Global Electronic Design Automation Software Market Size, Share, and COVID-19 Impact Analysis, By Product (Computer-aided Engineering (CAE), IC Physical Design and Verification, Printed Circuit Board and Multi-chip Module (PCB and MCM), Semiconductor Intellectual Property (SIP), and Services), By Deployment (Cloud and On-premise), By Application (Microprocessors & Controllers, Memory Management Unit (MMU), and Others), and By End-Use (Aerospace and Defense, Automotive, Healthcare, Industrial, Consumer Electronics, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: Electronics, ICT & MediaGlobal Electronic Design Automation Software Market Insights Forecasts to 2032

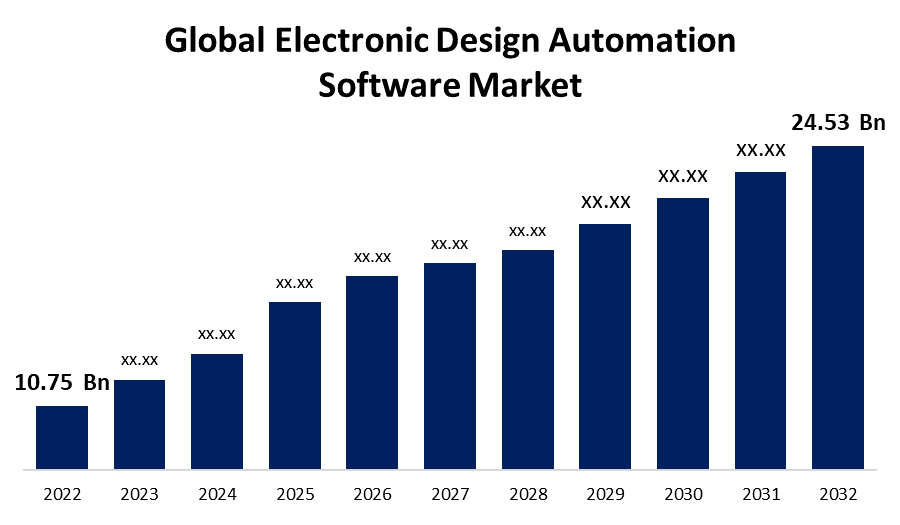

- The Electronic Design Automation Software Market Size was valued at USD 10.75 Billion in 2022.

- The Market Size is growing at a CAGR of 8.6% from 2022 to 2032.

- The global electronic design automation software Market Size is expected to reach USD 24.53 Billion by 2032.

- Asia-Pacific is expected to grow fastest during the forecast period.

Get more details on this report -

The Global Electronic Design Automation Software Market Size is expected to reach USD 24.53 Billion by 2032, at a CAGR of 8.6% during the forecast period 2022 to 2032.

Market Overview

Electronic Design Automation (EDA) software plays a pivotal role in the creation and optimization of electronic circuits and systems. EDA software encompasses a range of tools and applications that facilitate the design, analysis, and testing of integrated circuits, printed circuit boards, and other electronic components. These software solutions enable engineers and designers to streamline the entire electronic design process, from schematic capture and simulation to layout and manufacturing. EDA software often includes tools for circuit simulation, PCB layout, logic design, and verification, helping to reduce errors, improve efficiency, and accelerate time-to-market for electronic products.

Report Coverage

This research report categorizes the market for electronic design automation software market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the electronic design automation software market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the electronic design automation software market.

Global Electronic Design Automation Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 10.75 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 8.6% |

| 2032 Value Projection: | USD 24.53 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | COVID-19 Impact Analysis, By Product, By Deployment, By Application, and By End-Use, By Region |

| Companies covered:: | Advanced Micro Devices, Inc., Aldec, Inc., Altair Engineering Inc., Altium LLC, Autodesk, Inc., ANSYS, Inc., Cadence Design Systems, Inc., eInfochips, Keysight Technologies, EMA Design Automation, Inc., Microsemi, Synopsys, Inc., Silvaco, Inc., The MathWorks, Inc., Vennsa Technologies, Zuken, and Other key venders |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Electronic Design Automation (EDA) software market is driven by several key factors that collectively shape its growth and evolution, the ever-increasing demand for advanced and complex electronic devices is a significant driver. As technology continues to evolve rapidly, consumers and businesses alike seek smaller, more powerful, and energy-efficient electronics. EDA software enables engineers to design and optimize intricate integrated circuits and printed circuit boards, addressing these demands for high-performance electronic products. The growing complexity of electronic designs is a major driver. With the integration of AI, IoT, 5G, and other emerging technologies, electronic components are becoming more intricate. EDA software provides the essential tools for managing this complexity, offering simulation and verification capabilities to ensure the reliability and functionality of these advanced systems.

The rapid pace of technological innovation in semiconductor manufacturing is driving the EDA software market. As manufacturers strive to develop smaller and more efficient chips, EDA software assists in optimizing the semiconductor design process. Moreover, the demand for customizable semiconductor solutions, such as Field-Programmable Gate Arrays (FPGAs), is rising, and EDA software helps in designing and programming these versatile chips. Additionally, globalization and the outsourcing of electronic design services are influencing the EDA software market. Companies are increasingly looking for cost-effective ways to design electronic products, leading to the expansion of outsourced design services, which in turn drives the adoption of EDA software among design service providers. Furthermore, government regulations and standards related to electronics, especially in industries like automotive and aerospace, are fueling the EDA software market.

Restraining Factors

The Electronic Design Automation (EDA) Software Market faces several restraints, the high cost of EDA software and the need for powerful hardware to run these resource-intensive applications can be prohibitive for smaller companies and startups. The increasing complexity of designs and the need for highly skilled engineers can lead to longer development cycles, which may hinder time-to-market objectives. Intellectual property and security concerns in the EDA industry can limit collaboration and information sharing. Overall, the consolidation of EDA vendors has led to reduced competition and innovation in the market, potentially limiting choices for customers.

