Global Digital Diabetes Management Market Size, Share, and COVID-19 Impact Analysis, By Product (Smart Glucose Meter, Continuous Blood Glucose Monitoring System, Smart Insulin Pens, Smart Insulin Pumps, and Apps), By Type (Wearable Devices and Handheld Devices), By End-Use (Hospitals, Home Settings, and Diagnostic Centers), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: HealthcareGlobal Digital Diabetes Management Market Size Insights Forecasts to 2032

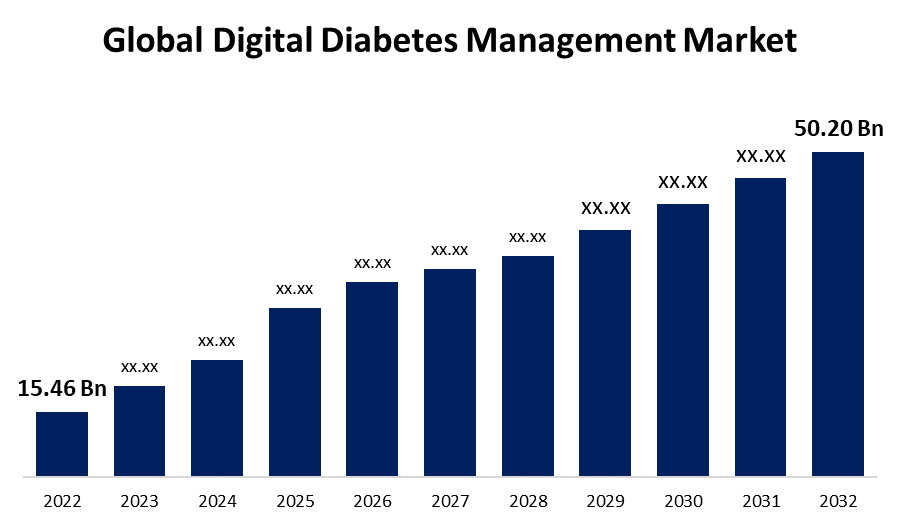

- The Digital Diabetes Management Market Size was valued at USD 15.46 Billion in 2022.

- The Market is Growing at a CAGR of 12.5% from 2022 to 2032

- The Worldwide Digital Diabetes Management Market Size is expected to reach USD 50.20 Billion by 2032.

- Asia-Pacific is expected to Grow higher during the forecast period.

Get more details on this report -

The Global Digital Diabetes Management Market Size is expected to reach USD 50.20 Billion by 2032, at a CAGR of 12.5% during the forecast period 2022 to 2032.

Market Overview

Digital diabetes management involves the use of technology to enhance the monitoring, treatment, and overall care of individuals with diabetes. This comprehensive approach integrates various digital tools such as mobile apps, wearable devices, and remote monitoring systems to track blood glucose levels, insulin administration, physical activity, and dietary intake. By collecting real-time data, individuals and healthcare providers can make informed decisions, customize treatment plans, and proactively address fluctuations in glucose levels. Digital platforms also facilitate communication between patients and healthcare professionals, enabling timely interventions and reducing the risk of complications. Through personalized insights, education, and behavior tracking, digital diabetes management empowers individuals to take control of their condition, improving self-management, and ultimately enhancing their quality of life.

Report Coverage

This research report categorizes the market for digital diabetes management market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the digital diabetes management market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the digital diabetes management market.

Global Digital Diabetes Management Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 15.46 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 12.5% |

| 2032 Value Projection: | USD 50.20 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By Type, By End-Use and COVID-19 Impact Analysis |

| Companies covered:: | Abbott Laboratories, Medtronic PLC, F. Hoffmann-La Roche Ltd., Bayer AG, Lifescan, Inc., Dexcom, Inc., Sanofi, Insulet Corporation, Ascensia Diabetes Care Holdings AG, B Braun Melsungen AG, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The digital diabetes management market is being propelled by a confluence of factors that are reshaping the landscape of diabetes care and treatment, the rapid proliferation of smartphones and wearable devices has created a seamless ecosystem for real-time health monitoring, including blood glucose levels, physical activity, and medication adherence. This ease of data collection and tracking is a fundamental driver, empowering both patients and healthcare providers with actionable insights. The rising prevalence of diabetes globally has led to an increased demand for more efficient and accessible management solutions. Digital platforms offer a way to scale healthcare efforts, enabling remote monitoring and personalized interventions. This is particularly significant in rural and underserved areas where access to medical facilities may be limited. Healthcare's gradual shift towards a value-based model emphasizes preventive care and cost-effective solutions. Digital diabetes management aligns with this trend by allowing early detection of glucose fluctuations, enabling timely interventions that can prevent complications and reduce healthcare expenditures in the long run. Furthermore, the integration of artificial intelligence and machine learning technologies in these platforms enhances their predictive capabilities. These algorithms can analyze vast amounts of data to forecast potential glycemic variations and suggest personalized adjustments, aiding in the creation of highly tailored treatment plans.

