Europe Canned Beverages Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Alcoholic Beverages, Dairy-Based Beverages, Sports & Energy Drinks, RTD Coffee & Tea, Fruits & Vegetable Juices, Others), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Convenience Stores, Online Retail, Others), and Europe Canned Beverages Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesEurope Canned Beverages Market Size Insights Forecasts to 2035

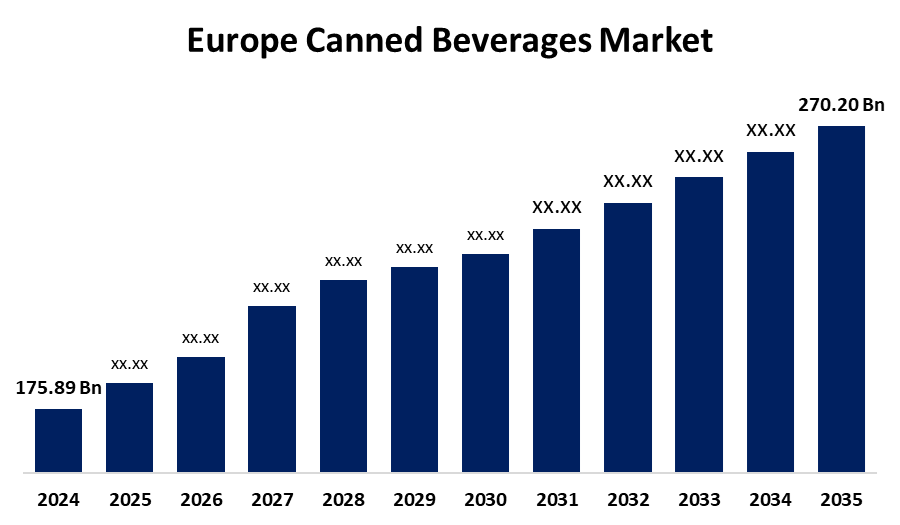

- The Europe Canned Beverages Market Size was Estimated at USD 175.89 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.98% from 2025 to 2035

- The Europe Canned Beverages Market Size is Expected to Reach USD 270.20 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the Europe Canned Beverages Market Size is anticipated to reach USD 270.20 Billion by 2035, growing at a CAGR of 3.98% from 2025 to 2035. The Europe Canned Drinks Market is driven by increased demand for convenient, ready-to-consume products, increasing trends toward canned alcoholic beverages, ongoing product innovation, broader distribution channels, and rising consumers' interest in health, sustainability, and environmentally friendly packaging solutions.

Market Overview

The Europe Canned Beverages Market Size is a term used to describe the business of manufacturing, distributing, and selling drinks that are packaged in cans across European nations. The market involves a range of drinks like alcoholic drinks, soft drinks, energy drinks, milk-based drinks, and juices, satisfying the need for convenient, portable, and ready-to-drink products. The market's objective is to be convenient, portable, and ready-to-drink for its consumers through the provision of products that may be appropriate for busy lifestyles as well as for wider tastes. Among the established benefits of canned beverages are longer shelf life, easier transportation, and recyclability, making it a practical and environmentally friendly option. Moreover, innovation is a key driver in this market, with companies introducing new flavors, healthier low-sugar and organic alternatives, plant-based options, and sustainable packaging solutions. These developments address changing consumer needs and sustainability issues, allowing brands to differentiate themselves in a crowded market. Health awareness and the need for eco-friendly packaging boost the market's growth further, making Europe canned beverages a dynamic and rapidly growing segment within the beverages market.

Report Coverage

This research report categorizes the market for Europe canned beverages market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe canned beverages market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe canned beverages market.

Europe Canned Beverages Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 175.89 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.98% |

| 2035 Value Projection: | USD 270.20 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 198 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | By Product Type, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | Anheuser-Busch InBev, Diageo Plc., Heineken NV, Pernod Ricard S.A., Carlsberg Breweries A/S, Coca-Cola HBC AG, PepsiCo Inc., Anadolu Efes Biracilik ve Malt Sanayii A.S., Red Bull GmbH, Nestle S.A., Others, and key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Consumers have been increasingly opting for ready-to-drink canned drinks for their convenience and portability. Busy life and on-the-go consumption patterns enhance the appeal of canned beverages in all categories, both alcoholic and non-alcoholic. High demand for RTD canned alcoholic beverages like hard seltzers, canned cocktails, and beers is a chief market driver. These readily available and stylish products find a broad base of consumers, particularly among young people. In addition, ongoing product innovation, such as new flavors, healthier products, and plant-based alternatives, appeals to various consumer segments. These innovations continue to make the market lively and promote repeat buying.

Restraining Factors

Increasing consumer awareness about the health risks associated with high sugar and artificial additives in many canned beverages limits demand. This drives consumers toward healthier alternatives, reducing the growth potential of sugary canned drinks like sodas and some flavored beverages. Moreover, the alcoholic beverages segment faces stringent regulations related to advertising, sales, and labeling across Europe. These policies can restrict market expansion, particularly for RTD alcoholic drinks, and limit promotional activities that drive consumer interest.

Market Segmentation

The Europe canned beverages market share is classified into product type and distribution channel.

- The alcoholic beverages segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Europe canned beverages market is segmented by product type into alcoholic beverages, dairy-based beverages, sports & energy drinks, RTD coffee & tea, fruits & vegetable juices, and others. Among these, the alcoholic beverages segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is due to customers increasingly prefer convenient, portable RTD alcoholic beverages such as canned cocktails and hard seltzers. They have proved to be particularly popular among customers for social events, outdoor activities, and on-the-go lifestyles, hence driving growth in this segment.

- The supermarkets/hypermarkets segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The Europe canned beverages market is segmented by distribution channel into supermarkets/hypermarkets, specialty stores, convenience stores, online retail, and others. Among these, the supermarkets/hypermarkets segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth is attributed to supermarkets and hypermarkets stocking a broad range of canned beverages, catering to diverse consumer preferences. This extensive variety ensures customers can find both popular and niche products in one location, making it a convenient one-stop shopping experience that drives higher sales in this segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved in the Europe canned beverages market. It also includes a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Anheuser-Busch InBev

- Diageo Plc.

- Heineken NV

- Pernod Ricard S.A.

- Carlsberg Breweries A/S

- Coca-Cola HBC AG

- PepsiCo Inc.

- Anadolu Efes Biracilik ve Malt Sanayii A.S.

- Red Bull GmbH

- Nestle S.A.

- Others

Recent Developments:

- In February 2024, Red Bull expanded its product line with the launch of the Curuba Elderflower energy drink, blending the flavors of curuba (banana passionfruit) and elderflower. The Iced Vanilla Berry variant was also introduced, featuring a mix of blueberry, vanilla, cotton candy, and eucalyptus flavors.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe canned beverages market based on the below-mentioned segments:

Europe Canned Beverages Market, By Product Type

- Alcoholic Beverages

- Dairy-Based Beverages

- Sports & Energy Drinks

- RTD Coffee & Tea

- Fruits & Vegetable Juices

- Others

Europe Canned Beverages Market, By Distribution Channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Retail

- Others

Need help to buy this report?