Europe Biobanking Market Size, Share, and COVID-19 Impact Analysis, By Type (Equipment, Consumables), By Sample (Human Tissues, Stem Cells, DNA or RNA, Bio-fluids, Others), By Application (Therapeutic Applications, Research Applications, Clinical Trials, Regenerative Medicine), By Country (United Kingdom, Germany, Italy, France, Spain, Netherlands, Rest of Europe), and Europe Biobanking Market Insights, Industry Trend, Forecasts 2022 - 2032

Industry: HealthcareEurope Biobanking Market Insights Forecasts to 2032

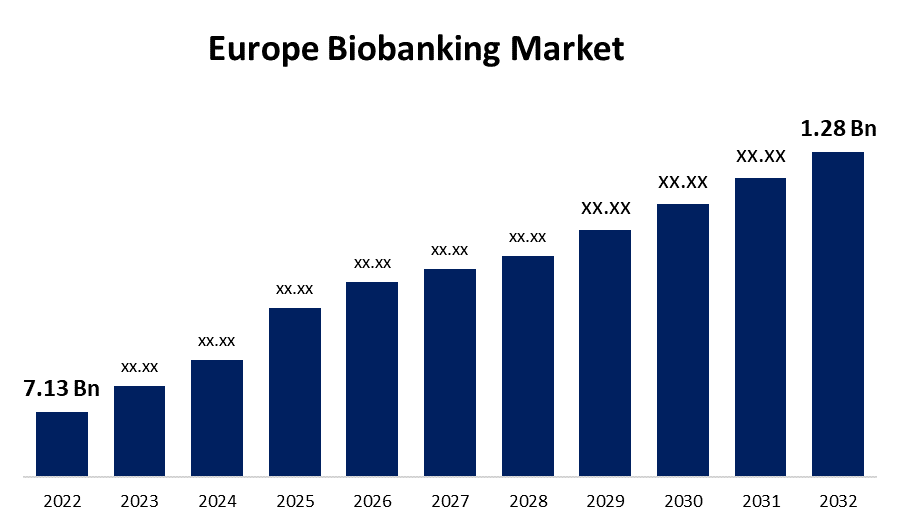

- The Europe Biobanking Market Size was valued at USD 7.13 Billion in 2022.

- The Market Size is Growing at a CAGR of 6.10% from 2022 to 2032.

- The Europe Biobanking Market Size is Expected To reach 1.28 Billion by 2032.

Get more details on this report -

The Europe Biobanking Market Size is expected to reach USD 1.28 Billion by 2032, at a CAGR of 6.10% during the forecast period 2022 to 2032.

Market Overview

Biobanks collect biological samples and associated data for medical-scientific research and diagnostic purposes, and then organize and store them in a systematic manner for future use. Sample and data collection for research purposes has a long history in the educational and medical systems. Growing investments and funding for biobanks, a focus on genetic testing and precision medicine, an increasing trend in the preservation of cord blood stem cells from newborns, and a favorable funding scenario for regenerative medicine research are driving the market growth in Europe. Furthermore, the European Union's member states are world leaders in the development of biobanking infrastructure to support research, making significant investments in such initiatives each year. The vision of the European Union is to link biobanks as part of a European infrastructure to support medical research and health care. This investment depends on and accelerate the long-term growth of Europe's life sciences medical field, which has the potential to lead to innovation in medical research, drug development, and health care delivery. However, the primary goal of biobank governance is expected to be European citizens to benefit from rapid advances in biobank research while also protecting them from potentially negative consequences of this line of research. The main benefit of establishing appropriate and comprehensive biobank governance mechanisms increase reliance in biobanking, which serves as essential for the development of biobanks in Europe.

Report Coverage

This research report categorizes the market for Europe biobanking market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe biobanking market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Europe biobanking market.

