Europe Data Center Colocation Market Size, Share, and COVID-19 Impact Analysis, By Type (Retail Colocation, Wholesale Colocation), By Enterprise Size (Small Enterprises, Medium Enterprises, and Large Enterprises), By End-Use Industry (BFSI, Healthcare, IT & Telecom, Media & Entertainment, Retail, Others), By Country (UK, Germany, France, Italy, Spain, Others), and Europe Data Center Colocation Market Insights Forecasts to 2032

Industry: Information & TechnologyEurope Data Center Colocation Market Insights Forecasts to 2032

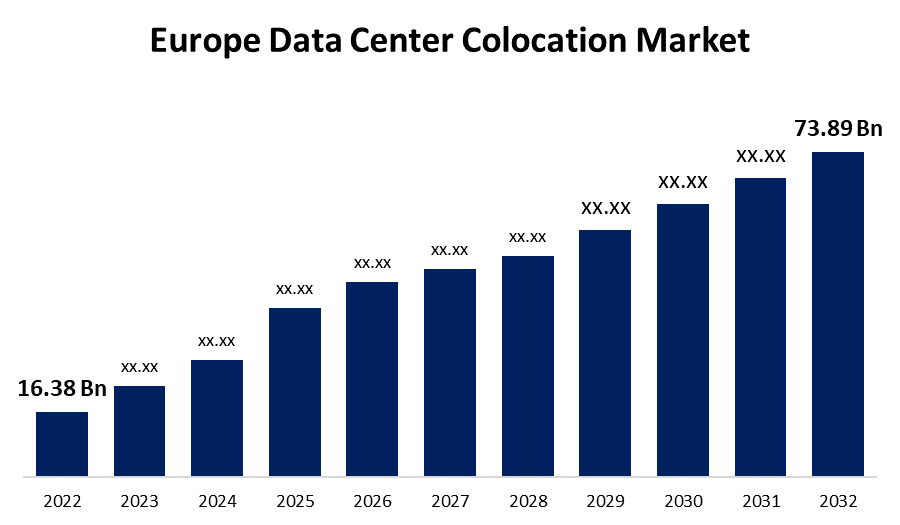

- The Europe Data Center Colocation Market Size was valued at USD 16.38 Billion in 2022.

- The Market Size is Growing at a CAGR of 16.2% from 2022 to 2032.

- The Europe Data Center Colocation Market Size is expected to reach USD 73.89 Billion by 2032.

- Europe is expected to grow the fastest during the forecast period.

Get more details on this report -

The Europe Data Center Colocation Market Size is expected to reach USD 73.89 Billion by 2032, at a CAGR of 16.2% during the forecast period 2022 to 2032.

Market Overview

Data center colocation is an information technology model of operation in which numerous clients lease floor/white spaces and/or infrastructure from a third-party vendor to help with their own IT data center demands. In certain circumstances, a whole facility is rented to a single client, with the colocation operator handling continuous surveillance, upgrades, and support. The service provides shared, secure rooms in cool, controlled setting that are perfect for server infrastructure, while also ensuring that bandwidth requirements are satisfied. The data center will provide service layers that ensure a specific level of availability. Cloud service companies, which use colo to accommodate their large equipment storage requirements, are driving up market demand. Additionally, the market continues to and is going to keep to be fluid as rules around cloud storage requirements evolve. The growing demand for connection bandwidth and expanding data transmission are two major drivers propelling the expansion of the Europe data center colocation market.

Report Coverage

This research report categorizes the market for Europe Data Center Colocation Market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe Data Center Colocation Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Europe Data Center Colocation Market.

Europe Data Center Colocation Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022 : | USD 16.38 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 16.2% |

| 2032 Value Projection: | USD 73.89 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Enterprise Size, By End-Use Industry, By Country |

| Companies covered:: | Equinix, Inc., Global Switch, Interxion, CoreSite Realty Corporation, Colt Group Holdings Ltd., CyrusOne, Telehouse, CenturyLink, Iron Mountain Incorporated, NTT Communications Corporation, RACKSPACE TECHNOLOGY, Cyxtera Technologies, Inc., Digital Realty Trust, Inc., China Telecom Corporation Limited. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising demand for faster processing speeds and high data transfer, the growing popularity of fully immersive technologies and smartphone adoption, and the increased usage of streaming services provided by OTT are key drivers boosting the Europe data center colocation market expansion. In addition, the region's data center colocation market is being influenced by the requirement for floor space, rising IT infrastructure expenses, and rising power costs. Organizations prefer colocation data centers because they provide greater reliability and are located close to the end user. Furthermore, colocation data center operators meet their space and power needs while also giving them the opportunity to grow up their equipment as needed.

