Europe Air Duct Market Size, Share, and COVID-19 Impact Analysis, By Type (Galvanized Steel, Aluminum (AI), Flexible Duct, Fabric Duct, and Others), By Application (Public Facilities, Commercial Facilities, Industrial Facilities, and Others), and Europe Air Duct Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsEurope Air Duct Market Insights Forecasts to 2035

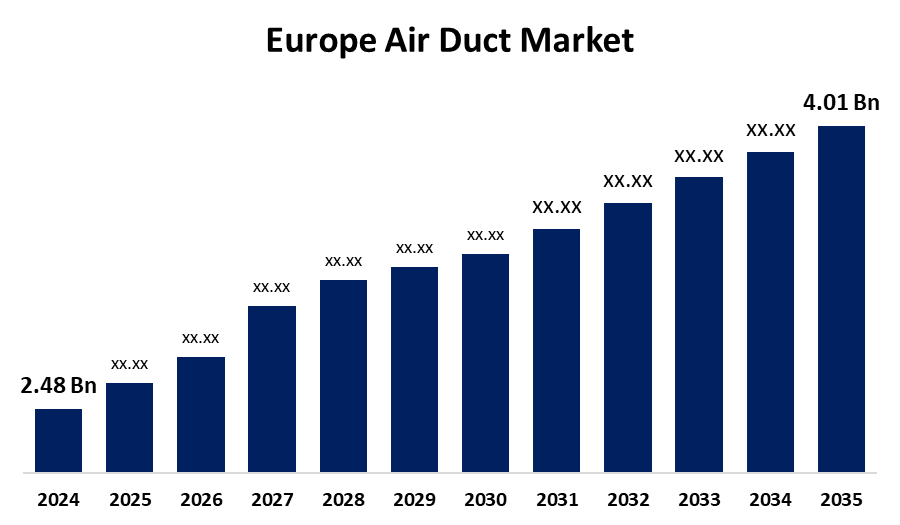

- The Europe Air Duct Market Size was Estimated at USD 2.48 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.47% from 2025 to 2035

- The Europe Air Duct Market Size is Expected to Reach USD 4.01 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Europe Air Duct Market Size is anticipated to reach USD 4.01 Billion by 2035, Growing at a CAGR of 4.47% from 2025 to 2035. The Europe air duct market size is spurred by energy efficiency codes, increased need for indoor air quality, integration with smart buildings, compliance with regulations, and advancements in duct material, all driving the expansion of the adoption of high-end HVAC and ventilation systems throughout the region.

Market Overview

The Europe Air Duct Market Size is the business engaged in the production, distribution, and installation of air duct systems for heating, ventilation, and air conditioning (HVAC) purposes in Europe. The air ducts make air movement and distribution efficient in residential, commercial, and industrial buildings, providing indoor air quality, thermal comfort, and energy efficiency. Its major purpose is to improve indoor air quality, provide thermal comfort, and enhance energy efficiency in buildings. The requirement for high-end air duct systems has also increased among the residential and commercial sectors. This is attributed to the increased requirement for well-ventilated living or sitting spaces, as well as the increasing consciousness of air quality and how it impacts human health. Innovations aim at light, flexible, and fire-resistant materials that enhance installation and safety. Further, environmentally friendly manufacturing processes and intelligent technologies are increasingly embraced to maximize efficiency, minimize environmental footprint, and offer improved control of airflow, ensuring the market develops according to sustainability and technological directions. Green product developments and sustainable production methods are also picking up speed, working to get the marketplace in sync with Europe's long-term energy efficiency and environmental protection objectives.

Report Coverage

This research report categorizes the market size for Europe air duct market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe air duct market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe air duct market.

Europe Air Duct Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.48 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.47% |

| 2035 Value Projection: | USD 4.01 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 117 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Lindab, Air Spiralo Groue, FabricAir, Kingspan Group, Domus, ISOVER, Aldes Groue, Airflow Developments Limited, ROKAFLEX, Nordfab, Aermec, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

European energy codes such as the EPBD require energy-efficient building systems. Air ducts enhance HVAC efficiency by minimizing air leakage and maximizing airflow, allowing buildings to achieve these requirements. This regulatory drive drives demand for sophisticated duct systems that aid overall energy-saving and sustainability objectives. In addition, intelligent HVAC systems with IoT-connected air ducts facilitate real-time airflow control as well as predictive maintenance. These technologies increase energy efficiency, lower the cost of operation, and enhance occupant comfort, making air ducts an indispensable element in contemporary buildings and spurring market growth.

Restraining Factors

Installation of galvanized steel involves qualified labor and a high initial cost. Routine maintenance and cleaning contribute to operating expenses, which may discourage low-volume or financially constrained-projects from using sophisticated duct solutions. Additionally, most European buildings are historic or possess aging infrastructure, thus making it difficult and costly to retrofit them with contemporary air duct systems. Structural constraints and aesthetic considerations for preserving architectural style can limit large-scale duct installation in such buildings.

Market Segmentation

The Europe air duct market share is classified into type and application.

- The galvanized steel segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Europe air duct market is segmented by type into galvanized steel, aluminum (ai), flexible duct, fabric duct, and others. Among these, the galvanized steel segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is due to galvanized steel ducts covered with zinc, which gives excellent protection against corrosion and rust. This makes them extremely long-lasting, particularly in humid or industrial settings, to have a longer life and lower maintenance costs, which is why it's greatly used throughout Europe on HVAC systems.

- The commercial facilities segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The Europe air duct market is segmented by application into public facilities, commercial facilities, industrial facilities, and others. Among these, the commercial facilities segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth is attributed to commercial properties like offices, hospitals, and schools that need strong HVAC systems for sustaining indoor air quality and thermal comfort. Air ducts play an important role in these systems, providing efficient distribution of air. With increasing regulatory pressure on energy efficiency, the installation of new duct systems in commercial buildings is increasingly on the rise throughout Europe.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved in the Europe air duct market. It also includes a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Lindab

- Air Spiralo Groue

- FabricAir

- Kingspan Group

- Domus

- ISOVER

- Aldes Groue

- Airflow Developments Limited

- ROKAFLEX

- Nordfab

- Aermec

- Others

Recent Developments:

- In February 2023, Durkeesox released a new product series of flexible air ducts. Durkeesox is a major global supplier in the fabric air ducts market used in the HVAC sector, and its new series of air ducts. Its latest entry in its extensive series of effective and fireproof air ducts will enable it to capture more of the market.

- In January 2023, Lindab, one of Europe's top ventilation businesses, unveiled its intentions to increase its capacity for production in Poland during January 2023, to satisfy the growing demand within the market.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe air duct market based on the below-mentioned segments:

Europe Air Duct Market, By Type

- Galvanized Steel

- Aluminum (AI)

- Flexible Duct

- Fabric Duct

- Others

Europe Air Duct Market, By Application

- Public Facilities

- Commercial Facilities

- Industrial Facilities

- Others

Need help to buy this report?