Europe Commercial Greenhouse Market Size, Share, and COVID-19 Impact Analysis, By Type (Glass Greenhouse, Plastic Greenhouse), By Crop (Fruits, Vegetables, Flowers & Ornamentals, Nursery Crops, Others), By Equipment (Hardware, Software & Services), By Country (United Kingdom, Germany, Italy, France, Spain, Netherlands, Rest of Europe), and Europe Commercial Greenhouse Market Insights, Industry Trend, Forecasts 2022 - 2032

Industry: AgricultureEurope Commercial Greenhouse Market Insights Forecasts to 2032

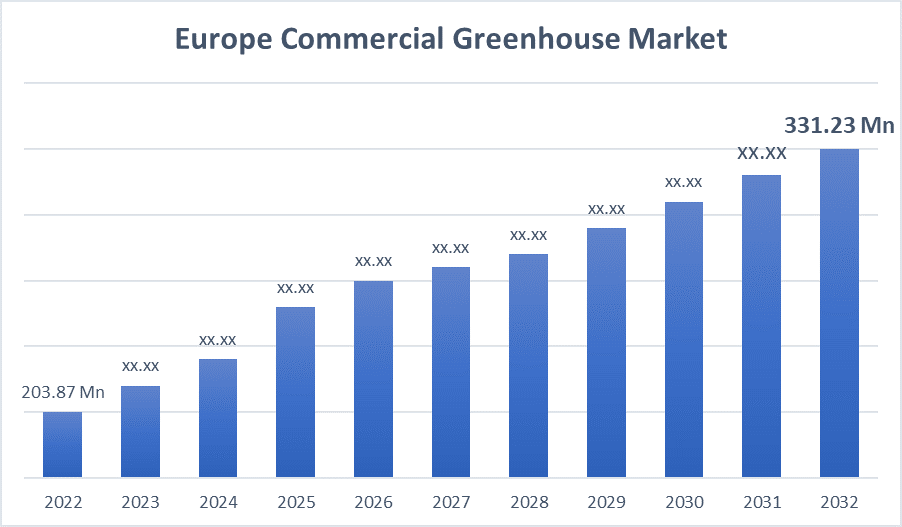

- The Europe Commercial Greenhouse Market Size was valued at USD 203.87 Million in 2022.

- The Market Size is Growing at a CAGR of 4.97% from 2022 to 2032.

- The Europe Commercial Greenhouse Market Size is expected to reach USD 331.23 Million by 2032.

Get more details on this report -

The Europe Commercial Greenhouse Market Size is expected to reach USD 331.23 Million by 2032, at a CAGR of 4.97% during the forecast period 2022 to 2032.

Market Overview

Commercial greenhouse is the practice of growing crops such as vegetables in a controlled atmosphere, typically using greenhouses. Greenhouses are glass or plastic structures that allow sunlight to enter and warm the interior while also protecting it from wind and pests. Plants are grown in soil or in containers filled with a growing medium such as stone wool, peat moss, or coconut coir in a commercial greenhouse operation. To create optimal growing conditions, the plants are watered and fertilized as needed, and the temperature, humidity, and light levels inside the greenhouse are carefully controlled. Rapid urbanization and the lack of agricultural land are propelling the expansion of the EU commercial greenhouse market. The European commercial greenhouse is one of the most energy-intensive agricultural sectors, and it significantly contributes to increased energy and environmental vulnerability in regions with large greenhouse farming systems. In particular, the European greenhouse farming sector is facing a trend that responds to changing consumer demands in a globally prosperous society. Europe was the first to implement advanced greenhouse techniques, particularly in countries such as Spain, Italy, and the Netherlands, where large areas of greenhouse cultivation are practiced. Europe is the largest player due to urbanization, rapid technological advancements, and high demand for fruits and vegetables. Government initiatives to promote greenhouse farming are driving the expansion of these commercial greenhouses.

Report Coverage

This research report categorizes the market for Europe commercial greenhouse market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe commercial greenhouse market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Europe Commercial Greenhouse Market.