The regulatory environment and reimbursement policies also play a crucial role. As regulatory agencies increasingly approve digital health solutions, the market gains credibility and user trust. Reimbursement support for these digital interventions further incentivizes healthcare providers to adopt these technologies, making them an integral part of diabetes management. Collaborations between technology companies, pharmaceutical manufacturers, and healthcare providers are fostering innovation in this space. Partnerships allow for the creation of comprehensive ecosystems that encompass medication management, lifestyle interventions, and continuous monitoring, thereby offering holistic care to individuals with diabetes. The patient empowerment is a key driver. Digital diabetes management puts individuals in control of their health, offering user-friendly interfaces, educational resources, and personalized feedback. This empowerment enhances patient engagement and adherence, resulting in improved outcomes.

Restraining Factors

Challenges facing the digital diabetes management market include limited technology access among elderly and economically disadvantaged populations, potentially exacerbating healthcare disparities. Data privacy concerns also hinder widespread adoption as sensitive health information is transmitted and stored digitally. Technical issues, such as device compatibility problems and inaccurate readings, can erode user trust. Additionally, the fast-paced nature of technology evolution may render some solutions obsolete quickly. The lack of standardized guidelines and regulations for digital diabetes management can lead to uncertainties regarding product safety and effectiveness, impeding market growth.

Market Segmentation

- In 2022, the continuous blood glucose monitoring system segment accounted for around 38.4% market share

On the basis of the product, the global digital diabetes management market is segmented into smart glucose meter, continuous blood glucose monitoring system, smart insulin pens, smart insulin pumps, and apps. The continuous blood glucose monitoring system segment commands the largest revenue share within the digital diabetes management market due to its transformative impact on diabetes care. This technology offers real-time monitoring, enabling individuals to track glucose levels continuously and receive timely alerts for necessary interventions. The system enhances patient compliance, reduces the risk of complications, and provides valuable data for treatment adjustments. As patients and healthcare professionals increasingly recognize its benefits, the demand for continuous blood glucose monitoring systems surges, solidifying its position as a dominant revenue generator in the market.

- The wearable devices segment held the largest market with more than 48.5% revenue share in 2022

Based on the type, the global digital diabetes management market is segmented into wearable devices and handheld devices. Wearable devices have captured the largest revenue share in the digital diabetes management market due to their convenience and multifunctionality. These devices, such as smartwatches and fitness trackers, seamlessly integrate glucose monitoring with other health metrics like physical activity and heart rate. This comprehensive approach resonates with users seeking holistic health insights. Wearable devices also offer continuous monitoring without invasive procedures, aligning with patient preferences. As their design and accuracy improve, along with the growing trend of health-conscious consumers, wearable devices continue to dominate the market, driving substantial revenue growth.

- The hospital segment is expected to grow at a significant CAGR during the forecast period

Based on the end-use, the global digital diabetes management market is segmented into hospitals, home settings, and diagnostic centers. The hospital segment is anticipated to experience significant growth within the digital diabetes management market due to multiple factors. Hospitals are pivotal hubs for critical diabetes care, diagnosis, and treatment. The integration of digital management solutions enhances patient monitoring, streamlines data sharing between healthcare providers, and improves overall care coordination. As hospitals embrace technology to optimize workflows and patient outcomes, the demand for digital diabetes management tools within these settings increases.

Regional Segment Analysis of the Digital Diabetes Management Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