Market Segmentation

- In 2022, the computer-aided engineering segment accounted for around 29.4% market share

On the basis of the product, the global electronic design automation software market is segmented into computer-aided engineering (CAE), IC physical design and verification, printed circuit board and multi-chip module (PCB and mcm), semiconductor intellectual property (SIP), and services. The Computer-Aided Engineering (CAE) segment has consistently held the largest market share in the field of engineering software due to its critical role in product development and design optimization. CAE tools enable engineers and designers to simulate and analyze complex physical behaviors of products, ranging from structural integrity and thermal performance to fluid dynamics and electromagnetic interactions. This capability is indispensable in industries like automotive, aerospace, and manufacturing, where safety, efficiency, and product reliability are paramount.

- The cloud segment is expected to grow at a higher CAGR of around 8.7% during the forecast period

Based on the deployment, the global electronic design automation software market is segmented into cloud and on-premise. The cloud segment is anticipated to experience higher growth during the forecast period in the realm of software and technology for several compelling reasons, the increasing adoption of cloud computing across industries provides a scalable and cost-effective platform for software deployment and usage. The cloud offers enhanced accessibility and collaboration, allowing users to access software and data from anywhere, fostering remote work and global teamwork. Cloud-based solutions often receive regular updates and maintenance, ensuring users have access to the latest features and security enhancements. This flexibility, efficiency, and scalability are propelling the cloud segment to a higher growth trajectory as organizations embrace digital transformation.

- The microprocessors and controllers segment held the largest market with more than 65.2% revenue share in 2022

Based on the type of application, the global electronic design automation software market is segmented into microprocessors & controllers, memory management unit (MMU), and others. The microprocessors and controllers segment has consistently held the largest market share in the semiconductor industry due to its fundamental role in powering electronic devices. Microprocessors and controllers are the brains behind a vast array of products, from smartphones and computers to automotive systems and IoT devices. Their pivotal role in modern electronics leads to extensive research, development, and integration efforts, driving the demand for Electronic Design Automation (EDA) software. As the need for increasingly powerful and efficient processors persists, this segment remains the dominant force in the EDA software market.

- The consumer electronics segment held the largest market with more than 38.5% revenue share in 2022

Based on the end-use, the global electronic design automation software market is segmented into aerospace and defense, automotive, healthcare, industrial, consumer electronics, and others. The consumer electronics segment has consistently held the largest market share in the electronic products industry due to its widespread consumer adoption. This category encompasses a wide range of devices, including smartphones, laptops, tablets, televisions, and smart home gadgets, which are integral to modern life. As consumers continually seek more advanced, feature-rich, and interconnected electronic products, manufacturers heavily invest in electronic design and utilize electronic design automation (EDA) software extensively.

Regional Segment Analysis of the Electronic Design Automation Software Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America dominated the market with more than 40.5% revenue share in 2022.

Get more details on this report -

Based on region, North America has consistently held the largest market share in the electronic design automation (EDA) software market due to the dynamic technology ecosystem, housing numerous semiconductor companies, electronic manufacturers, and research institutions. These entities drive the demand for EDA software to design cutting-edge electronic products and semiconductor chips. North America has a strong focus on innovation, with a high level of investment in research and development. This emphasis on technological advancement fuels the need for advanced EDA tools. Additionally, the region's stringent regulatory environment, particularly in industries like aerospace and automotive, mandates the use of EDA software for compliance, further boosting the market's growth.

Asia-Pacific is projected to experience the fastest growth in the electronic design automation (EDA) software market during the forecast period for several compelling reasons. The region is witnessing a surge in electronics manufacturing and design activities, driven by the rapid economic development and increasing consumer demand for electronic products. The presence of a burgeoning semiconductor industry in countries like China, Taiwan, and South Korea is driving the adoption of EDA software for chip design and fabrication.

Recent Developments

- In June 2022, Keysight Technologies has released new RF and microwave design and simulation tools. In the microwave and RF industries, this design and simulation software can quickly address complicated designs and higher frequencies.

- In March 2023, Synopsis.ai is an AI-driven, full-stack Electronic Design Automation (EDA) package for semiconductor makers launched by Synopsys. The integrated AI-driven engine supports chip makers in lowering manufacturing costs without sacrificing silicon quality and increasing engineering efficiency, hence promoting the expansion of the Electronic Design Automation (EDA) software industry.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global electronic design automation software market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Advanced Micro Devices, Inc.

- Aldec, Inc.

- Altair Engineering Inc.

- Altium LLC

- Autodesk, Inc.

- ANSYS, Inc.

- Cadence Design Systems, Inc.

- eInfochips

- Keysight Technologies

- EMA Design Automation, Inc.

- Microsemi

- Synopsys, Inc.

- Silvaco, Inc.

- The MathWorks, Inc.

- Vennsa Technologies

- Zuken

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global electronic design automation software market based on the below-mentioned segments:

Electronic Design Automation Software Market, By Product

- Computer-aided Engineering (CAE)

- IC Physical Design and Verification

- Printed Circuit Board and Multi-chip Module (PCB and MCM)

- Semiconductor Intellectual Property (SIP)

- Services

Electronic Design Automation Software Market, By Deployment

- Cloud

- On-premise

Electronic Design Automation Software Market, By Application

- Microprocessors & Controllers

- Memory Management Unit (MMU)

- Others

Electronic Design Automation Software Market, By End-Use

- Aerospace and Defense

- Automotive

- Healthcare

- Industrial

- Consumer Electronics

- Others

Electronic Design Automation Software Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?