Global Earthquake-Resistant Building Materials Market Size, Share, and COVID-19 Impact Analysis, By Material Type (Reinforced Concrete, Structural Steel, Fiber-Reinforced Polymers, Engineered Wood, Others), By End Use (Residential, Non-residential), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsEarthquake-Resistant Building Materials Market Size Summary

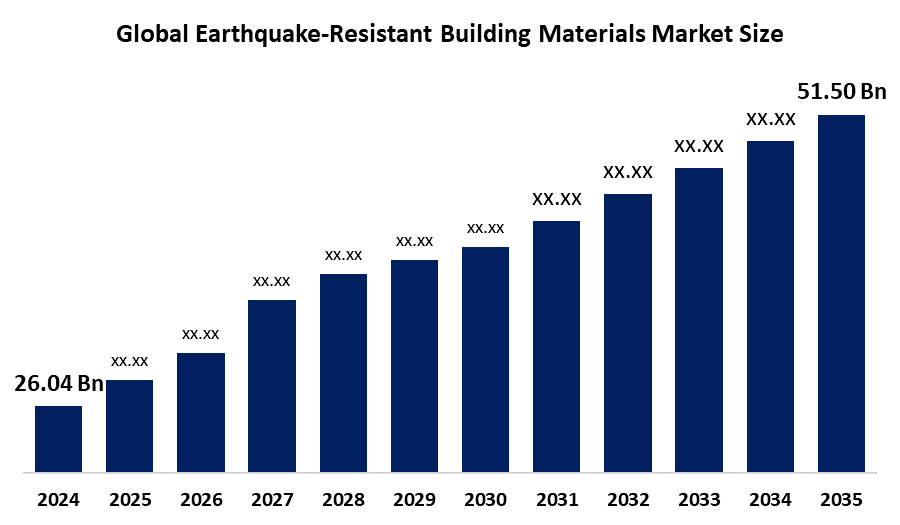

The Global Earthquake-Resistant Building Materials Market Size Was Estimated at USD 26.04 Billion in 2024 and is Projected to Reach USD 51.50 Billion by 2035, Growing at a CAGR of 6.4% from 2025 to 2035. The market for earthquake-resistant building materials is expanding due to several factors, including increased seismic activity, urbanisation in high-risk areas, improved building codes, technological developments, heightened awareness of disaster resilience, and government programs encouraging safer infrastructure in sensitive areas.

Get more details on this report -

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific earthquake-resistant building materials market held the largest revenue share of 38.2% and dominated the global market.

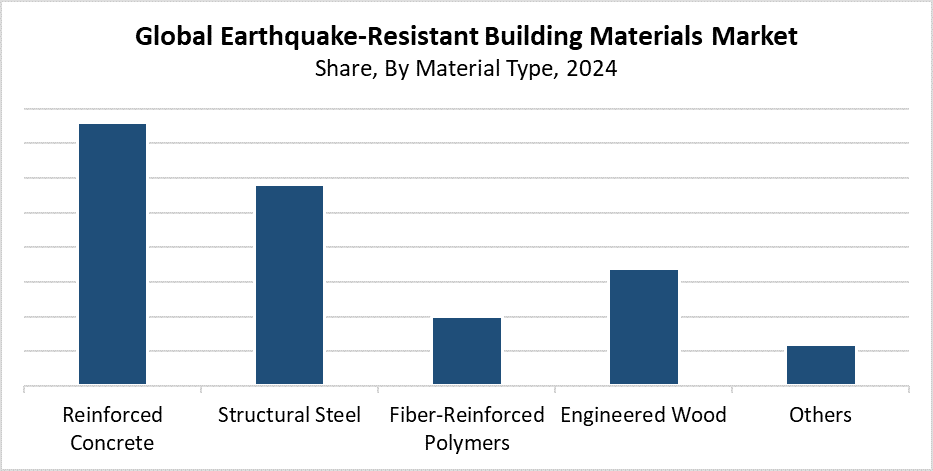

- In 2024, the reinforced concrete segment held the highest revenue share of 38.3% and dominated the global market by material type.

- With the biggest revenue share of 54.7% in 2024, the residential segment led the worldwide earthquake-resistant building materials market by end use.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 26.04 Billion

- 2035 Projected Market Size: USD 51.50 Billion

- CAGR (2025-2035): 6.4%

- Asia Pacific: Largest market in 2024

The market for earthquake-resistant building materials contains various construction items which serve to protect buildings from seismic forces. The materials which function to absorb and spread out ground motion energy consist of fibre-reinforced polymers, reinforced concrete, high-tensile steels, and engineered wood systems. The main drivers of this trend include fast urban growth in earthquake-prone areas, increasing infrastructure investments, and tightening construction safety standards. Governments and regulatory bodies enforce these worldwide. The increasing awareness about earthquake hazards among property owners and public sector entities drives up the demand for materials which serve to protect people and reduce monetary losses during earthquake events.

Modern technology development has brought major changes to building construction, which allows better protection against earthquakes. The use of shape-memory alloys and energy-dissipating devices, and self-healing concrete materials has led to better structural performance during seismic activity. Building Information Modelling (BIM) enables digital design techniques to create simulated and optimised earthquake-resistant building plans. The government supports these technologies through programs which include earthquake-safe construction incentives and mandatory retrofitting programs. Updated seismic codes. The new technologies together create safer, environmentally friendly construction methods for areas that experience earthquakes.

Material Type Insights

Get more details on this report -

How Did the Reinforced Concrete Segment Capture the Largest Market Share of 38.3% in the Earthquake-Resistant Building Materials Market in 2024?

