Europe Baby Food Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Milk Formula, Dried Baby Food, Prepared Baby Food, and Others), By Distribution Channel (Supermarkets/Hypermarkets, Pharmacies and Drug Stores, Convenience Stores, Online Retail Stores and Others), and Europe Baby Food Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesEurope Baby Food Market Insights Forecasts to 2035

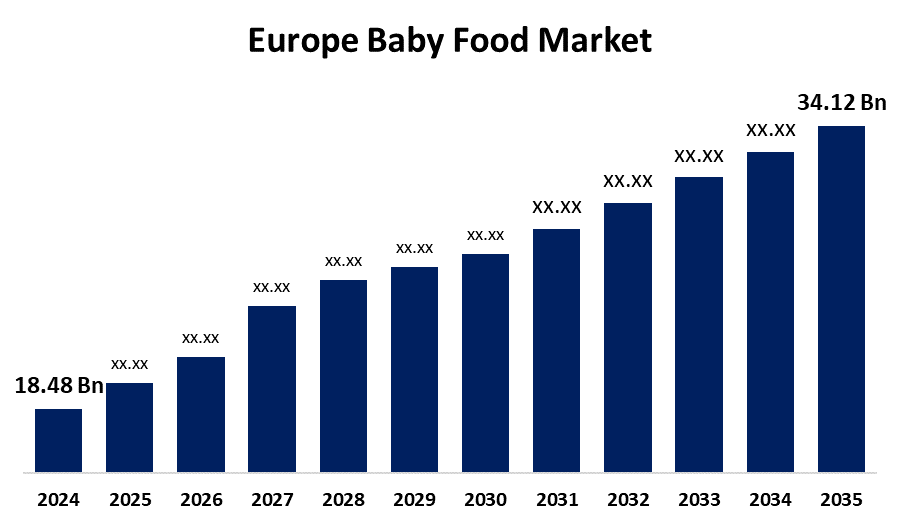

- The Europe Baby Food Market Size was Estimated at USD 18.48 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.73% from 2025 to 2035

- The Europe Baby Food Market Size is Expected to Reach USD 34.12 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Europe Baby Food Market Size is anticipated to reach USD 34.12 Billion by 2035, growing at a CAGR of 5.73 % from 2025 to 2035. The Europe baby food market is propelled by growing urbanization, rising numbers of working parents, increasing health consciousness, organic and natural product demand, continued innovation in products, and the growth of e-commerce, which improves convenience, variety, and access for consumers throughout the region.

Market Overview

The Europe baby foods market involves the manufacturing, distribution, and sale of specialized foods produced to provide the necessary nutrition for infants and toddlers. The market covers different categories of foods like milk formula, dried baby foods, prepared foods, and organic foods produced to suit healthy growth and development in early childhood. The main objective of the market is to offer nutritious, safe, and convenient feeding solutions that enable parents to provide their children with necessary nutrients when breastfeeding is not feasible or supplemented. The market provides parents with convenient access to scientifically developed products that adhere to stringent safety and quality standards, providing balanced nutrition. Shelf-stable and ready-to-eat baby foods offer convenience, particularly for working families, while special formulas serve infants with allergies or certain dietary requirements. Furthermore, organic and natural baby foods respond to the increasing trend towards chemical-free, natural foods and contribute to healthier eating habits at a young age. Further, companies are also launching intelligent packaging and tailored nutrition products to suit changing consumer trends. They assist in addressing various dietary needs and sustainability objectives, rendering the European baby food market vibrant and attentive to contemporary parenting demands.

Report Coverage

This research report categorizes the market for Europe baby food market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe baby food market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe baby food market.

Europe Baby Food Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 18.48 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 5.73% |

| 2035 Value Projection: | USD 34.12 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 256 |

| Tables, Charts & Figures: | 103 |

| Segments covered: | By Product Type and By Distribution |

| Companies covered:: | Nestle S.A., HiPP GmbH & Co. Vertrieb KG, Danone S.A., Ella’s Kitchen, Aptamil, Hero Group, Organix Brands Company, Bledina Company, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Rising urbanization and the growth of double-income families resulted in busier lifestyles with less time for the preparation of homemade baby food. This increases demand for convenient, easy-to-consume, and packaged baby food. Working parents desire reliable, healthy, and convenient baby foods, promoting market expansion across Europe. Further, ongoing innovation in formulation, packaging, and manufacturing technology enables companies to introduce superior, safer, and more varied baby food products. Breakthroughs like plant-based ingredients, allergen-free products, and more convenient packaging appeal to customers, driving market growth.

Restraining Factors

High-end baby food products, such as organic and specialty versions, tend to be more expensive than others. This higher price can keep price-conscious consumers away, curb accessibility, and curb overall market expansion. Though there is demand for high-quality nutrition, most parents would go for cheaper alternatives or homemade versions, limiting the growth of premium product segments. In addition, the European baby food industry is subject to strict regulations regarding safety, nutritional value, labeling, and advertising. Although these regulations guarantee product quality and safety for consumers, they raise the cost of production and make the new product approval process more difficult. This regulatory load can deter small producers from entering the market and hinder innovation, thereby affecting overall market growth.

Market Segmentation

The Europe Baby Food Market share is classified into product type and distribution channel.

- The milk formula segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Europe baby food market is segmented by product type into milk formula, dried baby food, prepared baby food, and others. Among these, the milk formula segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is due to milk formula acts as an important substitute or supplement to breast milk, offering full nutrition for babies who cannot be breastfed. It promotes healthy development and growth during the first few months, which makes it a must-have for most parents and fuels steady demand throughout Europe.

- The supermarkets/hypermarkets segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The Europe baby food market is segmented by distribution channel into supermarkets/hypermarkets, pharmacies and drug stores, convenience stores, online retail stores, and others. Among these, the supermarkets/hypermarkets segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth is attributed to supermarkets and hypermarkets providing a wide variety of baby food products in different brands and categories. This diversity caters to various consumer tastes, ranging from organic to standard and specialty formulas. These stores are favored by parents because they can compare and select the best for their baby's nutritional requirements in one location, making it more convenient and fulfilling.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved in the Europe baby food market. It also includes a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nestle S.A.

- HiPP GmbH & Co. Vertrieb KG

- Danone S.A.

- Ella’s Kitchen

- Aptamil

- Hero Group

- Organix Brands Company

- Bledina Company

- Others

Recent Developments:

- In November 2024, Kendamil introduced Bonya, a new premium baby formula brand that competes on price with high-end brands such as Aptamil and HiPP. At £8.45 for an 800g pack, Bonya is stocked in large UK retailers such as Tesco, Sainsbury's, and Boots and can also be obtained using NHS Healthy Start vouchers. The formula is palm oil-free, fish oil-free, and contains plant-derived DHA derived from algae and is thus compatible with vegetarian, halal, and kosher diets.

- In July 2022, Danone introduced a new dairy and plant-based blend baby formula for parents who want plant-based food options for their babies. This product joins the trend of greater consumption of plant-based diets and is a suitable alternative to conventional dairy-based formulas.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe baby food market based on the below-mentioned segments:

Europe Baby Food Market, By Product Type

- Milk Formula

- Dried Baby Food

- Prepared Baby Food

- Others

Europe Baby Food Market, By Distribution Channel

- Supermarkets/Hypermarkets

- Pharmacies and Drug Stores

- Convenience Stores

- Online Retail Stores

- Others

Need help to buy this report?