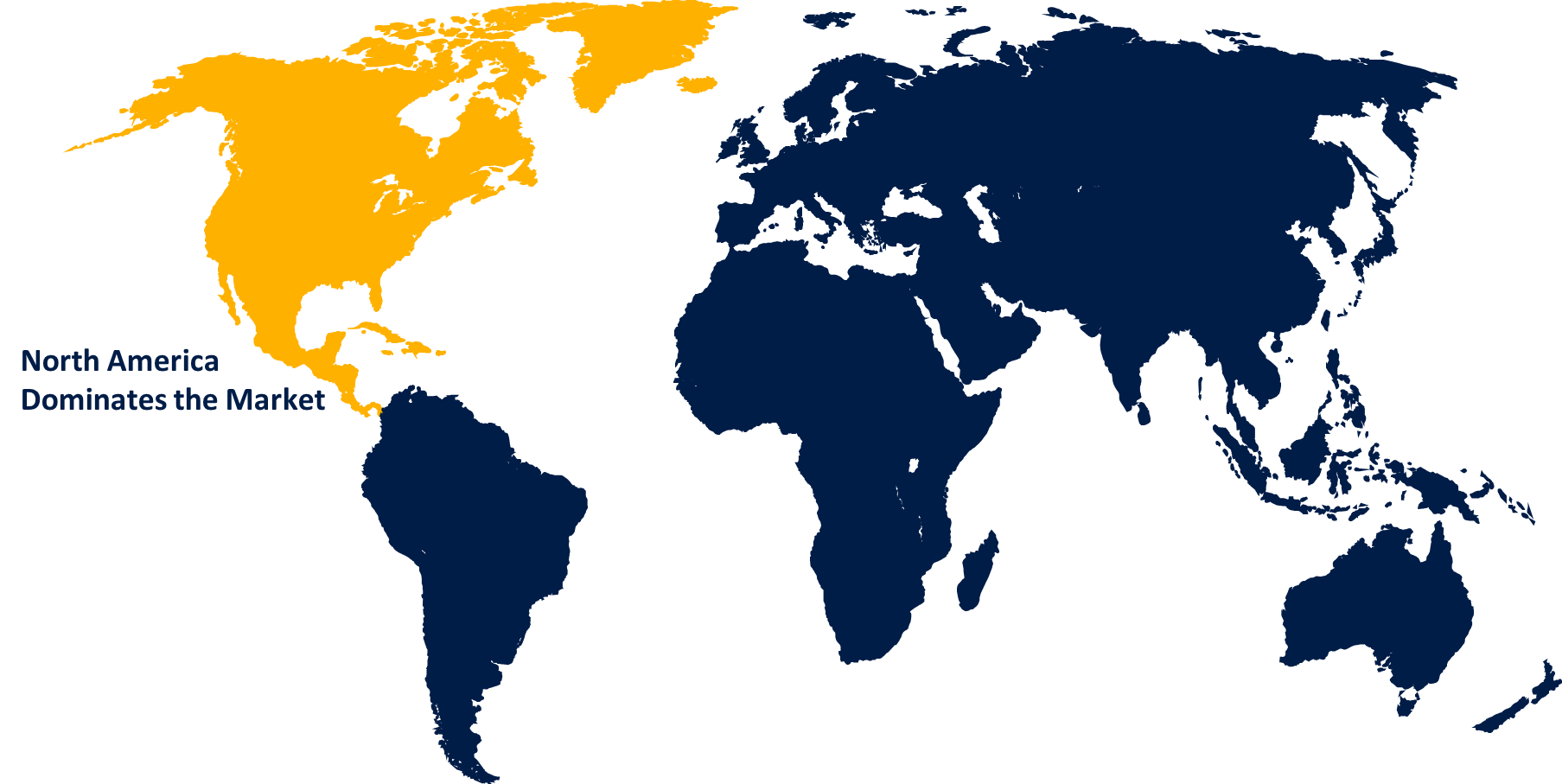

North America dominated the market with more than 34.5% revenue share in 2022.

Get more details on this report -

Based on region, North America asserts dominance in the digital diabetes management market due to its advanced healthcare infrastructure, high adoption of technology, and robust research and development initiatives. The region's significant diabetic population drives demand for innovative solutions. Favorable reimbursement policies and regulatory support further accelerate market growth. Moreover, partnerships between tech companies and healthcare providers contribute to the market's expansion. These factors collectively establish North America as a leader in digital diabetes management, with a comprehensive ecosystem fostering technology integration and patient empowerment.

Asia Pacific region is expected for exponential growth in the digital diabetes management market due to several factors. The region houses a substantial diabetic population, increasing the demand for advanced management solutions. Rapid technological adoption, propelled by a surge in smartphone usage and internet penetration, facilitates digital health integration. Economic development and improving healthcare infrastructure also play a role.

Recent Developments

- In May 2021, Ascensia Diabetes treatment has launched GlucoContro.online, a browser-based diabetes management and analytics platform that delivers data-driven treatment to those who use Contour blood glucose monitoring metres.

- In January 2022, Insulet Corporation announced that their Omnipod 5 Automated Insulin Delivery System, which interfaces with the Dexcom G6 Continuous Glucose Monitoring (CGM), has obtained FDA clearance. It allows for remote patient monitoring and data transfer via the Omnipod 5 mobile app, which has an integrated SmartBolus Calculator.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global digital diabetes management market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Abbott Laboratories

- Medtronic PLC

- F. Hoffmann-La Roche Ltd.

- Bayer AG

- Lifescan, Inc.

- Dexcom, Inc.

- Sanofi

- Insulet Corporation

- Ascensia Diabetes Care Holdings AG

- B Braun Melsungen AG

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global digital diabetes management market based on the below-mentioned segments:

Digital Diabetes Management Market, By Product

- Smart Glucose Meter

- Continuous Blood Glucose Monitoring System

- Smart Insulin Pens

- Smart Insulin Pumps

- Apps

Digital Diabetes Management Market, By Type

- Wearable Devices

- Handheld Devices

Digital Diabetes Management Market, By End-Use

- Hospitals

- Home Settings

- Diagnostic Centers

Digital Diabetes Management Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?