Global Endoluminal Suturing Devices Market Size, Share, and COVID-19 Impact Analysis, By Application (Bariatric Surgery, Gastrointestinal Surgery, and Gastroesophageal Reflux Disease Surgery), By Component (Suction Port, Cannula, and Needle), By End-User (Hospitals, Clinics, and Ambulatory Surgery Centers), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032).

Industry: HealthcareGlobal Endoluminal Suturing Devices Market Insights Forecasts to 2032

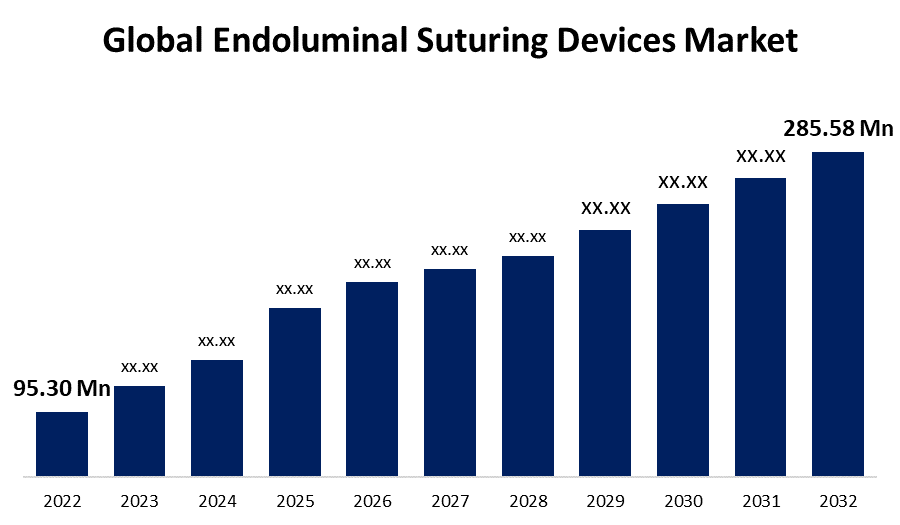

- The Endoluminal suturing devices market was valued at USD 95.30 Million in 2022.

- The Market is growing at a CAGR of 11.6% from 2022 to 2032.

- The Global endoluminal suturing devices market is expected to reach USD 285.58 Million by 2032.

- Asia-Pacific is expected to grow significant during the forecast period.

Get more details on this report -

The Global Endoluminal Suturing Devices Market is expected to reach USD 285.58 Million by 2032, at a CAGR of 11.6% during the forecast period 2022 to 2032.

Market Overview

Endoluminal suturing devices are innovative medical tools designed for minimally invasive procedures within the body's luminal structures. These devices enable the secure closure of tissue and organs from within, eliminating the need for open surgery. Utilizing advanced technology and flexible delivery systems, they allow physicians to suture and repair a wide range of gastrointestinal, vascular, and urological conditions. Endoluminal suturing devices offer numerous benefits, including reduced surgical trauma, shorter recovery times, and improved patient outcomes. Their precise and controlled suturing capabilities make them a valuable addition to modern medical practices, advancing the field of interventional medicine and expanding treatment options for various challenging conditions.

Report Coverage

This research report categorizes the market for endoluminal suturing devices market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the endoluminal suturing devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the endoluminal suturing devices market.

Global Endoluminal Suturing Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 95.30 Mn |

| Forecast Period: | 2022 – 2032 |

| Forecast Period CAGR 2022 – 2032 : | 11.6% |

| 022 – 2032 Value Projection: | USD 285.58 Mn |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 150 |

| Segments covered: | By Application, By Component, By End-User, By Region. |

| Companies covered:: | Apollo Endosurgery Inc., Johnson & Johnson, Boston Scientific Corporation, Medtronic PLC, Cook Group Incorporated, USG' Medical Inc., Stryker Corporation, ErgoSuture, Sutrue Ltd., Ovesco Endoscopy AG, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The endoluminal suturing devices market is driven by several key factors that contribute to its growth and widespread adoption in the medical field, such as the increasing prevalence of gastrointestinal disorders, such as gastroesophageal reflux disease (GERD), and vascular conditions, like arterial and venous insufficiency, fuels the demand for minimally invasive treatment options, where endoluminal suturing devices excel. Advancements in medical technology have led to the development of more sophisticated and efficient endoluminal suturing devices, enhancing their safety and efficacy. These devices offer improved suturing precision and better control during procedures, attracting both healthcare providers and patients seeking better treatment outcomes. The rising geriatric population globally contributes significantly to the market's growth. Elderly individuals are more prone to gastrointestinal and vascular issues, necessitating increased utilization of endoluminal suturing devices to address their specific medical needs. Moreover, the growing preference for minimally invasive procedures in general drives the demand for endoluminal suturing devices. Patients and physicians alike seek alternatives to traditional open surgery due to reduced post-operative complications, faster recovery times, and shorter hospital stays associated with minimally invasive approaches. Additionally, healthcare cost containment initiatives from governments and insurance providers prompt healthcare facilities to adopt cost-effective technologies, making endoluminal suturing devices an attractive option due to their potential to lower overall treatment expenses compared to open surgery. Furthermore, the expanding awareness among healthcare professionals about the benefits of endoluminal suturing devices and the continuous efforts of manufacturers to improve device design and accessibility also contribute to the market's growth. Overall, the combination of medical necessity, technological advancements, demographic trends, patient preferences, cost considerations, and increased awareness collectively propel the endoluminal suturing devices market forward.