The reinforced concrete segment holds the largest market share of 38.3% and dominated the earthquake-resistant building materials market in 2024. The material maintains its position as the leading choice for seismic-resistant construction because it provides both strong structural integrity and long-lasting performance at an affordable cost. Reinforced concrete provides two essential features, which make it suitable for various building designs. It can carry heavy loads and be shaped into various structural forms. The material demonstrates improved ductility and earthquake stress resistance because it forms a bond with steel reinforcement. The worldwide market leadership of reinforced concrete emerged because new seismic construction standards and earthquake-prone area infrastructure development expanded.

The structural steel segment of the earthquake-resistant building materials market is expected to grow at the fastest CAGR during the forecast period. The material shows exceptional growth because it provides the necessary strength and flexibility to handle seismic forces. Structural steel enables buildings to distribute seismic energy effectively. This leads to lower chances of structural damage. The construction method qualifies as a modern building technique because it requires minimal production time and fast assembly, and allows for material recycling. The steel market continues to grow because industrial buildings, tall structures, and seismic zone recovery efforts use more steel materials. The steel demand will rise during the next few years because steel design technology advances and people learn more about building structures that can withstand disasters.

End Use Insights

What Factors Enabled the Residential Segment to Lead the Earthquake-Resistant Building Materials Market in 2024?

The residential segment led the earthquake-resistant building materials market by holding the largest revenue share of 54.7% in 2024. The growing need for secure and durable homes in seismically active areas is the main factor driving this dominance. The combination of urban growth, rising population numbers, and better awareness about earthquake safety has made developers and homeowners choose earthquake-resistant construction methods as their main focus. The segment's expansion has also been greatly aided by government laws requiring residential structures to utilise seismic-compliant materials. The market demand continues to rise because people are choosing to modernise their existing homes to reach current safety standards. The demand for dependable, durable construction materials will rise because residential development continues to expand into areas that experience frequent natural disasters.

The non-residential segment of the earthquake-resistant building materials market is expected to grow at the fastest CAGR during the forecast period. The main driver of this expansion comes from growing spending on institutional, commercial, and industrial infrastructure development in seismically active areas. The structural integrity of buildings, including hospitals and schools, office complexes, and manufacturing facilities, needs improvement to protect occupants and keep operations running during earthquakes. The construction industry adopts new building materials because government agencies and private organisations dedicate more resources to earthquake safety standards in commercial buildings and public infrastructure projects. The demand for construction materials rises because buildings must now follow stricter regulations when upgrading their non-residential structures.

Regional Insights

The North American earthquake-resistant building materials market is expanding at a steady rate because of new construction rules and increased understanding of earthquake risks. The western United States, together with Canadian and Mexican territories, need to build resilient structures because this area experiences frequent earthquakes. Engineering practices, together with material science advancements, and supportive regulations now promote the use of fibre-reinforced composites, structural steel and reinforced concrete as high-performance materials. The market demand experiences changes because of growing expenditures on infrastructure modernisation and facility upgrades. These follow earthquake safety standards. North America serves as a vital market for creating new earthquake-resistant building systems.

Asia Pacific Earthquake-Resistant Building Materials Market Trends

Get more details on this report -

The global earthquake-resistant building materials market is dominated by the Asia Pacific region, by holding the largest revenue share of 38.2% in 2024. The region stands as the world leader because of its exposure to major seismic activity, which affects countries including China, India, Japan, and Indonesia. The demand for durable construction has emerged in residential and commercial buildings because of fast urban growth, rising population numbers, and ongoing infrastructure expansion. The region's governments support modern earthquake-resistant materials through their strict building codes and their funding of major public infrastructure projects. The Asia Pacific market position in this industry has become stronger because people now understand disaster preparedness better. They focus on building earthquake-resistant structures for reconstruction purposes.

Europe Earthquake-Resistant Building Materials Market Trends

The European market for earthquake-resistant building materials experiences significant growth because of expanding structural safety initiatives in seismically active areas, including Italy, Greece, and Turkey. The need for robust infrastructure has become more apparent since moderate to large earthquakes are occurring more frequently. The government, along with regulatory agencies, has implemented stricter seismic design requirements, which drives the adoption of modern construction materials such as fibre-reinforced composites, structural steel, and reinforced concrete. The market demand continues to rise because of the strong focus on upgrading existing buildings to comply with current safety standards. The European market growth continues to advance through investments in environmentally friendly building methods that also provide seismic resistance. Technological development establishes Europe as a leading centre for high-performance safety-oriented construction solutions.

Key Earthquake-Resistant Building Materials Companies:

The following are the leading companies in the earthquake-resistant building materials market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Tata Steel Limited

- Nippon Steel Corporation

- LafargeHolcim Ltd.

- CEMEX S.A.B. de C.V.

- CRH plc

- Sika AG

- Saint-Gobain S.A.

- Hilti Corporation

- Others

Recent Developments

- In October 2024, Aster Co., Ltd., a startup located in Japan, unveiled a novel coating that greatly increases the seismic resistance of masonry structures. This innovative coating, called Aster Power Coating, forms a flexible yet incredibly durable layer on brick surfaces by fusing soft acrylic silicone resin with short, hard glass fibres.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the earthquake-resistant building materials market based on the below-mentioned segments:

Global Earthquake-Resistant Building Materials Market, By Material Type

- Reinforced Concrete

- Structural Steel

- Fibre-Reinforced Polymers

- Engineered Wood

- Others

Global Earthquake-Resistant Building Materials Market, By End Use

- Residential

- Non-residential

Global Earthquake-Resistant Building Materials Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?