Global Epigenetics Drugs & Diagnostic Technologies Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Epigenetic Drugs and Diagnostic Technologies), By Technology (DNA Methylation, Histone Modification, RNA Modification, and Others), By Application (Oncology and Non-Oncology), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Epigenetics Drugs & Diagnostic Technologies Market Insights Forecasts to 2035

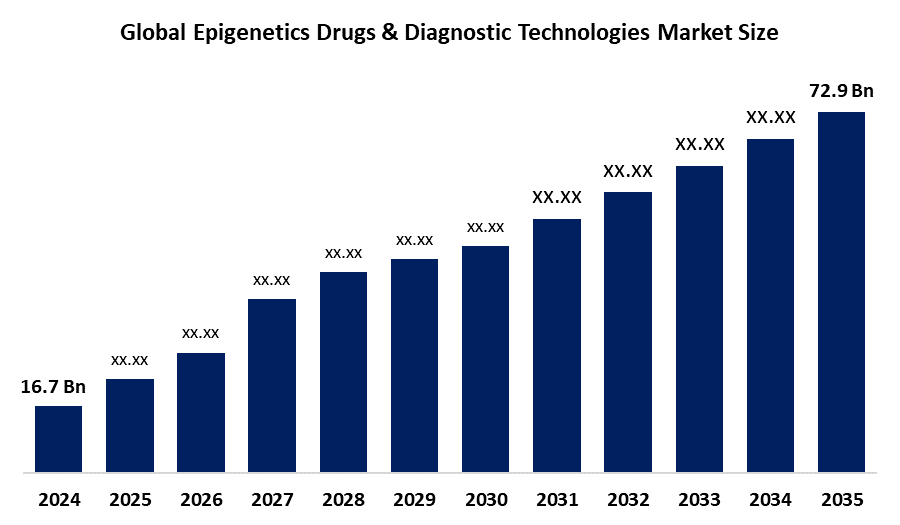

- The Global Epigenetics Drugs & Diagnostic Technologies Market Size Was Estimated at USD 16.7 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 14.34% from 2025 to 2035

- The Worldwide Epigenetics Drugs & Diagnostic Technologies Market Size is Expected to Reach USD 72.9 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global epigenetics drugs & diagnostic technologies market size was worth around USD 16.7 billion in 2024 and is predicted to grow to around USD 72.9 billion by 2035 with a compound annual growth rate (CAGR) of 14.34% from 2025 to 2035. The expansion in the epigenetics drugs and diagnostic technologies market is fueled by growing rates of chronic conditions, developments in genomic research, growing demand for personalized medicine, and robust government and private investment in targeted treatments and early, precise diagnostic tools.

Market Overview

The Market Size for epigenetics drugs and diagnostic technologies, defined broadly as treatments and assays that target or measure heritable but reversible changes in gene expression (such as DNA methylation, histone modification, and regulation by non-coding RNAs) is picking up considerable pace. They are used to screen, classify, and track diseases and to design therapies that can modulate epigenetic mechanisms, hence, more precise and personalized medicine. The market is fueled by an increasing prevalence of cancer and other diseases that are chronic in nature, an increasing geriatric pool, the integration of precision medicine, and higher R&D expenditure, especially in the North American and the Asia Pacific regions. Innovation is seen in the highly accelerated development of reagents, kits, and instruments for diagnostics (capturing the largest portion of the market) and in new drug classes such as histone deacetylase (HDAC) and DNA-methyltransferase (DNMT) inhibitors for oncology and other applications.

Key opportunities exist in expanding into non-oncology applications, including neurodegenerative, cardiovascular, and autoimmune diseases; the development of liquid biopsy epigenetic diagnostics; and the integration of artificial intelligence and multiomics technologies to improve detection and therapy personalization. Key players include global healthcare and life sciences companies such as Thermo Fisher Scientific Inc., Illumina Inc., Novartis AG, F. Hoffmann-La Roche Ltd., and Merck & Co. Inc., supported by collaborations, acquisitions, and robust innovation pipelines. In March 2024, the DFG initiated the Priority Programme EPIADAPT to investigate how epigenetic modifications of chromatin determine neural development. These modifications control gene expression, direct cell fate, and store environmental information in chromatin. In the CNS, adaptive changes in gene expression that accompany or induce changes in cell states during development are enabled by these mechanisms.

Report Coverage

This research report categorizes the epigenetics drugs & diagnostic technologies market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the epigenetics drugs & diagnostic technologies market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the epigenetics drugs & diagnostic technologies market.

