Global Drone Inspection and Monitoring Market Size, Share, and COVID-19 Impact Analysis, By Solution (Platform, Software, Infrastructure, and Service), By Type (Fixed Wing, Multirotor, & Hybrid), By Applications (Construction & Infrastructure, Agriculture, Oil & Gas, Utilities, Mining, & Others), By Mode of Operation (Remotely piloted, Optionally piloted, & Fully autonomous), By Distribution Channel (Online and Offline), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032.

Industry: Aerospace & DefenseDrone Inspection and Monitoring Market Insights Forecasts to 2032

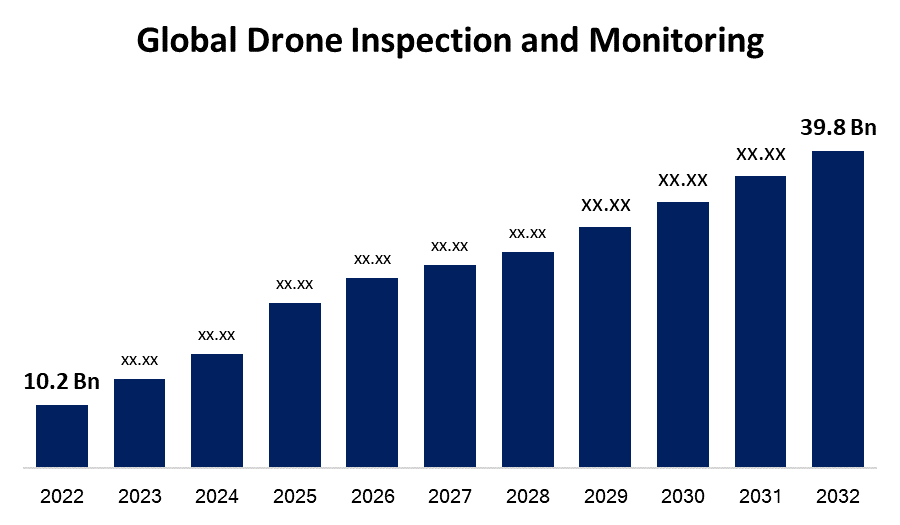

- The Drone Inspection and Monitoring Market Size was valued at USD 10.2 Billion in 2022.

- The Market Size is Growing at a CAGR of 14.5% from 2022 to 2032.

- The Worldwide Drone Inspection and Monitoring Market size is expected to reach USD 39.8 Billion by 2032.

- North America is expected To Grow the fastest during the forecast period.

Get more details on this report -

The Global Drone Inspection and Monitoring Market Size is expected to reach USD 39.8 Billion by 2032, at a CAGR of 14.5% during the forecast period 2022 to 2032.

Market Overview

A drone is a form of flying robot that is either operated by an automated system or by a human operator. Drones are miniature aircraft that may be used for a variety of tasks such as infrastructure inspection, aerial photography, surveillance, product delivery, and policing. Drone usage has migrated from the confined defense domain to wider commercial applications. The existence of high-resolution optical systems and the capacity to reach heights have increased the industrial sector's usage of Drones for inspection. Drone Inspection and Monitoring are becoming more popular as the need for robots to conduct risky and life-threatening tasks grows. Industries are increasingly using drones for monitoring and inspection as part of their maintenance processes. A visual examination is required to guarantee that a company's resources are properly maintained. Drones are utilized for a variety of purposes, including pipeline and infrastructure inspection, animal population and activity monitoring and inspection, remote infrastructure, and aircraft monitoring, agricultural yield inspection, oil and gas sector inspection, and utility inspection. Drone cameras are frequently used to replace the human eye in inspection and monitoring applications. Inspectors can avoid visiting dangerous places or sites such as scaffolding, chemical spills, or tall, lean towers by using drones to collect visual data.

Report Coverage

This research report categorizes the global drone inspection and monitoring market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global drone inspection and monitoring market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global drone inspection and monitoring market. Technological innovation and advancement will further optimize the performance of the product, enabling it to acquire a wider range of applications in the downstream market.