Furthermore, the continuing technological advancements growth with the implementation of gadgets equipped with new technologies like as 5G, IoT, AI, and AR will likely accelerate market expansion even further. Additionally, the market is pushed by large-scale data center clients such as open-source cloud service providers and major internet enterprises, who have a high need for colocation services. Moreover, the UK is predicted to have the highest growth rate during the forecast period. The large volume of internet traffic and the existence of various cloud service providers in the entire nation are related to this increase. Furthermore, Warsaw, Poland, has established itself as a hotspot for CEE investment, with numerous corporations establishing their data centers in Poland.

Market Segment

- In 2022, the retail colocation segment is expected to hold the largest share of Europe Data Center Colocation market during the forecast period.

Based on the type, the Europe Data Center Colocation Market is classified into retail colocation and wholesale colocation. Among these, the retail colocation segment is expected to hold the largest share of the Europe Data Center Colocation market during the forecast period. Because small businesses have relatively small data storage needs, they lack the need for specialized data centers. As a result, wholesale colocation services are costly for small businesses because they just provide space and power, but enterprises must maintain their own information technology systems and manpower. For a limited period, retail colocation offers racks, private data center suites, cabinets, and employees ideal for small businesses.

- In 2022, the large enterprises segment is witnessing a higher growth rate over the forecast period.

On the basis of enterprise size, the Europe Data Center Colocation Market is segmented into small enterprises, medium enterprises, and large enterprises. Among these, the large enterprises segment is witnessing a higher growth rate over the forecast period. This is due to the adoption of colocation services by major service providers for cloud computing and hyperscalers. Large organizations oversee a tremendous volume of data, necessitating infrastructure with high capabilities and enough of floor space to house the equipment. Datacenter colocation enables these businesses to meet their electrical and physical space objectives while maintaining full authority over data center equipment. Because of these concerns, large organizations are increasingly turning to colocation services rather than constructing and maintaining their own servers and networks.

- In 2022, the IT & telecom segment accounted for the largest revenue share of more than 62.3% over the forecast period.

On the basis of end-use industry, the Europe Data Center Colocation Market is segmented into BFSI, healthcare, IT & telecom, media & entertainment, retail, and others. Among these, the IT & telecom segment dominates the market with the highest revenue share of 62.3% over the forecast period. The significant share of the market is attributed to the industry's continual growth in software and applications, as well as the introduction of various start-ups around the region. Meanwhile, the telecom industry has seen a spike in smartphone broadband users, creating a significant demand for data storage in recent years. Technology advancements like as IoT and 5G are expected to stimulate demand in the IT and telecom industries, boosting market growth throughout the forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe Data Center Colocation Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Equinix, Inc.

- Global Switch

- Interxion

- CoreSite Realty Corporation

- Colt Group Holdings Ltd.

- CyrusOne

- Telehouse

- CenturyLink

- Iron Mountain Incorporated

- NTT Communications Corporation

- RACKSPACE TECHNOLOGY

- Cyxtera Technologies, Inc.

- Digital Realty Trust, Inc.

- China Telecom Corporation Limited.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- On January 2023, Penta Infra, a European data center operator, has bought Sungard's data center and colocation operations in Paris, France. Penta Infra has stated that it will acquire the colocation business and continue to provide data center services 'to the bulk' of its current client base. Sungard has inked a service contract with Penta Infra to continue using data center capacity and will remain on site as a partner in supplying managed hosting and other availability services to a'specific set' of existing clients.

- In August 2022, ST Telemedia Global Data Centres has concluded an agreement with Macquarie Asset Management to purchase a significant minority investment in data center provider VIRTUS Data Centres through Macquarie European Infrastructure Fund 7. Blue-chip clients, including global technology businesses and enterprise clients, rely on VIRTUS for colocation and cloud connectivity services. Its portfolio includes 11 data center buildings in Greater London with a total capacity of more than 180 MW, as well as a 100 MW pipeline of projects in prominent locations across the United Kingdom and Europe.

- In November 2023, Deft, a managed IT services company, has expanded its colocation footprint into Frankfurt, Germany, through a relationship with Digital Realty, the leading global supplier of cloud- and carrier-neutral data center, colocation, and interconnection solutions. This expansion contributes to the company's global customer base, roughly one-third of which is based in Europe.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the Europe Data Center Colocation Market based on the below-mentioned segments:

Europe Data Center Colocation Market, By Type

- Retail Colocation

- Wholesale Colocation

Europe Data Center Colocation Market, By Enterprise Size

- Small Enterprises

- Medium Enterprises

- Large Enterprises

Europe Data Center Colocation Market, By End-Use Industry

- BFSI

- Healthcare

- IT & Telecom

- Media & Entertainment

- Retail

- Others

Europe Data Center Colocation Market, By Country

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Rest of Europe

Need help to buy this report?