Global Electronic Shelf Labels Market Size, Share, and COVID-19 Impact Analysis, By Component (Displays, Batteries, Transceivers, Microprocessors, and Others), By Product Type (LCDs, Segmented E-paper Displays, and Fully Graphic E-paper Displays), By Communications Technology (Radio Frequency, Infrared, Near-field Communication, and Others), By Display Size (Less than 3 Inches, 3 to 7 Inches, 7 to 10 Inches, and More than 10 Inches), By Application (Retail and Industrial), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: Semiconductors & ElectronicsGlobal Electronic Shelf Labels Market Insights Forecasts to 2032

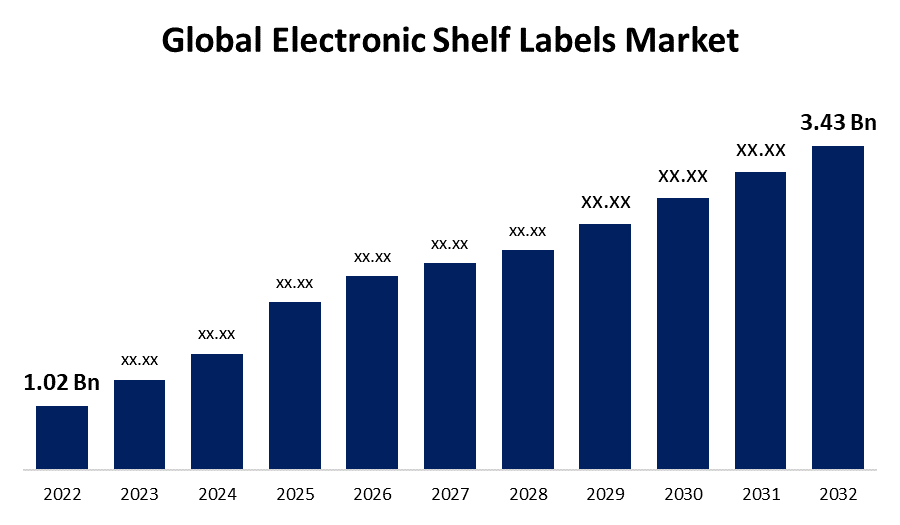

- The Global Electronic Shelf Labels Market Size was valued at USD 1.02 Billion in 2022.

- The Market is Growing at a CAGR of 12.9% from 2023 to 2032

- The Worldwide Electronic Shelf Labels Market Size is expected to reach USD 3.43 Billion by 2032

- Europe is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Electronic Shelf Labels Market Size is expected to reach USD 3.43 Billion by 2032, at a CAGR of 12.9% during the forecast period 2022 to 2032.

Market Overview

Electronic shelf labels are digital price tags used in retail environments to replace traditional paper labels. These innovative labels are equipped with electronic displays that can be updated remotely, providing real-time pricing and product information to customers. ESLs offer numerous advantages to both retailers and shoppers. Retailers can easily and quickly change prices, update promotions, and manage inventory centrally, eliminating the need for manual label changes and reducing pricing errors. The dynamic nature of ESLs enables retailers to implement dynamic pricing strategies and optimize sales. Customers benefit from accurate and up-to-date pricing information, reducing confusion and improving their shopping experience. ESLs also facilitate efficient stock management, enabling retailers to monitor inventory levels and quickly identify out-of-stock items. Overall, ESLs enhance operational efficiency, boost sales, and deliver an enhanced shopping experience in the retail industry.

Report Coverage

This research report categorizes the market for electronic shelf labels market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the electronic shelf labels market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the electronic shelf labels market.

Global Electronic Shelf Labels Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 1.02 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 12.9% |

| 2032 Value Projection: | USD 3.43 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Component, By Product Type, By Communications Technology, By Display Size, By Application, By Region, and COVID-19 Impact Analysis |

| Companies covered:: | SES-imagotag, SoluM Co., Ltd., Pricer AB, Displaydata Limited, Teraoka Seiko Co., Ltd., M2COMM, Opticon Sensors Europe B.V., Rainus, Shanghai SUNMI Technology Co., Ltd., Hanshow Technology. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The electronic shelf labels market is driven by several factors. ESLs offer cost savings and operational efficiency for retailers. The ability to remotely update pricing and product information reduces labor costs associated with manual label changes and minimizes pricing errors. The ESLs enable dynamic pricing strategies, allowing retailers to quickly adjust prices in response to market conditions and optimize sales. ESLs enhance the shopping experience by providing accurate and real-time pricing information to customers, reducing confusion, and improving customer satisfaction. Furthermore, ESLs facilitate efficient inventory management, enabling retailers to monitor stock levels in real time and minimize out-of-stock situations. The growing trend of digitization in the retail industry and the increasing adoption of IoT technologies also drive the demand for ESLs.

