Europe Coffee Pods & Capsules Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Pods and Capsules), By Distribution Channel (On-Trade and Off-Trade), and Europe Coffee Pods & Capsules Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesEurope Coffee Pods & Capsules Market Insights Forecasts to 2035

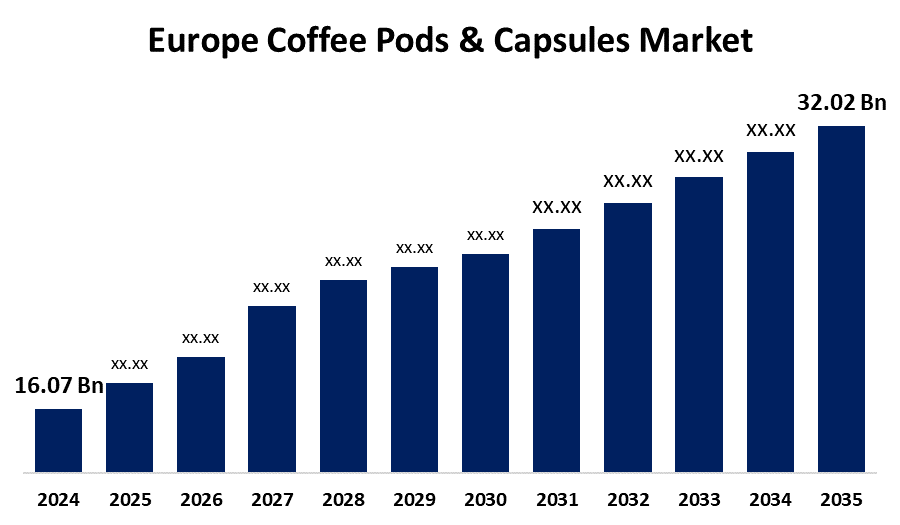

- The Europe Coffee Pods & Capsules Market Size was Estimated at USD 16.07 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.47% from 2025 to 2035

- The Europe Coffee Pods & Capsules Market Size is Expected to Reach USD 32.02 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Europe Coffee Pods & Capsules Market Size is anticipated to reach USD 32.02 Billion by 2035, growing at a CAGR of 6.47% from 2025 to 2035. Convenience, high-end demand for coffee, and technology drive growth. Increased sustainability efforts with recyclable capsules appeal to environmentally conscious consumers. Extension of retail and digital channels enhances availability, leading to increased sales and increased usage of coffee pods and capsules in Europe.

Market Overview

The Europe coffee pods & capsules market is the segment of the industry that concentrates on the manufacturing, distribution, and sale of individual coffee pods and capsules utilized in compatible coffee machines. It responds to customer demands for convenient, fast, and high-quality coffee brewing options within European homes and commercial outlets. The main purpose of this market is to offer consumers convenient coffee solutions that are simple to use, consistently deliver flavor, freshness, and variety, and respond to the changing tastes and attitudes of European coffee drinkers. Growing demand for convenience and ready-to-brew coffee solutions takes top priority. Improved brewing technology and the development of environmentally friendly capsule materials respond to consumer demands for sustainability. Businesses continue to create recyclable and compostable capsules to minimize environmental footprints. They also launched smart coffee machines with personalized brewing options, improved flavor profiles, and subscription-based service for consumer convenience. These developments not only address consumer needs but also build brand loyalty and market competitiveness. Overall, the Europe coffee pods & capsules market is fueled by convenience, quality, sustainability, and technology advancement, which drive the future of coffee consumption in the region.

Report Coverage

This research report categorizes the market for the Europe coffee pods & capsules market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe coffee pods & capsules market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe coffee pods & capsules market.

Europe Coffee Pods & Capsules Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 16.07 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 6.47% |

| 2035 Value Projection: | USD 32.02 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 237 |

| Tables, Charts & Figures: | 98 |

| Segments covered: | By Product Type and By Distribution Channel |

| Companies covered:: | Nestle, Starbucks Corporation, JAB Holding Company, Luigi Lavazza S.p.A., Keurig Dr Pepper Inc., Tchibo, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Customers are increasingly opting for convenient, easy-to-use coffee solutions that take less time and effort. Coffee capsules and pods provide an easy brewing experience with minimal cleanup, perfectly suiting busy lifestyles and fueling their success in European homes. European customers are developing an increasing demand for specialty and premium coffee experiences. Capsules tend to deliver high-quality, consistent coffee and espresso flavors, addressing the need for café-quality coffee in the home and fueling market expansion. Additionally, innovations like enhanced brewing technology, reusable capsules, and customizable feature-carrying machines make the user experience better. Such advancements appeal to more consumers by providing improved taste, eco-friendliness, and ease.

Restraining Factors

Compared to traditional ground coffee or instant coffee, capsules are generally more costly per cup. This increased cost is likely to deter price-sensitive consumers, particularly in areas where economic conditions influence buying habits, and thereby restrict broader penetration. Additionally, not all coffee makers accept each brand's capsule, which is inconvenient and limits consumer choice. This absence of standardization may deter customers from buying machines that cannot use their preferred brands of capsules.

Market Segmentation

The Europe Coffee Pods & Capsules Market Share is classified into product type and distribution channel.

- The capsules segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Europe coffee pods & capsules market is segmented by product type into pods and capsules. Among these, the capsules segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is due to capsules provide an affluent, stronger coffee experience, particularly espresso, that most European consumers prefer. Their airtight sealing preserves freshness and aroma better than pods, providing a premium taste that appeals to coffee aficionados, contributing to their market leadership.

- The off-trade segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The Europe coffee pods & capsules market is segmented by application into on-trade and off-trade. Among these, the off-trade segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth is attributed to off-trade channels such as online stores and supermarkets providing convenient access to coffee capsules and pods, which allow consumers to buy at their convenience. Consumers can shop in bulk, stock up, and try various brands and varieties without a time limit, driving high-volume purchases and loyalty in the off-trade channel.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved in the Europe coffee pods & capsules market. It also includes a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nestle

- Starbucks Corporation

- JAB Holding Company

- Luigi Lavazza S.p.A.

- Keurig Dr Pepper Inc.

- Tchibo

- Others

Recent Developments:

- In July 2024, Greiner Packaging and Constantia Flexibles launched a home compostable coffee capsule solution in the European market in July 2024. The solution includes a Constantia Flexibles paper-based EcoPressoLid and Greiner's compostable polymer capsule body. Both the capsule and lid have been certified by TÜV Austria's "OK Compost Home," demonstrating their dedication to sustainability in coffee packaging.

- In April 2024, Nespresso introduced its first compostable paper coffee capsules at Milan Design Week. The capsules, created from a mix of paper pulp, are completely biodegradable and interoperable with Nespresso's Original line of machines. The roll-out is accompanied by five new coffee blends, each designed with distinct flavor profiles, a major step towards sustainability.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe coffee pods & capsules market based on the below-mentioned segments:

Europe Coffee Pods & Capsules Market, By Product Type

- Pods

- Capsules

Europe Coffee Pods & Capsules Market, By Distribution Channel

- On-Trade

- Off-Trade

Need help to buy this report?