Restraining Factors

The endoluminal suturing devices market faces several restraints that may impede its growth and adoption, the initial high costs associated with acquiring and implementing advanced endoluminal suturing technologies can limit their accessibility to smaller healthcare facilities with limited budgets. The learning curve associated with mastering these complex devices may deter some physicians from adopting them, especially in regions with a shortage of trained specialists. Additionally, regulatory hurdles and stringent approval processes for new medical devices can slow down market expansion. Moreover, the preference for established conventional surgical techniques and the lack of awareness among patients and healthcare providers about the benefits of endoluminal suturing devices may further limit their widespread adoption.

Market Segmentation

- In 2022, the gastrointestinal surgery segment accounted for around 39.2% market share

On the basis of the application, the global endoluminal suturing devices market is segmented into bariatric surgery, gastrointestinal surgery, and gastroesophageal reflux disease surgery. The gastrointestinal surgery segment held the largest market share in the endoluminal suturing devices market due to the high prevalence of gastrointestinal disorders, such as GERD and ulcers, has increased the demand for minimally invasive surgical options, driving the adoption of endoluminal suturing devices. Moreover, advancements in endoscopic techniques and the availability of specialized suturing devices for gastrointestinal procedures have further fueled the segment's growth. Additionally, the reduced post-operative complications, shorter recovery times, and improved patient outcomes associated with endoluminal suturing in gastrointestinal surgeries have contributed to its prominence in the market.

- The needle segment is expected to grow at a significant CAGR during the forecast period

Based on the component, the global endoluminal suturing devices market is segmented into suction port, cannula, and needle. The needle segment is expected to grow significantly during the forecast period in the endoluminal suturing devices market due to needles are a crucial component used for precise and accurate suturing in various endoluminal procedures. As medical technology continues to advance, needle designs are becoming more sophisticated, offering enhanced control and maneuverability during surgeries. Additionally, the rising prevalence of gastrointestinal and vascular disorders necessitates increased adoption of endoluminal suturing techniques, driving the demand for specialized needles. Furthermore, the growing preference for minimally invasive procedures and improved patient outcomes also contribute to the segment's projected growth.

- The hospital segment held the largest market over the forecast period

Based on the end-user, the global endoluminal suturing devices market is segmented into hospitals, clinics, and ambulatory surgery centers. The hospital segment held the largest market share in the endoluminal suturing devices market due to several key reasons. Hospitals are major healthcare centers equipped with advanced medical facilities, making them ideal settings for complex endoluminal procedures. They handle a wide range of gastrointestinal, vascular, and urological cases, increasing the demand for endoluminal suturing devices. Additionally, hospitals typically have specialized medical teams capable of performing these procedures, further driving the adoption of these innovative devices. Moreover, the preference for minimally invasive surgeries in hospitals, coupled with favorable reimbursement policies for such procedures, contributes to the segment's dominance in the market.

Regional Segment Analysis of the Endoluminal Suturing Devices Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America dominated the market with more than 43.7% revenue share in 2022.

Get more details on this report -

Based on region, North America held the largest market share in the endoluminal suturing devices market due to its well-established and advanced healthcare infrastructure, providing easy access to innovative medical technologies. The high prevalence of gastrointestinal and vascular disorders in North America has increased the demand for minimally invasive treatment options, boosting the adoption of endoluminal suturing devices. Additionally, the presence of key market players and continuous research and development efforts in the region contribute to the availability and advancement of these devices.

Asia-Pacific is expected to be a significant player in the endoluminal suturing devices market during the forecast period, a large and rapidly growing population, leading to a higher prevalence of gastrointestinal and vascular disorders, which drives the demand for advanced medical technologies like endoluminal suturing devices. The improving healthcare infrastructure and rising healthcare expenditures in countries like China, India, and Japan are expected to facilitate the adoption of these innovative devices.

Recent Developments

- In June 2021, Ethicon, a Johnson & Johnson company and global leader in flexible endoluminal robotics and soft tissue microwave ablation, announced that its Plus Sutures has been recommended for use by the National Institute for Health and Care Excellence (NICEnew) medical technology guidelines.

- In July 2022, Ovesco Endoscopy AG has obtained ANVISA approval, allowing them to market and sell the OTSC System in Brazil. This regulatory clearance signifies that the Brazilian health authorities have reviewed and deemed the device to be safe and effective for use in endoscopic procedures within the country. This approval opens up opportunities for Ovesco to expand its presence and offer their advanced endoscopic suturing technology to healthcare providers and patients in the Brazilian market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global endoluminal suturing devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Apollo Endosurgery Inc.

- Johnson & Johnson

- Boston Scientific Corporation

- Medtronic PLC

- Cook Group Incorporated

- USG' Medical Inc.

- Stryker Corporation

- ErgoSuture

- Sutrue Ltd.

- Ovesco Endoscopy AG

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global endoluminal suturing devices market based on the below-mentioned segments:

Endoluminal Suturing Devices Market, By Application

- Bariatric Surgery

- Gastrointestinal Surgery

- Gastroesophageal Reflux Disease Surgery

Endoluminal Suturing Devices Market, By Component

- Suction Port

- Cannula

- Needle

Endoluminal Suturing Devices Market, By End-User

- Hospitals

- Clinics

- Ambulatory Surgery Centers

Endoluminal Suturing Devices Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?