Global Enterprise Financial Management Software (EFM) Market Size, Share, and COVID-19 Impact Analysis, By Type (Web-based Software, Mobile-based Software), By Enterprise Size (Large Enterprises, Small Enterprises), By Application (Payroll Management Systems, Billing & Invoice System, Enterprise Resource Planning Systems, Time & Expense Management Systems, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: Information & TechnologyGlobal Enterprise Financial Management Software (EFM) Market Size Insights Forecasts to 2032

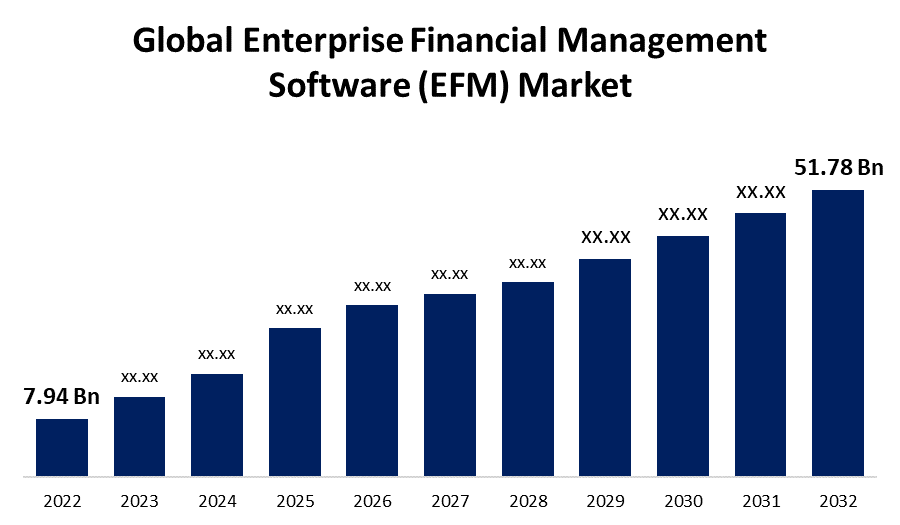

- The Global Enterprise Financial Management Software (EFM) Market Size was valued at USD 7.94 Billion in 2022.

- The Market Size is Growing at a CAGR of 20.62% from 2022 to 2032

- The Worldwide Enterprise Financial Management Software (EFM) Market Size is expected to reach USD 51.78 Billion by 2032

- Europe is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Enterprise Financial Management Software (EFM) Market Size is expected to reach USD 51.78 Billion by 2032, at a CAGR of 20.62% during the forecast period 2022 to 2032.

Enterprise financial management software (EFM) is an accounting software solution simplify the accounting process, save time, and ensure error-free transactions between businesses and clients. By archiving, automating, and integrating human resource systems, these systems are intended to boost productivity. Accounting software implementation in SMEs helps reduce errors in dealings with clients and companies, improving relationships and reputations while allowing time to focus on the core business idea. EFM software typically offers a centralised platform for integrating financial data from various sources, such as sales, procurement, payroll, and general ledger systems. Developments in solutions, such as the integration of live chat support with employee performance reviews, assist organizations in understanding consumer needs and behaviour. This, in turn, accelerates market growth. This integration enables the automation of routine financial tasks like invoicing, payment processing, and financial reporting, which can reduce errors, improve efficiency, and save time. The rise in demand for digital banking channels, enhanced customer services provided by financial service software, and an increase in demand for workforce optimisation solutions drive the growth of the financial service software market.

Global Enterprise Financial Management Software (EFM) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 7.94 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 20.62% |

| 2032 Value Projection: | USD 51.78 Billion |

| Historical Data for: | 2020-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Enterprise size, By Application, By Region |

| Companies covered:: | Onestream Software LLC, The Sage Group Plc, Zoho Corporation, Xero Limited, IBM, Infor, Wave Financial, Epicor, Oracle, Freshbooks, Microsoft Corporation, Intuit, Inc, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

An increase in digital innovation is a key trend gaining traction in the financial services software market. Because of the increase in digital innovation and digitalization in the financial sector, the provision of on-touch payment, secure connections, and many other services is improving the customer experience. Furthermore, financial service providers are allocating a significant portion of their budgets to improving the customer experience. Furthermore, the increased emphasis on improving financial services in commercial banks, such as payment, deposit, or lending services, is improving customer experience. This is expected to increase market demand for financial services applications during the forecast period. However, increased investment by fintech companies in big data, mobility, and cloud technologies is expected to provide numerous opportunities for the expansion of the financial service software market during the forecast period.

Restraining Factors

Many enterprise financial management software solutions require significant investments in infrastructure, hardware, and personnel, making them difficult to implement for smaller businesses such factors are hamper the market growth during forecast period.

Market Segmentation

By Type Insights

The web-based software segment dominates the market with the largest revenue share over the forecast period.