Global Drone Inspection and Monitoring Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 10.2 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 14.5% |

| 2032 Value Projection: | USD 39.8 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Solution, By Type, By Applications, By Mode of Operation, By Distribution Channel, By Region. |

| Companies covered:: | Lockheed Martin Corporation, Northrop Grumman Corporation, EchoBlue Ltd., Industrial SkyWorks Inc., A FlytBase, Inc., Endeavor Business Media, LLC, DJI Innovations, MISTRAS Group, Intertek, Parrot SA, Kespry, Intel Corporation, FEDS, AZUR DRONES, Terra Drone Corporation, idea Forge |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The drone inspection and monitoring market is growing significantly due to the introduction of new technologies and the benefits they provide, such as lower prices, enhanced human safety, and improved efficiency. Humans, airplanes, helicopters, and organizations may now obtain previously inaccessible levels of visibility at a reasonable cost by deploying drones for inspection and surveillance. Drones are utilized to increase worker safety and offer access to asset information in a variety of dynamic and complicated sectors. Drone inspections and monitoring may most of the time properly identify the problems that need to be addressed. Human inspectors are not as effective as drones in performing inspections and monitoring. Furthermore, the emergence of new start-ups drives the drone inspection and monitoring industry. However, concerns over drone safety and security are limiting industry expansion. On the contrary, technical improvements in drones are projected to open up attractive industry potential.

Restraining Factors

The dual-use nature of drones is restricting the Global Drone Inspection and Monitoring Market's development. The main constraint here is the limited flying time and low capacity to handle the weight of the drone. Also, Malevolent organizations using drones to execute physical and cyber-attacks endanger society by violating the confidentiality of people and endangering public safety. In truth, many technological and operational aspects of drones are being abused for possible strikes. This includes vital operations based on active reconnaissance, as well as surveillance targeted at following individual persons and places, resulting in safety and privacy concerns.

Market Segmentation

- In 2022, the software segment is dominating the largest market share over the forecast period.

On the basis of solution, the global drone inspection and monitoring market is bifurcated into platform, software, infrastructure, and service. Among these segments, the software segment is dominating the market with the largest revenue share during the forecast period. Various drone-based applications can improve the user's flight experience as well as a photo editing/taking experience. Depending on the application, the software market for drone inspection and monitoring is divided into route planning and optimization, inventory management, live tracking, fleet management, and computer vision & object recognition.

- In 2022, the multirotor segment is influencing the largest market growth over the forecast period.

Based on the type, the global drone inspection and monitoring market is segmented into different segments such as fixed-wing, multirotor, & hybrid. Among these segments, the multirotor segment is dominating the market during the forecast period. Multirotor drones typically have two, three, four, six, or eight rotors and are referred to as bicopters, tricopters, quadcopters, hexacopters, and octocopters, respectively. The most prevalent form of multirotor drone design is the quadcopter. Their stabilization mechanism is less sophisticated than that of tricopters. They have fewer pieces (implying lower production costs) than hexacopters or octocopters. The more rotors a multirotor drone has, the more thrust it can create and, hence, the heavier cargo it can lift. Hexacopters and octocopters are the most typical multirotor drones for carrying big industrial cameras or delivering payloads. Drones with more than four rotors have a degree of dismissal, which allows them to continue descending even when individual rotors break or collapse.

- In 2022, the construction & infrastructure segment is leading the market with the largest market growth during the forecast period.

On the basis of application, the global drone inspection and monitoring market is segmented into construction & infrastructure, agriculture, oil & gas, utilities, mining, & others. Among these segments, the construction & infrastructure segment is dominating the market with the largest share during the forecast period due to the widespread usage of machines has revolutionized building procedures. Drones are increasingly being used in construction projects for visual inspections and surveillance of areas with high populations. Drones boost on-site communication and management efficiency by monitoring and capturing real-time data.

- In 2022, the offline segment is leading the largest market share over the forecast period.

Based on the distribution channel, the global drone inspection and monitoring market is divided into online and offline. Among these segments, the offline segment is dominating the market with the largest market share during the forecast period. Whereas, the online distribution channel will have the highest CAGR throughout the anticipated period.