Global Epigenetics Drugs And Diagnostic Technologies Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 16.7 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 14.34% |

| 2035 Value Projection: | USD 72.9 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type, By Technology |

| Companies covered:: | Thermo Fisher Scientific Inc., Eisai Co., Ltd., Roche Diagnostics, Illumina, Inc., Cantata Bio, Novartis AG, ELEMENT BIOSCIENCES, Active Motif Inc., Qiagen, Agilent Technologies, Merck KGaA, Abcam Limited., Hoffmann-La Roche Ltd., Zymo Research Corporation, And Other Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for epigenetics drugs and diagnostic technologies is driven by the growing prevalence of cancer, neurological, and autoimmune diseases, for which early diagnostics and personalized treatment are essential. Rising investment in precision medicine, epigenetic biomarker awareness, and technological breakthroughs in high-throughput sequencing technology further drive growth. Government support, growing research partnerships, and pharmaceutical R&D pipelines focusing on epigenetic pathways also add to growth. The combination of artificial intelligence and multi-omics platforms is also boosting drug discovery and diagnostic accuracy. These combined provide a strong setting for commercialization and innovation in therapeutic and diagnostic uses of epigenetics.

Restraining Factors

The market for epigenetics diagnostic technologies and drugs is hindered by high R&D costs, complicated regulatory processes, and low awareness in emerging markets. Technical problems in biomarker validation and specialization also hinder broad adoption, particularly in non-oncology indications and smaller healthcare systems.

Market Segmentation

The epigenetics drugs & diagnostic technologies market share is classified into product type, technology, and application.

- The diagnostic technologies segment dominated the market in 2024, approximately 93% and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the epigenetics drugs & diagnostic technologies market is divided into epigenetic drugs and diagnostic technologies. Among these, the diagnostic technologies segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Oncology leads the market due to epigenetic mechanisms play a pivotal role in cancer. Diagnostic technologies are crucial in epigenetics, allowing detection of DNA methylation, histone modifications, and RNA alterations for accurate, early disease diagnosis. Their implementation in the clinic enhances patient stratification and monitoring, leading to better treatment outcomes. Advances in high-throughput sequencing and bioinformatics are also revolutionizing diagnostics, making them integral to personalized medicine and more efficient healthcare approaches.

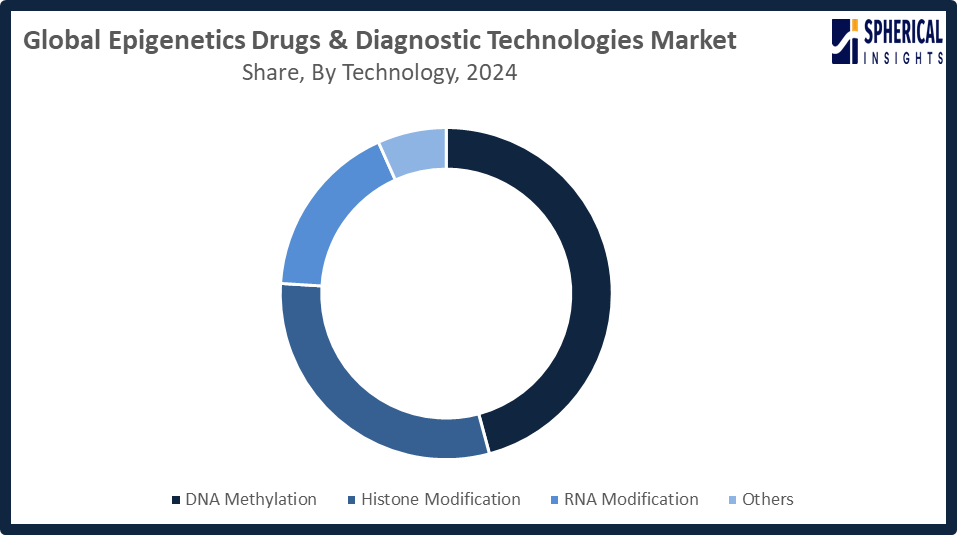

- The DNA methylation segment accounted for the largest share in 2024, approximately 46% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the technology, the epigenetics drugs & diagnostic technologies market is divided into DNA methylation, histone modification, RNA modification, and others. Among these, the DNA methylation segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. DNA methylation is crucial for genomic stability and gene regulation. Technologies to study methylation profiles are critical in epigenetic diagnostics and therapeutics, particularly in identifying cancer-associated abnormalities. These technologies provide insights for tailored treatments. Future development in DNA methylation technologies will have a great impact on growth and innovation in the epigenetics industry.

Get more details on this report -

- The oncology segment accounted for the highest market revenue in 2024, approximately 68% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the epigenetics drugs & diagnostic technologies market is divided into oncology and non-oncology. Among these, the oncology segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Oncology leads the market due to epigenetic mechanisms play a pivotal role in cancer. Histone modifications and DNA methylation modulate gene expression and tumor growth. Epigenetic diagnostics and drugs offer new targets, facilitating early detection and prognosis. More and more incorporated into cancer therapies, these treatments enhance efficacy and patient survival, rendering them indispensable in current oncology treatments.