Europe Commercial Greenhouse Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 203.87 Million |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 4.97% |

| 2032 Value Projection: | USD 331.23 Million |

| Historical Data for: | 2020-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Crop, By Equipment, By Country |

| Companies covered:: | Richel Group, Certhon, Richel Group, Dutch Greenhouse, Siap Spain Sl, Agra Tech, Inc., NETAFIM, ININSA, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

As the population grows, available arable land becomes scarce, making efficient land utilization a critical concern. Commercial greenhouses address this issue by maximizing space utilization through vertical farming, hydroponic, and aeroponic systems, which enable multiple layers of cultivation in a small space. When compared to traditional open-field methods, this spatial efficiency allows growers to achieve significantly higher crop yields. Furthermore, water scarcity is a pressing concern in many regions, necessitating the use of water-efficient farming techniques. Commercial greenhouses excel in this area by allowing precise control over irrigation and preventing water waste by delivering water directly to plant roots. In additional, advanced irrigation systems within greenhouses, such as drip and recirculation systems, optimize water use and reduce evaporation losses. As a result, these factors are expected to drive the market growth in Europe.

Restraining Factors

Commercial greenhouses are extremely expensive due to the use of numerous high-priced systems, such as HVAC systems, control systems, LED grow lights, and sensors. Each LED grow light unit contains an array of LEDs designed specifically for greenhouse applications, which raises the overall cost. These units contain various types of LED lights with varying wattages and wavelengths to provide the light spectrum required for the optimal growth of specific plant species.

Market Segment

- In 2022, the plastic greenhouse segment accounted for the largest revenue share over the forecast period.

Based on the type, the Europe commercial greenhouse market is segmented into glass greenhouse and plastic greenhouse. Among these, the plastic greenhouse segment has the largest revenue share over the forecast period. Plastic greenhouses have excellent insulating properties. They can retain heat more effectively than glass buildings, resulting in energy savings while maintaining temperature control. This thermal efficiency helps to maintain favorable growing conditions while lowering heating and cooling costs. As a result, such factors contribute to market growth, and the plastic greenhouse category is the type segment's fastest-growing segment.

- In 2022, the vegetables segment accounted for the largest revenue share over the forecast period.

On the basis of crop, the Europe commercial greenhouse market is segmented into fruits, vegetables, flowers & ornamentals and nursery crops. Among these, the vegetables segment has the largest revenue share over the forecast period. Consumers are increasingly looking for nutritious and visually appealing vegetables, which greenhouse farming techniques can produce more consistently. Because vegetables are used in the majority of dishes and are considered a staple food around the world, there is a never-ending demand for vegetables, which is expected to drive the commercial greenhouse market in the coming years.

- In 2022, the hardware segment is expected to hold the largest share of the Europe commercial greenhouse market during the forecast period.

Based on the equipment, the Europe commercial greenhouse market is classified into hardware, software & services. Among these, the hardware segment is expected to hold the largest share of the Europe commercial greenhouse market during the forecast period. due to its key function in the establishment and maintenance of greenhouse structures. Typically, hardware components are designed to withstand environmental challenges such as wind, snow, rain, and freezing temperatures. High-quality hardware components also protect the durability and dependability of the greenhouse structure, reducing the need for frequent repairs or replacements and assisting greenhouse operators in saving money overall. Furthermore, the expansion of commercial greenhouse farming into regions with varying climates and agricultural practices necessitates the use of adaptable and dependable hardware solutions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe commercial greenhouse market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Richel Group

- Certhon

- Richel Group

- Dutch Greenhouse

- Siap Spain Sl

- Agra Tech, Inc.

- NETAFIM

- ININSA

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- On August 2023, Certhon (Netherlands) acquired DENSO (Japan), which aided Certhon's worldwide growth of its farming business by leveraging Certhon's developed horticultural technologies to develop innovative farm models, address food challenges, and improve the agricultural value chain.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the Europe commercial greenhouse market based on the below-mentioned segments:

Europe Commercial Greenhouse Market, By Type

- Glass Greenhouse

- Plastic Greenhouse

Europe Commercial Greenhouse Market, By Crop

- Fruits

- Vegetables

- Flowers & Ornamentals

- Nursery Crops

- Others

Europe Commercial Greenhouse Market, By Equipment

- Hardware

- Software & Service

Europe Commercial Greenhouse Market, By Country

- United Kingdom

- Germany

- Italy

- France

- Spain

- Netherlands

- Rest of Europe

Need help to buy this report?