Global eSIM Market Size, Share, and COVID-19 Impact Analysis, By Solution (Hardware, Connectivity Services), By Application (Consumer Electronics, M2M), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 - 2030) Global eSIM Market Insights Forecasts to 2030

Industry: Semiconductors & ElectronicsGlobal eSIM Market Insights Forecasts to 2030

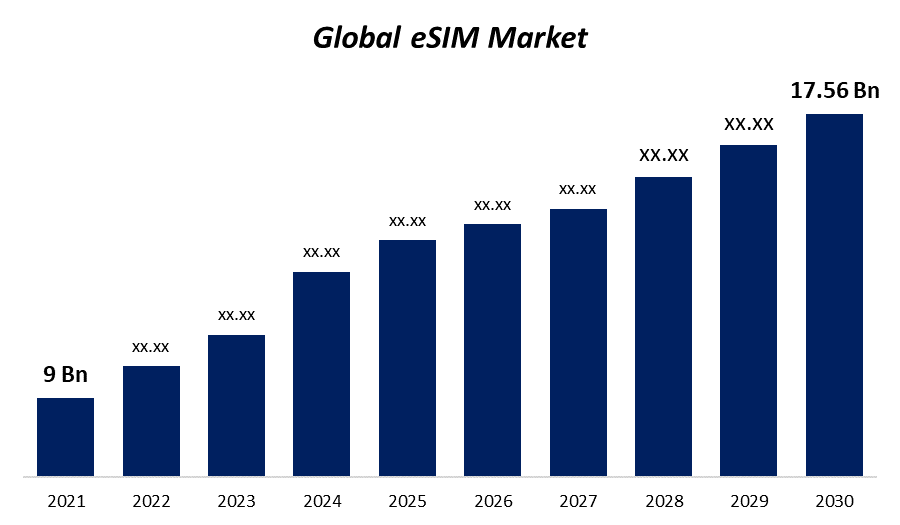

- The Global eSIM Market Size was valued at USD 9 billion in 2021.

- The Worldwide Market Share is growing at a CAGR of 7% from 2022 to 2030

- The Global eSIM Market Size is expected to reach USD 17.56 billion by 2030

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global eSIM Market Size is expected to reach USD 17.56 billion by 2030, at a CAGR of 7% during the forecast period 2022 to 2030. The rising usage of IoT-connected devices in consumer electronics and M2M applications is driving market growth. The frequency with which eSIM profiles are downloaded to consumer devices has increased. The increased use of eSIM-connected devices is driving the growth of the eSIM market.

Market Overview

With the help of this gadget, the user can operate multiple devices at once. The user has the option of remote use. The users of eSIM do not need to switch out their SIM cards. The market offers this sim in both soldered and detachable variants. The user can utilise many network operators at once with this sim. The length of this universal integrated embedded card is less than 6mm. The eSIM market is more in demand thanks to its distinctive features. This sim attracts excellent adoption from numerous verticals thanks to its M2 features. Internet of things devices are anticipated to overtake mobile phones in the next years. With eSIM, connected gadgets can operate effectively.

Report Coverage

This research report categorizes the market for eSIM market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the eSIM market. Recent market developments and competitive strategies such as expansion, product launch and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the eSIM market.

Global eSIM Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 9 Billion |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 7% |

| 2030 Value Projection: | USD 15 Billion |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 209 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Solution, By Application, By Region, COVID-19 Impact Analysis |

| Companies covered:: | Singapore Telecommunications Limited, Telephonic, S.A, Deutsche Telekom AG, NTT DOCOMO INC, Giesecke & Devrient GmbH, STMicroelectronics, Infineon Technologies AG, NXP Semiconductors N.V, Gemalto NV |

| Pitfalls & Challenges: | Due to the increasing number of COVID-19 cases |

Get more details on this report -

Driving Factors

With the advent of eSIM in the automotive sector, trucks and vehicles now have a great deal of choice when it comes to cellular connectivity while also being able to access new features and capabilities. It is anticipated that all automobiles will be cellular-enabled within the next several years, improving the driving experience thanks to cutting-edge linked services. Through the implementation of the GSMA Embedded SIM specification to improve vehicle connectivity, the automotive industry recently made a significant advancement in enabling the next generation of connected cars. As a result, security for various connected services is supposed to be improved. The eSIM-enabled systems provide remote SIM profile provisioning in addition to automatic interoperability across different SIM operators and connecting platforms. The running chain of these systems now includes several network service providers, making it more difficult to manage the security of these systems. The eSIM collects and stores Mobile Network Operators' (MNOs') credentials in the device's built-in software, leaving them open to security lapses. Additionally, the use of eSIM across a variety of physical platforms and MNOs exposes it to a number of risks related to virtual environments. As a result, if security is compromised, the operational flexibility offered by eSIM may be rendered useless, preventing market expansion.

