodontic anchor. Osseointegration is a biological process that underpins dental implants. Metals (titanium) and nonmetals (ceramic) are polymers that bond with the skin. The dental implant is implanted such that it may be connected to additional implants, and a dental prosthesis can be added afterward.

Report Coverage

This research report categorizes the market of Europe dental implants market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe dental implants market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Europe dental implants market.

Europe Dental Implants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 1.5 Bn |

| Forecast Period: | 2022 – 2032 |

| Forecast Period CAGR 2022 – 2032 : | 7.53% |

| 022 – 2032 Value Projection: | USD 3.1 Bn |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Part, By Material, By Country. |

| Companies covered:: | 3D Diagnostix, Botiss Biomaterials, 3D Med, Bredent, A.B. Dental, Blue Sky Bio, ADIN Dental Implant Systems, Bicon Dental Implants, Easy System Implant, Zimmer Biomet and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Dental disorders are becoming more prevalent in Europe as a result of changing lifestyles and poor dietary habits. In addition to their lifestyle choices, genetics may play a role in the increased prevalence of dental problems. Missing teeth, gum recession, loose roots, dental decay, and gum disease are all becoming more common. As a result, the market for dental implants is expanding. Furthermore, the business is gaining popularity as people become more willing to spend money on their dental health. Also, People looking for treatment for dental concerns or alternative solutions such as whitening or polishing are increasing their demand for cosmetic dentistry treatments. In recent years, the smile restoration technique has gained popularity in European nations, which is propelling the demand for dental implants.

Restraining Factors

Dental implant procedures have a high failure rate if they are not customized to the patient's gums. It can lead to bone degradation, infection, and gum recession, among other problems. It can also damage the gums and bone surrounding the tooth. All of these challenges represent serious dangers to the European dental implant sector.

Market Segment

- In 2022, the fixture segment is dominating the largest market share during the forecast period.

Based on the part, the Europe dental implants market is segmented into fixture and abutment. Among these segments, the fixture segment dominates the largest market share during the forecast period. The four types of sub-segments found in fixtures include endosteal implants, subperiosteal implants, transosteal implants, and intramucosal implants. Endosteal implants are in high demand on the market. The bulk of them are connected to bones. Transosteal implants are also becoming more popular, particularly in challenging surgeries, which will boost demand during the forecast period.

- In 2022, the titanium implants segment is influencing the largest market growth during the forecast period.

Based on material, the Europe dental implants market is divided into various segments including titanium implants and zirconium implants. Among these, the titanium implants segment held the largest market share during the forecast period. This is owing to advantages such as biocompatibility, non-allergic nature, and convenience of use in several operations. Zirconium has also been increasingly popular in recent years. Titanium alloys are becoming increasingly popular for the fabrication of implant devices, which will drive up demand for this material over the forecast period.

- In 2022, the United Kingdom is leading the largest market share over the forecast period.

Based on the region, the Europe dental implants market is classified into Germany, United Kingdom, France, Spain, Italy, Russia, & Rest of Europe. Among these segments, United Kingdom dominates the largest market share during the forecast period due to the availability of a solid dental healthcare system as well as attractive reimbursement policies. Furthermore, increased demand for dental procedures, as well as the incidence of numerous oral disorders, is driving demand for dental implants in the United Kingdom. France and Germany, on the other hand, have a substantial market share.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe dental implants market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 3D Diagnostix

- Botiss Biomaterials

- 3D Med

- Bredent

- A.B. Dental

- Blue Sky Bio

- ADIN Dental Implant Systems

- Bicon Dental Implants

- Easy System Implant

- Zimmer Biomet

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2021, the French National Research Agency funded Z3DLAB Montmagny in Île-de-France, France, and a partnership with the Centre National de la Recherche Scientifique (CNRS), to produce complex concentrated alloys for bio-implants, or CoCoA-Bio, using Additive Manufacturing.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2032. Spherical Insights has segmented the Europe Dental Implants Market based on the below-mentioned segments:

Europe Dental Implants Market, By Part

- Fixture

- Abutment

Europe Dental Implants Market, By Material

- Titanium Implants

- Zirconium Implants

Europe Dental Implants Market, By Region

- Germany

- United Kingdom

- France

- Spain

- Italy

- Russia

- Rest of Europe

Need help to buy this report?