Europe Controlled Release Fertilizers Market Size, Share, and COVID-19 Impact Analysis, By Product (Polymer Sulfur Coated Urea/Sulfur Coated Urea, Polymer Coated Urea, Polymer Coated NPK, Others), By Crop (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, Others), By Country (Germany, UK, France, Italy, Spain, Russia, Rest of Europe), and Europe Controlled Release Fertilizers Market Insights Forecasts to 2032

Industry: Chemicals & MaterialsEurope Controlled Release Fertilizers Market Size Insights Forecasts to 2032

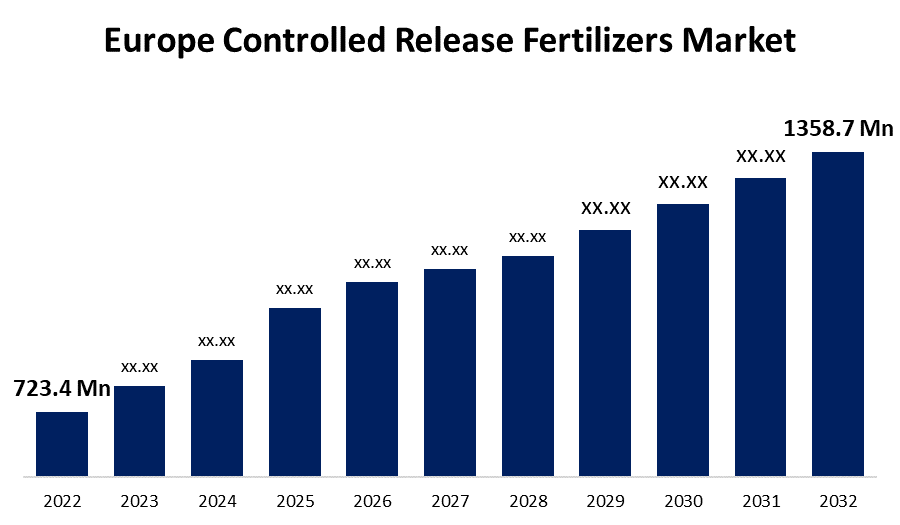

- The Europe Controlled Release Fertilizers Market Size was valued at USD 723.4 Million in 2022.

- The Market Size is Growing at a CAGR of 6.5% from 2022 to 2032.

- The Europe Controlled Release Fertilizers Market Size is expected to reach USD 1358.7 Million by 2032.

- Europe is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Europe Controlled Release Fertilizers Market Size is expected to reach USD 1358.7 Million by 2032, at a CAGR of 6.5% during the forecast period 2022 to 2032.

Market Overview

Controlled release fertilizers are designed to dissipate fertilizers at a steady rate that corresponds to crop nutrient absorption requirements. This guarantees that plants get the nutrients they require when they need them while experiencing little wastage. Various elements, such as soil humidity, temperature, or microbial activity, impact the release process. They have been demonstrated to be an effective tool for increasing crop yields, maximizing nutrient uptake, and decreasing pollution generated by traditional pesticides. Controlled release fertilizers are used in a variety of agricultural and horticultural applications. They are especially popular in applications such as ornamental plant cultivation, landscaping, and greenhouse farming, where precision nutrient management is essential. The European agriculture sector has been rapidly transforming as a result of governmental reforms, shifting consumer tastes, and sustainability concerns. Furthermore, as Europe moves toward more environmentally friendly farming methods, controlled release fertilizers have begun to gain favor in field crops, providing a sustainable alternative to traditional fertilization processes.

Report Coverage

This research report categorizes the market for Europe Controlled Release Fertilizers Market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe Controlled Release Fertilizers Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Europe Controlled Release Fertilizers Market.