Europe Biobanking Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 7.13 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 6.10% |

| 2032 Value Projection: | USD 1.28 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Sample, By Application, By Country, and COVID-19 Impact Analysis. |

| Companies covered:: | Merck KGaA, Qiagen, BioLifeSolutions Inc, Sigma-Aldrich Inc, Thermo Fisher Scientific Inc., VWR International LLC., Chart Industries Inc., and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Rising European government support and funding for biobanking research, advancements in sample storage technology and techniques. The higher demand for high-quality biological specimens for research, a greater awareness of the benefits of biobanking, increased emphasis on precision medicine and targeted therapies, and increasing research activities in fields such as genomics and proteomics are expected to support the European. In addition, the rising popularity of precision/personalized medicine and genetic testing has been a major market driver. Biobanks have played an important role in biomedical research. Platforms and tools used in genetic studies have advanced significantly over the years, boosting market growth in Europe. The central goal of biobank governance must be to allow European citizens to benefit from the rapid progress in biobank research while also protecting them from the potentially negative consequences of this line of research. An effective governance system must also address and adapt to the new challenges that the construction of a biobank infrastructure presents.

Restraining Factors

The high cost of automated machinery is expected to steady market growth. Advanced sample handling systems, for example, can significantly improve the efficiency and quality of biobanking operations. The high cost of this equipment, on the other hand, can be a significant barrier to entry for smaller biobanking companies or those with limited financial resources.

Market Segment

- In 2022, the equipment segment accounted for the largest revenue share over the forecast period.

Based on the type, the Europe biobanking market is segmented into equipment and consumables. Among these, the equipment segment has the largest revenue share over the forecast period. Because the number of new biobanks is rapidly increasing, and initial equipment installation is expensive. A variety of equipment is available to assist with various biobanking procedures such as sample preparation, collection, processing includes storage and shipment all these factors are boost the demand for the market growth.

- In 2022, the human tissues segment accounted for the largest revenue share over the forecast period.

On the basis of sample, the Europe biobanking market is segmented into human tissues, stem cells, DNA or RNA, bio-fluids, others. Among these, the human tissues segment has the largest revenue share over the forecast period. The large number of biobanks with tissue storage facilities, the easy availability of tissue samples, and the availability of advanced technology for storing and retrieving banked tissues. Growing investment in disease-specific R&D is expected to increase demand for diseased tissue samples for oncology studies, such as lymphoma, myeloma, ovarian leukemia, brain, prostate, colorectal carcinoma, breast, and lung tissues all these factors are boost market growth in Europe.

- In 2022, the research applications segment is expected to hold the largest share of the Europe Biobanking market during the forecast period.

Based on the application, the Europe biobanking market is classified into therapeutic applications, research applications, clinical trials, regenerative medicine. Among these, the research applications segment is expected to hold the largest share of the Europe biobanking market during the forecast period. The improvements of regenerative medicine and an increase in the prevalence of chronic diseases these factors are boost market growth in forecast period. However, the therapeutic segment is expected to grow significantly during the forecast period due to a gradual increase in the prevalence of chronic diseases and trauma emergencies, an increase in the incidence of degenerative diseases, and a shortage of organs for transplantation.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe biobanking market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Merck KGaA

- Qiagen

- BioLifeSolutions Inc

- Sigma-Aldrich Inc

- Thermo Fisher Scientific Inc.

- VWR International LLC.

- Chart Industries Inc.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- On July 2023, Thermo Fisher Scientific Inc. introduced two new reproductive health assays for accelerating fertility research: The Ion AmpliSeq Polyploidy Kit and the Ion ReproSeq PGT-A kit.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the Europe biobanking market based on the below-mentioned segments:

Europe Biobanking Market, By Type

- Equipment

- Consumables

Europe Biobanking Market, By Sample

- Human Tissues

- Stem Cells

- DNA OR RNA

- Bio-Fluids

- Others

Europe Biobanking Market, By Application

- Therapeutic Applications

- Research Applications

- Clinical Trials

- Regenerative Medicine

Europe Biobanking Market, By Country

- United Kingdom

- Germany

- Italy

- France

- Spain

- Rest of Europe

Need help to buy this report?