Restraining Factors

The electronic shelf label market faces several restraints. The initial implementation cost of ESL systems can be high, requiring investments in hardware, software, and infrastructure. The transition from traditional paper labels to ESLs may require significant changes in store layouts and processes, causing disruption and resistance from employees. The compatibility issues with existing systems and integration challenges can pose barriers to adoption. Additionally, concerns about data security and privacy may deter some retailers from embracing ESL technology. Lastly, the rapid advancement of technology introduces the risk of obsolescence, as newer and more advanced solutions may emerge, requiring further investments.

Market Segmentation

- In 2022, the radio frequency segment accounted for around 30.5% market share

On the basis of communication technology, the global electronic shelf labels market is segmented into radio frequency, infrared, near-field communication, and others. The radio frequency segment has emerged as the leader in the electronic shelf labels market, holding the largest market share. This segment utilizes RF technology, such as RFID or NFC, for communication between the ESLs and the central management system. Several factors contribute to its dominance. RF-based ESLs offer reliable and efficient wireless communication, allowing for quick and seamless updates of pricing and product information. RF technology provides a longer communication range compared to other alternatives, ensuring reliable connectivity even in large retail environments. Additionally, RF-based ESLs are compatible with existing RF infrastructure, reducing implementation costs and complexity. Furthermore, RF technology enables advanced features like real-time inventory management and anti-theft systems, adding value for retailers. Overall, the RF segment's robust communication capabilities, compatibility, and enhanced functionalities have made it the preferred choice, leading to its significant market share in the ESL industry.

- In 2022, the less than 3 inches segment dominated with more than 27.6% market share

Based on the type of display size, the global electronic shelf labels market is segmented into less than 3 inches, 3 to 7 inches, 7 to 10 inches, and more than 10 inches. The less than 3 inches segment has emerged as the dominant player in the electronic shelf labels market. This segment refers to ESLs with display sizes smaller than 3 inches. Several factors contribute to its dominance. These compact ESLs are highly versatile and can be easily integrated into various retail environments, including small stores and shelves with limited space. Their smaller form factor allows for greater flexibility in positioning and placement, enabling retailers to optimize their shelf space effectively. Additionally, the reduced size results in lower production costs and allows for cost-effective implementation across a larger number of products and shelves. Furthermore, advancements in display technology have made it possible to maintain high visibility and readability despite the smaller size. Overall, the less than 3 inches segment offers practicality, affordability, and adaptability, making it the market leader in the ESL industry.

Regional Segment Analysis of the Electronic Shelf Labels Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America dominated the market with more than 35.8% revenue share in 2022.

Get more details on this report -

Based on region, North America has emerged as a dominant player in the electronic shelf labels market, holding the largest market share. Several factors contribute to this leadership position. North America is home to numerous large retail chains and technologically advanced stores that have readily embraced digital transformation. These retailers are actively investing in ESLs to streamline operations, enhance pricing accuracy, and deliver an improved customer experience. The region has a highly developed retail infrastructure and a mature market for automation and IoT technologies. This favorable ecosystem enables easier integration of ESL systems and supports their widespread adoption. Additionally, North America boasts a tech-savvy consumer base that appreciates the convenience and real-time information provided by ESLs. The region's strong focus on innovation and early adoption of advanced retail solutions further solidifies its position as the largest market for ESLs in terms of market share.

Recent Developments

In September 2022, SES-imagotag and Instacart, a prominent grocery technology company in North America, have joined forces through a partnership. This collaboration facilitates the seamless integration of SES-imagotag's Electronic Shelf Labels (ESLs) and VUSION IOT retail cloud platform into grocery stores. The aim is to provide customers with an elevated shopping experience.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global electronic shelf labels market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- SES-imagotag

- SoluM Co., Ltd.

- Pricer AB

- Displaydata Limited

- Teraoka Seiko Co., Ltd.

- M2COMM

- Opticon Sensors Europe B.V.

- Rainus

- Shanghai SUNMI Technology Co., Ltd.

- Hanshow Technology

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global electronic shelf labels market based on the below-mentioned segments:

Electronic Shelf Labels Market, By Component

- Displays

- Batteries

- Transceivers

- Microprocessors

- Others

Electronic Shelf Labels Market, By Product Type

- LCDs

- Segmented E-paper Displays

- Fully Graphic E-paper Displays

Electronic Shelf Labels Market, By Communication Technology

- Radio Frequency

- Infrared

- Near-field Communication

- Others

Electronic Shelf Labels Market, By Display Size

- Less than 3 Inches

- 3 to 7 Inches

- 7 to 10 Inches

- More than 10 Inches

Electronic Shelf Labels Market, By Application

- Retail

- Industrial

Electronic Shelf Labels Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?