Regional Segment Analysis of the Epigenetics Drugs & Diagnostic Technologies Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the epigenetics drugs & diagnostic technologies market over the predicted timeframe.

North America is anticipated to hold the largest share of the epigenetics drugs & diagnostic technologies market over the predicted timeframe. North America is expected to have approximately 40% of the market share of the epigenetics drugs and diagnostic technologies market in the forecast period because it has an advanced healthcare infrastructure, high research spending, and an intense presence of major market players such as Thermo Fisher Scientific, Illumina, and Roche Diagnostics. The United States, specifically, leads the way in growth through strong government support of genomic and epigenetic research, universal prevalence of precision medicine, and well-established clinical diagnostic networks. All these together enable innovation, product development, and fast-market adoption, reinforcing North America's pole position.

Asia Pacific is expected to grow at a rapid CAGR in the epigenetics drugs & diagnostic technologies market during the forecast period. Asia Pacific is rapidly growing in the epigenetics drugs and diagnostics technologies market, with an approximate 21% market share, due to rising healthcare spending, growing research programs, and expanding demand for precision medicine. It is being led by countries such as China, India, Japan, and South Korea, backed by government-sponsored screening programs and enhanced healthcare facilities. Moreover, indigenous manufacturing lowers diagnostic reagent and equipment costs, making technologies more affordable. Increasing knowledge about epigenetic diseases and vast patient pools further propel regional market growth.

Europe is in an important position in the epigenetics drugs and diagnostic technologies market, with high research efforts, government funding, and sophisticated healthcare infrastructures. The UK, Germany, and France are major contributors to growth through intense investment in epigenetic research and initiatives into precision medicine. Well-developed pharma industries and partnerships in academia and biotech companies in the region ensure innovation, which drives development and acceptance of epigenetic diagnostics and therapies in Europe.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the epigenetics drugs & diagnostic technologies market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Thermo Fisher Scientific Inc.

- Eisai Co., Ltd.

- Roche Diagnostics

- Illumina, Inc.

- Cantata Bio

- Novartis AG

- ELEMENT BIOSCIENCES

- Active Motif Inc.

- Qiagen

- Agilent Technologies

- Merck KGaA

- Abcam Limited.

- Hoffmann-La Roche Ltd.

- Zymo Research Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2025, Illumina announced its 5-base solution, a major advance in scalable multiomic analysis. This innovation enables simultaneous detection of genomic variants and DNA methylation from a single sample. Powered by proprietary chemistry and DRAGEN algorithms, it offers high-resolution insights with a streamlined, cost-effective workflow.

- In September 2025, Illumina announced partnerships with global pharmaceutical companies to develop companion diagnostics (CDx) using its TruSight Oncology Comprehensive test. Focused on KRAS alterations, these tumor-agnostic CDx solutions aim to expand global access to precision oncology, supporting standardized cancer care and improved patient outcomes through genomic profiling.

- In April 2025, Gene Solutions and Element Biosciences announced a strategic collaboration formalized by a Memorandum of Understanding (MoU). The partnership, signed during Element Biosciences' visit to Gene Solutions' lab, aims to advance access to advanced genetic testing and life science solutions globally.

- In April 2025, Zymo Research launched the RNome Disruptive Research Grant to support scientists mapping the RNome and advancing RNA understanding. Aligned with the Human RNome Project, the grant fosters collaboration and innovation, accelerating breakthroughs with potential diagnostic and therapeutic applications across all organisms.

- In February 2025, Roche announced its proprietary Sequencing by Expansion (SBX) technology, introducing a new category in next-generation sequencing. SBX combines advanced chemistry with an innovative sensor module to deliver ultra-rapid, high-throughput sequencing that is flexible, scalable, and suited for a wide range of genomic applications.

- In April 2024, Merck launched Aptegra CHO, the first all-in-one validated genetic stability assay. Utilizing whole genome sequencing and bioinformatics, it accelerates biosafety testing, helping clients advance more quickly into commercial production.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the epigenetics drugs & diagnostic technologies market based on the below-mentioned segments:

Global Epigenetics Drugs & Diagnostic Technologies Market, By Product Type

- Epigenetic Drugs

- Diagnostic Technologies

Global Epigenetics Drugs & Diagnostic Technologies Market, By Technology

- DNA Methylation

- Histone Modification

- RNA Modification

- Others

Global Epigenetics Drugs & Diagnostic Technologies Market, By Application

- Oncology

- Non-Oncology

Global Epigenetics Drugs & Diagnostic Technologies Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?