Regional Segment Analysis of the drone inspection and monitoring market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

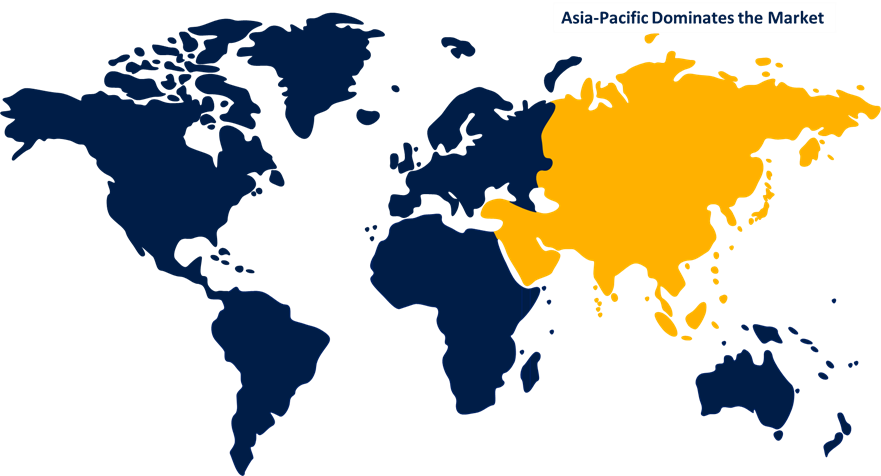

Asia Pacific dominates the market with the largest market share during the forecast period

Get more details on this report -

Asia Pacific dominates the market with the largest market share during the forecast period, due to the countries such as China, Australia, India, Japan, and South Korea significantly contributing to the expansion of the Asia Pacific drone inspection and monitoring business. Political difficulties in several Asia Pacific nations have resulted in the deployment of drones for regional border protection. This is one of the most critical reasons driving the growth of the Asia Pacific drone inspection and monitoring market. Furthermore, China has a major manufacturer and purchaser of drones worldwide. There are around 500 drone manufacturers worldwide, with 400 of them headquartered in China. The country's UAV producers have seen growing demand from Asia Pacific, Africa, and the Middle East, which is favorably influencing the drone inspection and monitoring industry.

North America is predicted to be the second fastest-growing region for the drone inspection and monitoring market during the forecast period due to the market's constant growth in passenger automobile sales and supported by growing income levels. Furthermore, favorable rules about electric cars are expected to have a beneficial influence on the industry.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the global drone inspection and monitoring market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- EchoBlue Ltd.

- Industrial SkyWorks Inc.

- A FlytBase, Inc.

- Endeavor Business Media, LLC

- DJI Innovations

- MISTRAS Group

- Intertek

- Parrot SA

- Kespry

- Intel Corporation

- FEDS

- AZUR DRONES

- Terra Drone Corporation

- ideaForge

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2022, Percepto, an Israeli producer of autonomous inspection drones, completed a proof-of-concept test of its Percepto Air drone-in-a-box platform in Thailand for monitoring a 250-acre floating solar farm. The Percepto Autonomous Inspection and Monitoring (AIM) software and drone-in-a-box will be used for routine inspections of the facility's 145,000 solar panels following the trial, which was carried out in collaboration with the Electric Generating Authority of Thailand (EGAT) and Top Engineering Corp., a Thai drone consultancy and equipment provider.

- In July 2022, At the "Leading the low altitude airspace infrastructure construction" news conference, GDU-Tech Co., Ltd. introduced the professional S400 quadrotor drone and the K01 automated docking station. The drone and flight platform are intended for use in all types of unmanned applications.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2032. Spherical Insights has segmented the Global Drone Inspection and Monitoring Market based on the below-mentioned segments:

Global Drone Inspection and Monitoring Market, By Solution

- Platform

- Software

- Infrastructure

- Service

Global Drone Inspection and Monitoring Market, By Type

- Fixed Wing

- Multirotor

- Hybrid

Global Drone Inspection and Monitoring Market, By Application

- Construction & infrastructure

- Agriculture

- Oil & Gas

- Utilities

- Mining

- Others

Global Drone Inspection and Monitoring Market, By Mode of Operation

- Remotely piloted

- Optionally piloted

- Fully autonomous

Global Drone Inspection and Monitoring Market, By Distribution Channel

- Online

- Offline

Drone Inspection and Monitoring Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?