Europe Clean Label Ingredient Market Size, Share, and COVID-19 Impact Analysis, By Ingredient Type (Food Preservatives, Food Sweeteners, Food Colorants, and Others), By Application (Bakery and Confectionery, Dairy and Confectionery, Beverages, Meat and Meat Products, and Others), and Europe Clean Label Ingredient Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesEurope Clean Label Ingredient Market Insights Forecasts to 2035

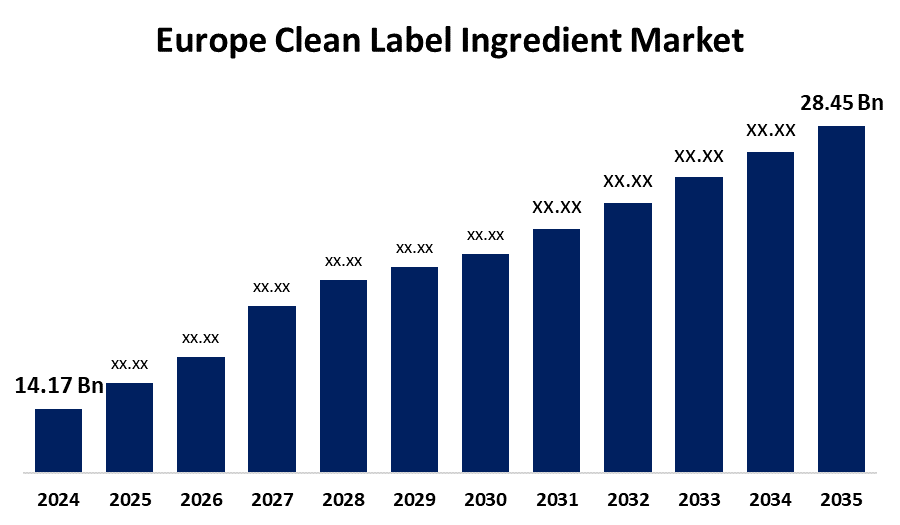

- The Europe Clean Label Ingredient Market Size was Estimated at USD 14.17 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.54% from 2025 to 2035

- The Europe Clean Label Ingredient Market Size is Expected to Reach USD 28.45 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the Europe Clean Label Ingredient Market Size is Anticipated to Reach USD 28.45 Billion by 2035, Growing at a CAGR of 6.54% from 2025 to 2035. The Europe clean label ingredient market is driven by rising consumer demand for natural, transparent products, strict EU food regulations, the popularity of plant-based and functional foods, and brands seeking differentiation through clean label claims to attract health-conscious consumers.

Market Overview

The Europe clean label ingredient market refers to the growing industry dedicated to providing natural, minimally processed, and easily recognizable food ingredients that meet consumer expectations for health, transparency, and sustainability. These ingredients typically exclude artificial additives, synthetic preservatives, artificial colorants, and flavor enhancers, aligning with a broader consumer shift toward "free-from" and "natural" food choices. Clean label products are increasingly in demand across Europe due to heightened health awareness and regulatory scrutiny. The core aim of the clean label ingredient movement is to simplify ingredient lists and increase transparency in food production. Clean label ingredients help food manufacturers build consumer trust, meet labeling requirements, and differentiate their products in a highly competitive market. Companies are developing plant-based preservatives, fermented fibers, and upcycled ingredients like citrus fiber and pea protein. Technology is also enabling natural extraction methods, enzyme-based processing, and AI-driven formulation to achieve the desired taste, texture, and shelf life without synthetic chemicals. These advancements support sustainable development goals and appeal to environmentally conscious consumers.

Report Coverage

This research report categorizes the market for Europe clean label ingredient market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe clean label ingredient market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe clean label ingredient market.

Europe Clean Label Ingredient Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 14.17 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 6.54% |

| 2035 Value Projection: | USD 28.45 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Ingredient Type, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | Ingredion Incorporated, Cargill, Incorporated, Kerry Group plc, Archer Daniels Midland Company, Tate & Lyle PLC, Corbion N.V., DSM-Firmenich AG and Other. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

European consumers are increasingly prioritizing health and wellness. They prefer foods made with recognizable, natural ingredients and reject artificial additives. This strong preference for ingredient transparency is pushing manufacturers across Europe to adopt clean label ingredients that align with "free-from" and natural product trends. Food companies in Europe are using clean label claims like “no artificial preservatives,” “non-GMO,” or “naturally sourced” as a way to differentiate their products and justify premium pricing. This marketing strategy resonates well with ethically and health-conscious consumers, contributing to the increasing adoption of clean label ingredients.

Restraining Factors

Clean label ingredients such as natural colorants, preservatives, and sweeteners—are typically more expensive to source and process than synthetic alternatives. This increases production costs for manufacturers. Small and mid-sized food producers may find it challenging to reformulate existing products due to these higher costs, which slows widespread market adoption.

Market Segmentation

The Europe clean label ingredient market share is classified into ingredient type and application.

- The food sweeteners segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Europe clean label ingredient market is segmented by ingredient type into food preservatives, food sweeteners, food colorants, and others. Among these, the food sweeteners segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is due to European consumers increasingly avoiding refined sugar due to health concerns like obesity and diabetes. This trend has led to the growing use of clean label sweeteners such as stevia, honey, and monk fruit. These alternatives offer natural sweetness while meeting clean label standards, driving their widespread adoption across various food and beverage categories.

- The bakery and confectionery segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The Europe clean label ingredient market is segmented by application into bakery and confectionery, dairy and confectionery, beverages, meat and meat products, and others. Among these, the bakery and confectionery segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth is attributed to European consumers increasingly preferring baked products with simple, natural ingredients. Bread, cakes, and snacks are everyday staples, and the demand for healthier options free from synthetic additives fuels clean label adoption. This trend positions the bakery and confectionery segment as a leading consumer of clean label solutions in Europe.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved in the Europe clean label ingredient market. It also includes a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ingredion Incorporated

- Cargill, Incorporated

- Kerry Group plc

- Archer Daniels Midland Company

- Tate & Lyle PLC

- Corbion N.V.

- DSM-Firmenich AG

- Others

Recent Developments:

- In July 2024, Ingredion has recently expanded its clean label ingredient offerings with the launch of FIBERTEX™ CF 500 and FIBERTEX™ CF 100, multi-benefit citrus fibers. These minimally processed, upcycled fibers are derived from citrus peels and are designed to provide enhanced texturizing properties, gelling, and improved emulsion and texture stability over shelf life. They serve as cost-effective, consumer-preferred alternatives to traditional additives like modified starch and hydrocolloids. These fibers support popular on-pack claims such as "derived from natural sources," "non-GMO," and "source of dietary fiber," aligning with growing consumer demand for clean label products.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe clean label ingredient market based on the below-mentioned segments:

Europe Clean Label Ingredient Market, By Ingredient Type

- Food Preservatives

- Food Sweeteners

- Food Colorants

- Others

Europe Clean Label Ingredient Market, By Application

- Bakery and Confectionery

- Dairy and Confectionery

- Beverages

- Meat and Meat Products

- Others

Need help to buy this report?