Restraining Factors

The eSIM industry is constrained by a lack of technical know-how. The majority of company processes employ ESIM. This sim can be used by anyone with technical knowledge. Additionally, eSIM is a technology that is utilised in laptops, M2M, and linked autos. It is primarily utilised in the technology and customer service industries. To use the market, more technical knowledge is required. Market inefficiency may result from poor management of the market. All of these market limitations have the potential to slow the industry's rate of expansion. Fewer people are needed in many organisations to run this technology. With the market's projected revenue growth rates, these constraints may be very severe.

Market Segmentation

- In 2021, the Connectivity segment is dominating the market over the forecast period.

On the basis of solution, the global eSIM market is segmented into Hardware, Connectivity Services. Among these, the connectivity segment is dominating the market over the forecast period. The increased use of eSIM for M2M connections, which is anticipated to generate revenue for network operators through subscription services, may be the cause of this rapid rise. Mobile Network Operators (MNOs) offer connectivity services for securely managing end-user cellular subscriptions from a distance. The GSMA Embedded SIM Specification, which will boost vehicle connectivity and pave the way for a new generation of connected vehicles, has just received support from the automotive industry. It is anticipated that it would enhance security for a number of connection services, enabling the market to expand.

- In 2021, the M2M segment holds the highest market share over the forecast period.

Based on application, the global eSIM market is segmented into Consumer Electronics, M2M. Among these, the M2M segment holds the highest market share over the forecast period. The M2M segment is growing as a result of the expanding usage of eSIM technology in the automotive sector for M2M communication. Additionally, the main demand generators in the automobile sector are connected cars. The adoption of eSIM in the automotive sector is anticipated to greatly simplify production and promote the growth of the connected car market. The adoption of M2M and IoT technologies in other industries is anticipated to increase as a result.

Regional Segment Analysis of the eSIM Market

Get more details on this report -

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

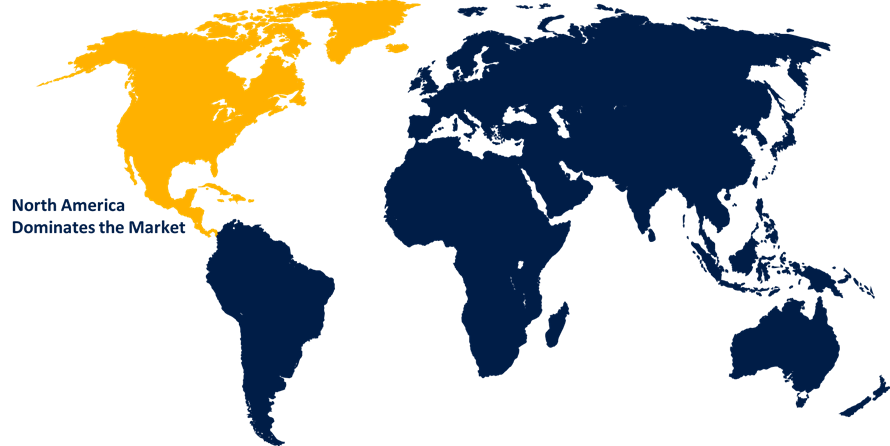

North America is dominating the market with the largest market share over the forecast period.

Among these, North America is dominating the market with the largest market share over the forecast period. The rise is a result of the region's rapid technological advancements and the widespread presence of network providers.

Recent Developments

- In September 2021, In partnership with Bayerische Motoren Werke AG, Deutsche Telekom AG announced the introduction of personal eSIM networking solutions and in-car 5G. Vehicle connectivity with the customer's mobile network was connected via 5G using personal eSIM and MobilityConnect by Deutsche Telekom AG and Bayerische Motoren Werke AG.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global eSIM market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Singapore Telecommunications Limited

- Telephonic, S.A

- Deutsche Telekom AG

- NTT DOCOMO INC

- Giesecke & Devrient GmbH

- STMicroelectronics

- Infineon Technologies AG

- NXP Semiconductors N.V

- Gemalto NV

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2030. Spherical Insights has segmented the global eSIM market based on the below-mentioned segments:

eSIM Market, By Solution

- Hardware

- Connectivity Services

eSIM Market, By Application

- Consumer Electronics

- M2M

eSIM Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?