On the basis of type, the global enterprise financial management software (EFM) market is segmented into web-based software and mobile-based software. Among these, the web-based software segment is dominating the market with the largest revenue share over the forecast period. IT concerns about workstations and operating systems are eliminated when using web-based software. Web-based software is inexpensive and requires no capital or IT resources to implement. This is one of the most compelling reasons businesses choose stay staffed technologies' web-based software solutions.

By Enterprise Size Insights

The large enterprises segment is witnessing significant CAGR growth over the forecast period.

On the basis of enterprise size, the global enterprise financial management software (EFM) market is segmented into large enterprises and small enterprises. Among these, the large enterprises segment is witnessing significant growth over the forecast period. Large corporations generate a large number of financial transactions, invoices, and other financial records. And it's critical to handle and interpret this data correctly and quickly. Analysing and processing this vast amount of data manually can be overwhelming, resulting in errors and inefficiencies such factors are boost market growth during forecast period.

By Application Insights

The enterprise resource planning systems segment is expected to hold the largest share of the global enterprise financial management software (EFM) market during the forecast period.

Based on the application, the global enterprise financial management software (EFM) Market is classified into payroll management systems, billing & invoice system, enterprise resource planning systems, time & expense management systems and others. Among these, the enterprise resource planning systems segment is expected to hold the largest share of the enterprise financial management software (EFM) market during the forecast period. ERP assists organizations in automating and managing core business processes to achieve peak performance. ERP software manages the data flow between a company's business processes, creating a single source of truth and streamlining operations across the enterprise. It can integrate a company's financials, supply chain, operations, commerce, reporting, manufacturing, and human resources activities onto a single platform.

Regional Insights

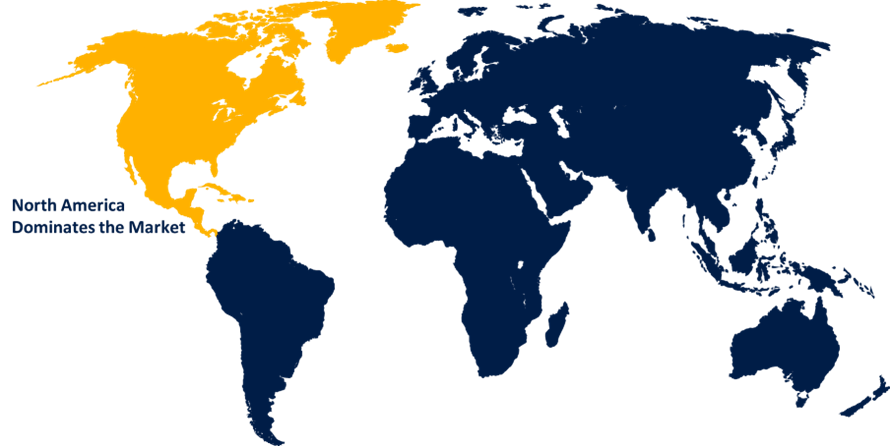

North America dominates the market with the largest market share over the forecast period.

Get more details on this report -

North America is dominating the market with the largest market share over the forecast period. The North American market for enterprise financial management software is expanding the fastest, with the United States and Canada playing a significant role. Since the presence of large corporations and the increasing use of cloud-based financial management software solutions, the market is expanding in this area. North America's market is also expanding as a result of rising demand for automation and data security features in financial management software.

Europe is expected to grow the fastest during the forecast period. The United Kingdom, Germany, and France are the primary drivers of growth. The market in this area is expanding as a result of increased adoption of cloud-based financial management software solutions and increased focus on data security and compliance.

List of Key Market Players

- Onestream Software LLC

- The Sage Group Plc

- Zoho Corporation

- Xero Limited

- IBM

- Infor

- Wave Financial

- Epicor

- Oracle

- Freshbooks

- Microsoft Corporation

- Intuit, Inc

- Lucanet Ag

Key Market Developments

- On March 2023, Focus Softnet has announced the release of its new accounting software, FocusLyte, a cloud-based system that aids in the management of a company's invoices and payments. The software is primarily intended for medium and small businesses.

- On February 2023, Oracle Financials Cloud, its latest cloud-based enterprise financial management software, has been released. Improved data visualisation, automated cash application, and improved compliance are among the new software's features.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the global enterprise financial management software (EFM) market based on the below-mentioned segments:

Enterprise Financial Management Software (EFM) Market, Type Analysis

- Web-based Software

- Mobile-based Software

Enterprise Financial Management Software (EFM) Market, Enterprise Size Analysis

- Large Enterprises

- Small Enterprises

- Enterprise Financial Management Software (EFM) Market, Application Analysis

- Payroll Management Systems

- Billing & Invoice System

- Enterprise Resource Planning Systems

- Time & Expense Management Systems

- Others

Enterprise Financial Management Software (EFM) Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?