Europe Bottled Water Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Carbonated Bottled Water, Still Bottled Water, and Flavored/Functional Bottled Water), By Distribution Channel (On-Trade and Off-Trade), and Europe Bottled Water Market Insights, Industry Trend, Forecasts to 2035.

Industry: Food & BeveragesEurope Bottled Water Market Insights Forecasts to 2035

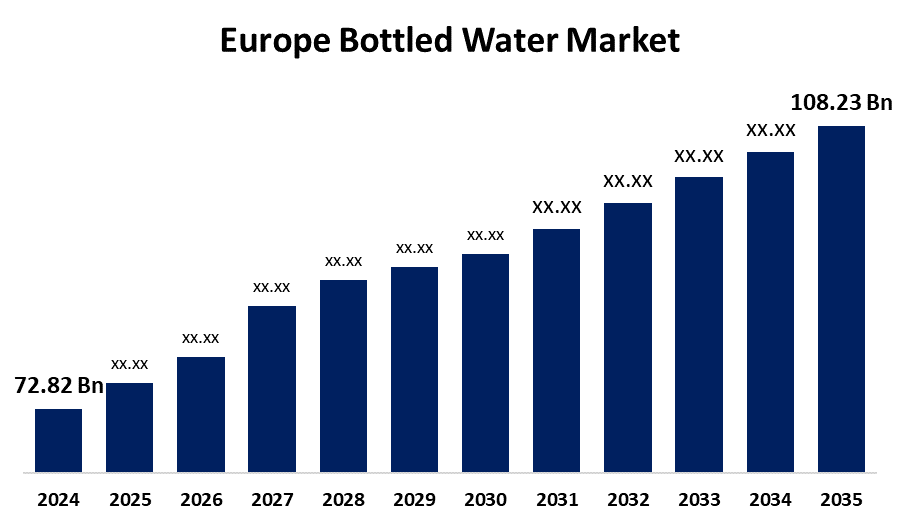

- The Europe Bottled Water Market Size was estimated at USD 72.82 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.67% from 2025 To 2035

- The Europe Bottled Water Market Size is Expected to Reach USD 108.23 Billion By 2033

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Europe Bottled Water Market Size is Anticipated to reach USD 108.23 Billion By 2035, growing at a CAGR of 3.67% from 2025 To 2035. The European bottled water industry is fueled by improving health consciousness, augmented demand for functional and flavored waters expanded on-the-go drinking, premium product innovations, and increased retail and online convenience, all augmenting convenience and responding to varied consumer needs.

Market Overview

The Europe bottled water market is the commercial industry engaged in packaged drinking water manufacturing, distribution, and sale in European nations. It caters to increasing consumer desire for convenient, safe, and healthy water intake in the face of increasing health awareness and lifestyle modifications. The main objective of this market is to offer affordable, pure water beverages that enhance wellness, refreshment, and hydration requirements in rural and urban locations. Secondly, the market intends to service different tastes by providing improved waters that contain vitamins, minerals, and natural flavors hence expanding customer appeal. Bottled water also provides a convenient option for active lifestyles, athletes, and health-focused consumers looking for calorie and sugar-free drink alternatives. The industry is essential in maintaining public health as well as generating a contribution to the economy through employment, innovation, and export. Additionally, certain companies are tackling sustainability through recycling-friendly plastics and encouraging refill programs, responding to market and regulatory pressures for more environmentally friendly alternatives. As a whole, the Europe bottled water market is constantly changing with demand from consumers for health, convenience, and sustainability.

Report Coverage

This research report categorizes the market for the Europe bottled water market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe bottled water market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe bottled water market.

Europe Bottled Water Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 72.82 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.67% |

| 2035 Value Projection: | USD 108.23 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 189 |

| Tables, Charts & Figures: | 92 |

| Segments covered: | By Product Type, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | Danane SA, Ferrarelle SpA, The Coca-Cola Company, Gerolsteiner Brunnen GmbH & Co. Kg, PepsiCo Inc., Agua Mineral San Benedetto SAU, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

European consumers are more health-conscious, fit-conscious, and hydration-conscious today. Bottled water particularly still and mineral water is considered a healthy, calorie-free, and pure alternative to carbonated soft drinks. This lifestyle change and dietary behavior change is ensuring a steady demand for bottled water among consumers of all ages. Further, there is an increased demand for enhanced waters that contain added vitamins, minerals, or natural flavors. Functional drinks that promote immunity, digestion, or energy are on the rise, particularly among young, health-conscious consumers. These new-fangled products push the envelope on bottled water beyond plain hydration.

Restraining Factors

Many European countries have high-quality, safe-to-drink tap water available in homes and public spaces. Government campaigns promoting tap water as a sustainable and cost-effective alternative to bottled water have gained traction. This cultural shift reduces the perceived need for purchasing bottled water, especially among environmentally conscious consumers.

Market Segmentation

The Europe bottled water market share is classified into product type and distribution channel.

- The still bottled water segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Europe bottled water market is segmented by product type into carbonated bottled water, still bottled water, and flavored/functional bottled water. Among these, the still bottled water segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is due to still bottled water is gaining popularity for its clean, neutral flavor and convenience. It is suitable for all ages and dietary requirements and hence becomes the popular beverage of choice. It does not lead to bloating or flavor fatigue, unlike carbonated or flavored water, which makes it a daily favorite at home, workplaces, schools, and public venues.

- The off-trade segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The Europe bottled water market is segmented by distribution channel into on-trade and off-trade. Among these, the off-trade segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth is attributed to off-trade platforms such as supermarkets, hypermarkets, and convenience stores are readily available in urban and rural locations. This wide availability allows consumers to access bottled water with ease at regular shopping, contributing to high volumes of sales. Such channels cater to everyday consumer needs such as family and work requirements, thus being a powerful driver of sales.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved in the Europe bottled water market. It also includes a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Danane SA

- Ferrarelle SpA

- The Coca Cola Company

- Gerolsteiner Brunnen GmbH & Co. Kg

- PepsiCo Inc.

- Agua Mineral San Benedetto SAU

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In February 2024, Haus Cramer Group ventured into Germanys packaged food and beverages market with its first ever water brand in its H. C. Drinks Solutions arm. This represents a strategic expansion away from beer and soft drinks into non beverage segments, such as leveraging its Warsteiner bottling and logistics infrastructure. The entry complements its diversification strategy and caters to increasing consumer demand for new beverage formats.

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe bottled water market based on the below-mentioned segments

Europe Bottled Water Market, By Product Type

- Carbonated Bottled Water

- Still Bottled Water

- Flavored/Functional Bottled Water

Europe Bottled Water Market, By Distribution Channel

- On-Trade

- Off-Trade

Need help to buy this report?