Europe Controlled Release Fertilizers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 723.4 Million |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 6.5% |

| 2032 Value Projection: | USD 1358.7 Million |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Crop, By Country and COVID-19 Impact Analysis |

| Companies covered:: | Yara International, ICL Specialty Fertilizers, BASF SE, Agrium Inc., Van Iperen International, Sociedad Quimica Y Minera S.A., DeltaChem, SQM, OCI Nitrogen, Compo Expert GmbH, Nutrien Ltd., and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Europe controlled release fertilizers market is primarily influenced by variables such as severe ecological laws, growing awareness of organic farming methods, and economic advantages derived from reduced labor and resources in the long run. Rising concerns about environmental deterioration, water contamination, and climate change have propelled Europe to the top of sustainable farming techniques. Controlled release fertilizers help to achieve these objectives by decreasing the discharge of nutrients and encouraging effective nutrient absorption. CRFs were developed and demonstrated to increase crop yields and improve harvest quality. Controlled release fertilizers are becoming increasingly popular among European farmers, who frequently raise high-value crops. Also, there is an increasing demand in Europe for organic farming. As such, organic controlled release fertilizers that meet stringent organic accreditation standards are becoming increasingly prominent among organic growers. Furthermore, CRF manufacturers are providing specialized platforms that take unique crop needs, soil types, and geographical variances into account. This tendency ensures that controlled release fertilizers are specifically designed for agricultural conditions in Europe.

Market Segment

- In 2022, the polymer sulfur coated urea/sulfur coated urea segment is expected to hold the largest share of Europe Controlled Release Fertilizers Market during the forecast period.

Based on the product, the Europe Controlled Release Fertilizers Market is classified into polymer sulfur coated urea/sulfur coated urea, polymer coated urea, polymer coated NPK, and others. Among these, the polymer sulfur coated urea/sulfur coated urea segment is expected to hold the largest share of the Europe Controlled Release Fertilizers Market during the forecast period. SCU is a form of controlled release fertilizer that consists of urea pellets coated with a sulfur compound and polymer coating. As the sulfur layer eventually oxidizes, nutrients are released. Sulfur coated urea is used extensively because of its excellent nitrogen controlled-release method, which is an important nutrient for crop development. It aids in the reduction of nitrogen leaking, the improvement of fertilizer usage efficiency, and the attainment of sustainable agricultural practices.

- In 2022, the fruits & vegetables segment accounted for the largest revenue share of more than 42.3% over the forecast period.

On the basis of crop, the Europe Controlled Release Fertilizers Market is segmented into cereals & grains, oilseeds & pulses, fruits & vegetables, and others. Among these, the fruits & vegetables segment dominates the market with the highest revenue share of 42.3% over the forecast period. The climate in Europe tends to be diverse, thus making it suited for a wide range of fruit and vegetable crops. Because many of these crops have an excellent return on investment, farmers frequently invest in controlled-release fertilizers for greater yield and produce quality. Fruits and vegetables have a wide range of dietary requirements, and constant nutrition is essential to ensure high-quality produce. Controlled-release fertilizers can provide a consistent nutrient release that corresponds to the plant's absorption. Controlled-release fertilizers are particularly useful for perennial fruit crops that benefit from long-term nutrient strategies, in addition to high-value vegetable crops where quality is critical.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe Controlled Release Fertilizers Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Yara International

- ICL Specialty Fertilizers

- BASF SE

- Agrium Inc.

- Van Iperen International

- Sociedad Quimica Y Minera S.A.

- DeltaChem

- SQM

- OCI Nitrogen

- Compo Expert GmbH

- Nutrien Ltd.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- On June 2023, BASF and Yara Clean Ammonia collaborated to assess the viability of establishing a large-scale low-carbon blue ammonia manufacturing facility in the US Gulf Coast region, aided by carbon capture technology. With an annual capacity of 1.2 to 1.4 million tons, the factory seeks to address the expanding global demand for environmentally friendly ammonia. This collaboration relies on a strong history of collaboration and intends to considerably reduce its activities' carbon impact. Ammonia is an important basic ingredient in the production of fertilizers, particularly controlled-release fertilizers. Yara's production of clean ammonia with a lower carbon footprint may improve the green credentials of controlled-release fertilizers.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the Europe Controlled Release Fertilizers Market based on the below-mentioned segments:

Europe Controlled Release Fertilizers Market, By Product

- Polymer Sulfur Coated Urea/Sulfur Coated Urea

- Polymer Coated Urea

- Polymer Coated NPK

- Others

Europe Controlled Release Fertilizers Market, By Crop

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

Europe Controlled Release Fertilizers Market, By Country

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

Need help to buy this report?